Integration platform Open Banking Hub

Open Banking API extends your value chain

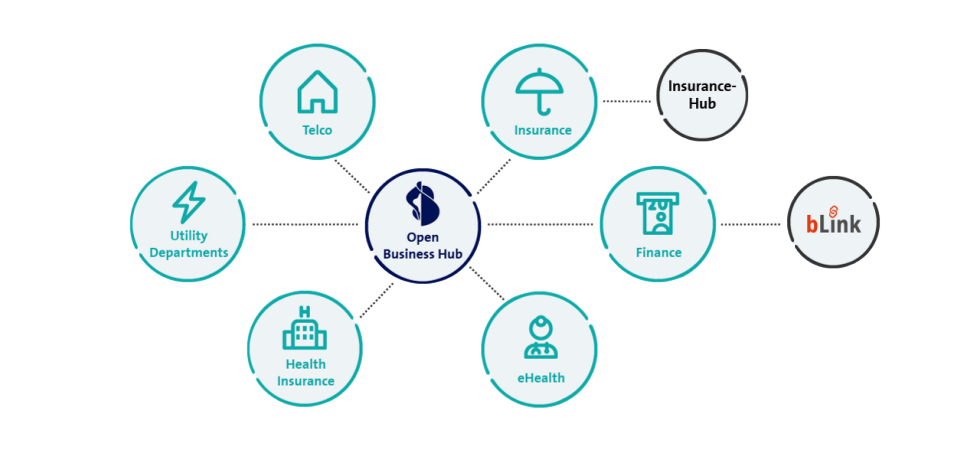

Our Open Business Hub is the central access point to Business API ecosystems including infrastructure for the financial sector. Connect applications and service partners using standardised Open Banking APIs. Expand your core services with partner services and grow your customer value chains within a customer-centric, open ecosystem. That’s how you achieve open banking in Switzerland.

Your benefits

Simple connection of applications using market standards

Reduced integration and operating expense

Access cross-industry API Hubs and their services such as bLink from SIX

When is it the right solution?

OBH is the recommended integration platform if you want to implement ideas for new products or services without major investments. Banks, FinTechs or InsurTechs can then offer or source proprietary or existing marketed solutions and services.

What’s in it for you:

- Integration platform with access to cross-industry API Hub platforms

- Extensive integration and smooth operation of interfaces

- Future-oriented FinTech and InsurTech services

Arrange an appointment

The first step: a free initial consultation

Talk to us about OBH. We will work with you to identify the specific applications that are possible for you, provide greater detail about promising use cases and prepare a no-obligation quotation.

Additional information

Swisscom Open Business Hub

On the marketplace, you will find all FinTech and InsurTech companies that offer services via OBH, which you can integrate in your value chains.

Open Business Hub at a glance

Our aim is to provide a cross-industry Business API ecosystem with diverse ‘Hub-Hub connections’

Talk to us about the possible applications of the Open Business Hub at your company.