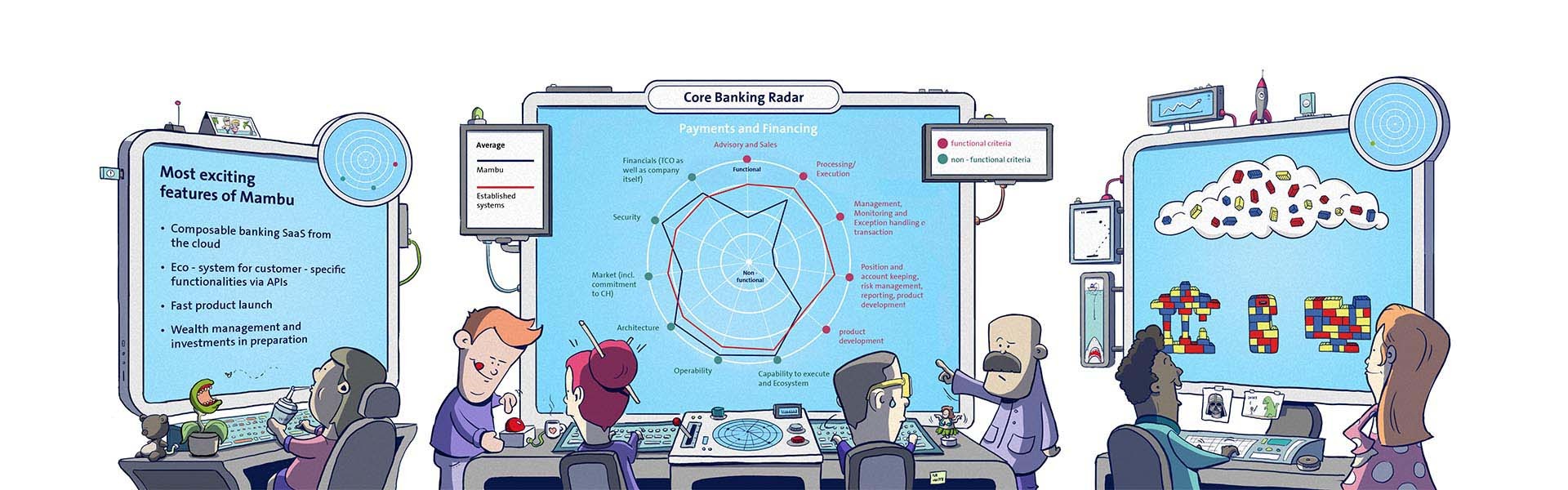

Core Banking Radar

«Mambu - a new generation of core banking system manufacturer relies on SaaS»

Berlin’s fintech Mambu built a cloud-native, core banking platform from the ground up. As an alternative concept to traditional core banking systems, its solution is based on the composable banking approach. With more than 160 customers already, Mambu has definitely passed the first practical test. Certainly the best-known customer is the innovation bank N26.

In cooperation with the Business Engineering Institute St. Gallen (BEI), the Core Banking Radar of Swisscom has been monitoring the system support of banks since 2017, and analyses the most common systems in Switzerland at regular intervals using a comprehensive assessment module. This article combines findings from a detailed survey of the manufacturer Mambu and current market trends in order to highlight developments in core banking and shows success factors for system support by the neo core banking system, Mambu.

The challenge of the banks

Accompaniment of a complete customer journey, from the need for home ownership up to moving in, including a first-class customer experience on the mobile phone?

Banks are facing quickly changing requirements in the digital age, some of which cannot be implemented in their established core banking systems as fast as end customers would like.

Hence, every bank is being confronted with the challenge of how their core banking systems will look in the future. The variant of complete migration of a core banking system is very costly. In addition, it blocks resources for years, which are also urgently needed for the future orientation of the bank. Furthermore, a pure replacement by a complete migration of the core banking system most likely does not satisfy the requirements laid down by the bank for the system change, but rather simply replaces the one system with another with somewhat different development focal points (see our comparison of the biggest core banking systems in Switzerland here).

An alternative is offered by neo core banking systems, which promise new features, great flexibility and performance for competitive prices. However, neo core banking systems must first prove themselves in the Swiss market.

The world of newcomers

At the beginning of 2021, we will see several new core banking systems in the market, which are steadily gaining maturity. Specifically worth mentioning in the German-speaking region are Leveris, Ariadne, Thought Machine and Mambu.

Leveris, from Ireland, generally covers the basic functions by itself – such as items and accounts – in the core, which runs on an Oracle database. Through its central data storage, Leveris enables the analysis of customer requirements in real time. Furthermore, Leveris relies heavily on the integration of peripheral systems. There is currently no coverage of securities functions, but this can be achieved via peripheral systems. Leveris’ customers include very large banks.

Thought Machine, based in London, also serves major banks with its Vault system, and provides many functions related to smart contracts. Coverage of securities is planned. Currently, Vault customers still – to a great extent – have to add their own graphical user interfaces to Vault for account executives and end customers.

SolitX, from the Swiss company Ariadne, demonstrates innovative transaction processing based on the latest mathematical finance approaches and smart contracts thereby covering extensive services from financing and the securities business. The system is still in the development phase.

The German fintech Mambu provides a ready to use Software-as-a-Service (SaaS) solution including user interfaces, and allows its customer banks to react quickly and flexibly to market requirements through its Open-API strategy. Investment capabilities are also on Mambu’s roadmap.

Origin and structure of Mambu

Founded in 2011 by three Master’s students Mambu had 450 employees at the end of November 2020, with a sharply increasing trend. The founders saw a market niche for SaaS solutions in core banking, and developed a core banking system from scratch that is exclusively available as a service in the cloud. There is no need for licences and installations; it is subscription based and customers use the platform over the internet with encryption.

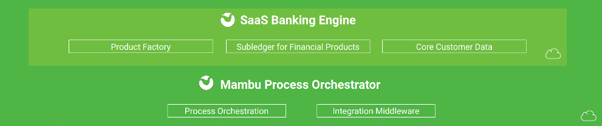

Core of Mambu

The core of the Mambu banking system consists of the Product Factory with engines for credit and deposit products (finance), transactions and accounts, a subledger for accounting for the finance products, as well as the customer data. Mambu places the Process Orchestrator on top, which allows for the integration of peripheral systems via so-called connectors without in-depth programming knowledge.

While other systems promote their modularity, Mambu differentiates itself by its vision of “composable banking.” In modular systems, proprietary modules can be combined like pieces of a puzzle that are exactly matched to each other. In contrast, Mambu describes its system as being comparable to Lego bricks: It allows not only configuration within a pre-defined suite, but also provides free expansion by means of provided, open programming interfaces (APIs), which enable the connection of any systems.

Mambu's vision of composable banking

Customer structure and internationality of Mambu

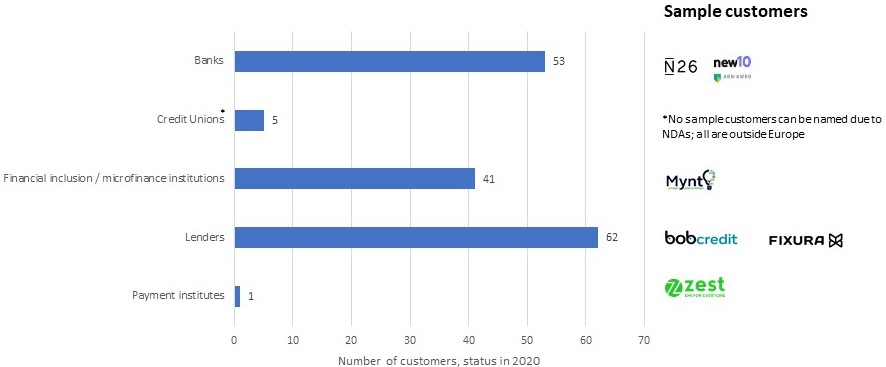

In its soon to be 10 years of existence, Mambu has created an impressive base of around 160 customers. The original focus was on microfinance institutions, but more and more banks have been added over the years.

New10 for example, is the digital spin-off of the Dutch bank ABN AMRO, with the objective of offering a fully-integrated user experience on the mobile phone with a credit decision in 15 minutes, and digital onboarding. The development and market launch of the New10 system, which is completely independent of the parent company, was carried out in 10 months on the basis of the SaaS core banking system platform of Mambu.

Number of customers per form of organisation

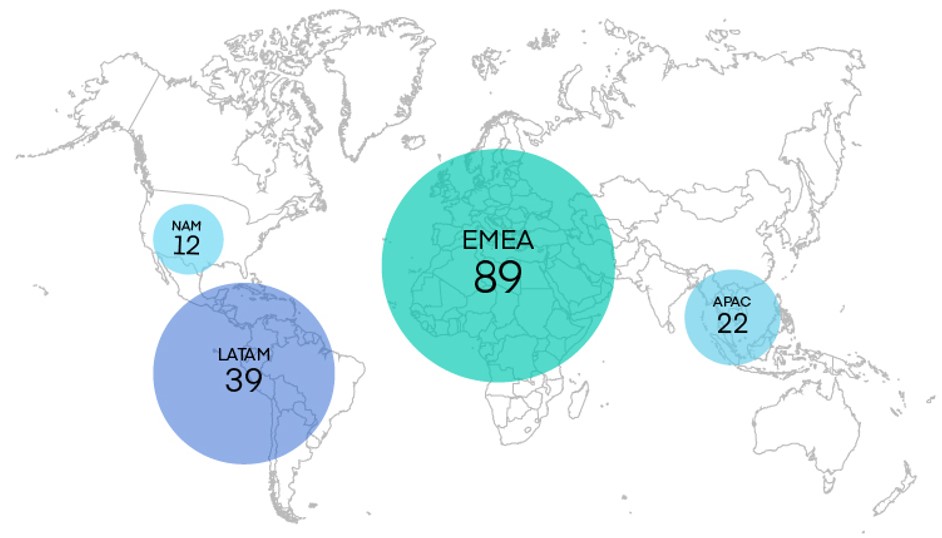

Mambu’s customers are mainly found in the retail sector and mostly use special applications such as granting credit and transactions. This also includes a Swiss customer: Bob Finance, which belongs to Valora Schweiz AG, and operates the processing of banking transactions from the Glarner Kantonalbank. According to its own information, Mambu is very good at adapting to local conditions, and its customers are correspondingly international.

Number of customers per region

This internationality is enabled by Mambu’s ecosystem approach to regionalisation: Mambu provides the operation of a core banking system with the most important core functionalities, while the expanded, customised functional coverage is ensured by local providers, depending on the requirements of the customers.

For example, cross-border operation and handling of time zones, currencies and languages for international transfers is supported by the TransferWise peripheral system integrated by Mambu.

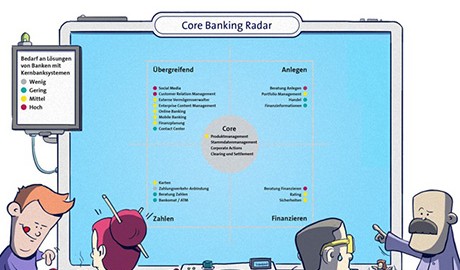

Mambu functionalities

In 2020, the range of functions of the Mambu platform itself covered the areas of payment transactions, financing and deposits as well as customer management.

In the payment area, Mambu also supports innovative services such as an e-Wallet. In addition to standard financial services, factoring and P2P credit functions can be obtained from Mambu. The Mambu functions in the area of investments can only be used when they are available (most likely in 2021).

Besides its own functionalities, Mambu relies heavily on collaboration with peripheral systems with which banks tailor a customer-specific, flexible, complete solution depending on the requirement. That way, very high functionality coverage is possible, naturally depending on the choice of partner.

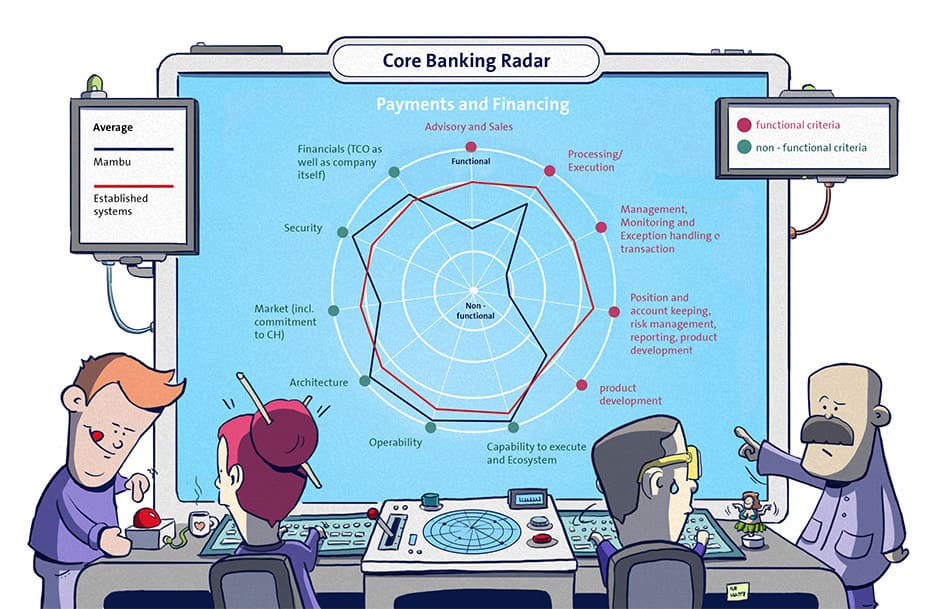

Functional and non-functional coverage of Mambu in the payment and financial service areas

The customer management and underlying data model support any type of customer, while the partner management enables the display and reference of partner-relevant information.

In addition, Mambu provides support functions like data warehouse, document management and business process management. Hence, Mambu provides a configurable data model for storing and linking any structured and unstructured data. In addition, there is the possibility of storing templates in the system and filling them in dynamically with data from processes. There is also version management, automatic preparation for different channels and tracking of the document status.

The Mambu Process Orchestrator (MPO) is a workflow engine that simplifies the mapping of individual business processes, including the integration of external services, because it supports data exchange between different systems via middleware.

The Mambu Product Factory allows not only the simulation of product ideas, but also the creation of product configurations in the areas of finance, payment and accounts. This also permits, for example, the use of smart contracts.

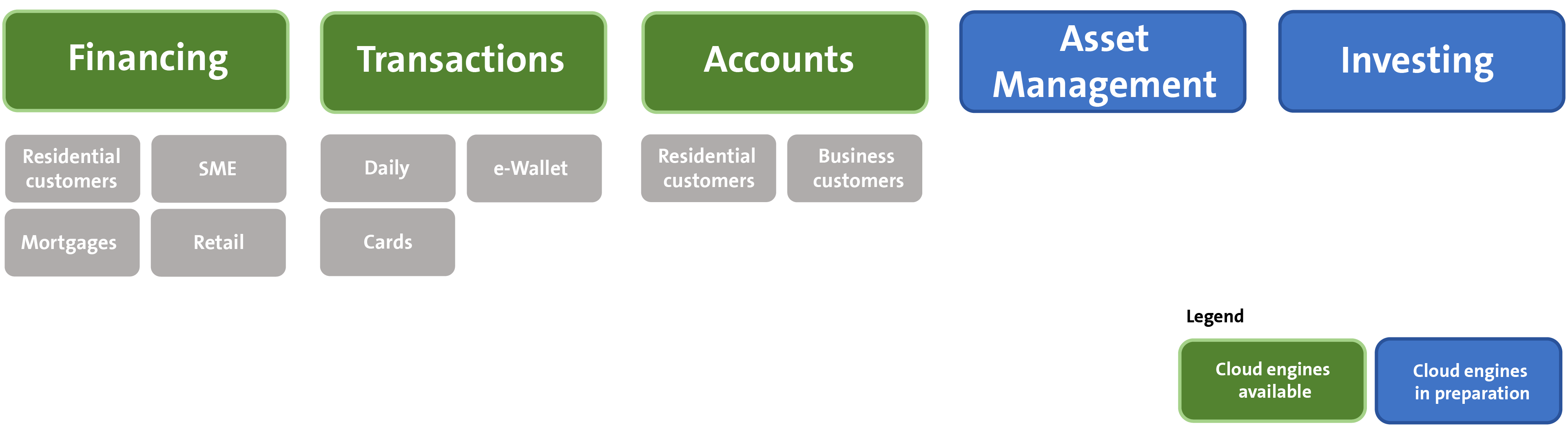

Today, customers can activate the desired components from a lending cloud engine, transactional cloud engine and a deposit cloud engine. Wealth management and investment cloud engines are in preparation.

Mambu’s flexibly selectable cloud engine packages

Non-functional support

Whereas Mambu works a great deal with integrated third-party providers for functional coverage compared to established core banking systems in Switzerland, it has above-average coverage for non-functional support.

Delivery capability and ecosystem

Due to the openness of the system, Mambu is highly capable of networking. Structured partner management and the cooperation in the ecosystem are important elements of the Mambu DNA. Mambu works together with partners around the globe, who are sought out based on their local knowledge. Mambu’s objective is to put together more and more market-specific teams in order to grow sustainably. The experience from 160 installations in the last 10 years helps with the current approximate 60 implementations.

By its own account, Mambu has sufficient resources for development, integration and maintenance to also be able to address the specific requirements of the customers.

Mambu customers play a central role in the product development of the Mambu SaaS platform by contributing new ideas and evaluating them online According to its own information, a major part of Mambu’s functionalities are proposed by users.

Operability

Mambu promises 99.9% availability of the system in a month. This status can be retrieved online at any time and enables uninterrupted maintenance and releases. Data is processed in real time, which makes batch jobs unnecessary to a great extent.

Compared to conventional core banking systems, Mambu considers the launch of the system (without migration) to be less complex due to its user interface.

Architecture

Mambu is operated completely from the cloud, which means all applications are consistently provided online and are highly virtualised, and are no longer installed on dedicated servers of the bank. In Europe, the system currently runs on Amazon Web Services (AWS), and will run on Microsoft Azure and Google Cloud as of 2021. Additional clouds are conceivable; however, many banks have already invested in the mentioned cloud data centres, which is why Mambu focussed primarily on them. Independent of the cloud, Mambu retains control over the source code. Accordingly, ongoing alignment between Mambu cloud operation and any local clouds will be necessary. A local cloud solution must be found for Switzerland, or the Swiss banks on Mambu must inform all their customers about the international data storage until Mambu runs on a cloud with data centres in Switzerland.

Outstanding features of Mambu

Business model of Mambu

Mambu’s customers pay for their selected service package in the yearly, changeable subscription model. Additional usage volume is charged in addition to base subscription costs that include a certain number of users, which leads to variable total costs. 100 hours are included in the standard service package for technical and procedural support for the activation. Other packages include additional hours of support and workshop days.

Mambu rates its integration and operating costs to be reasonable on a Swiss comparison. There are no separate integration costs because no installations are necessary due to the cloud-based principle, and customers in principle only have to login to Mambu to get started. However, against the background of the possibility to connect different peripheral systems, the challenge arises that they can increase the costs for a complete platform.

The first indicators show prices that are competitive but comparable to Swiss providers, if the complete system is migrated. Mambu’s price structure ought to be interesting especially for retail banks or spin-offs of major banks, which would only like to offer specific services and for which a complete core banking system contains too many functions.

In addition, data migration for smaller banks can be quick and easy, whereas system integrators are required for larger banks, which then result in additional costs.

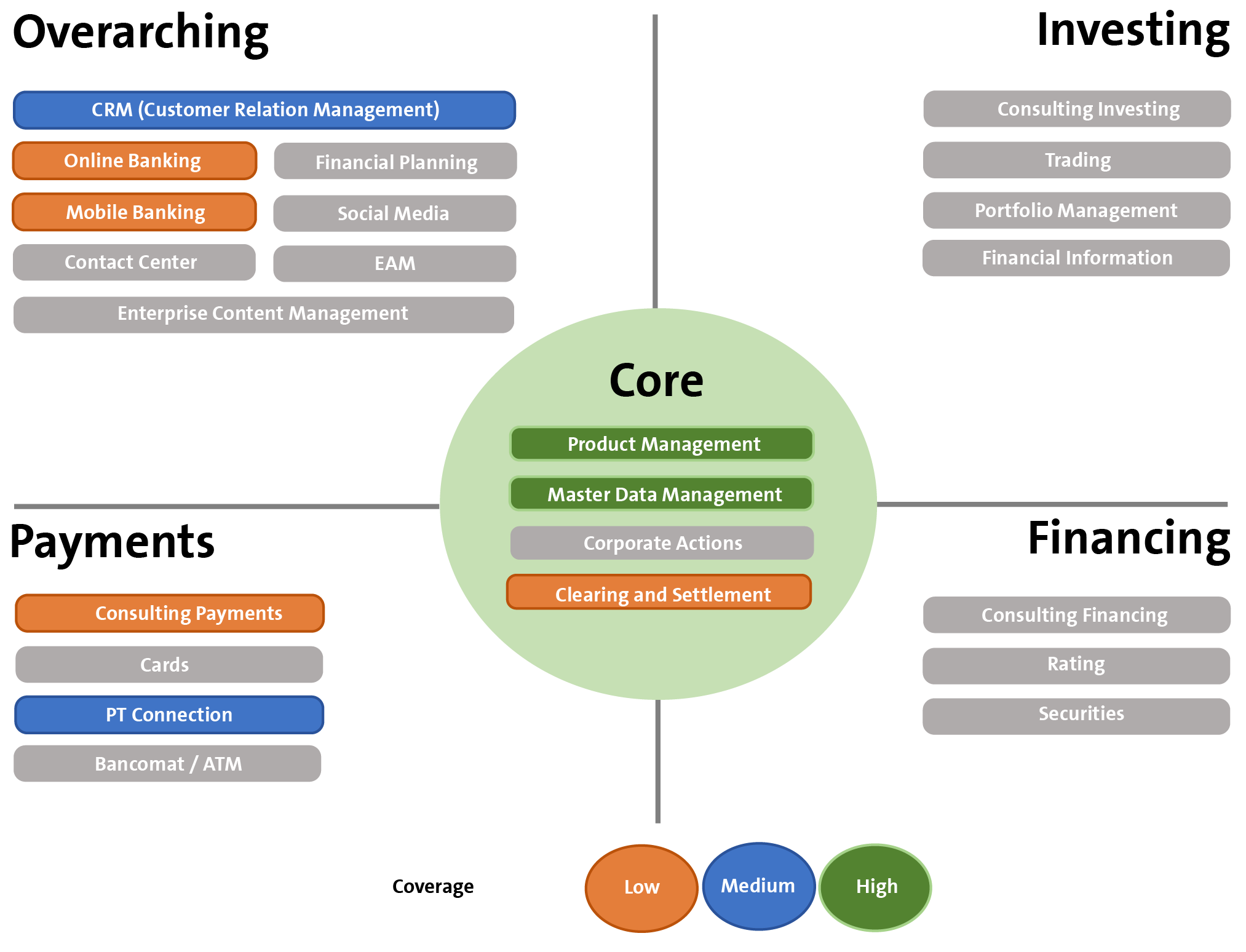

Theoretically, in our opinion, an innovation bank like N26 can run with the following functionalities from Mambu (the Mambu functionalities that the bank uses in reality remain its company secret, because customers are free to choose what happens after the implementation):

Mambu functionalities which are potentially used by an innovation bank (like N26)

Future system support with Mambu

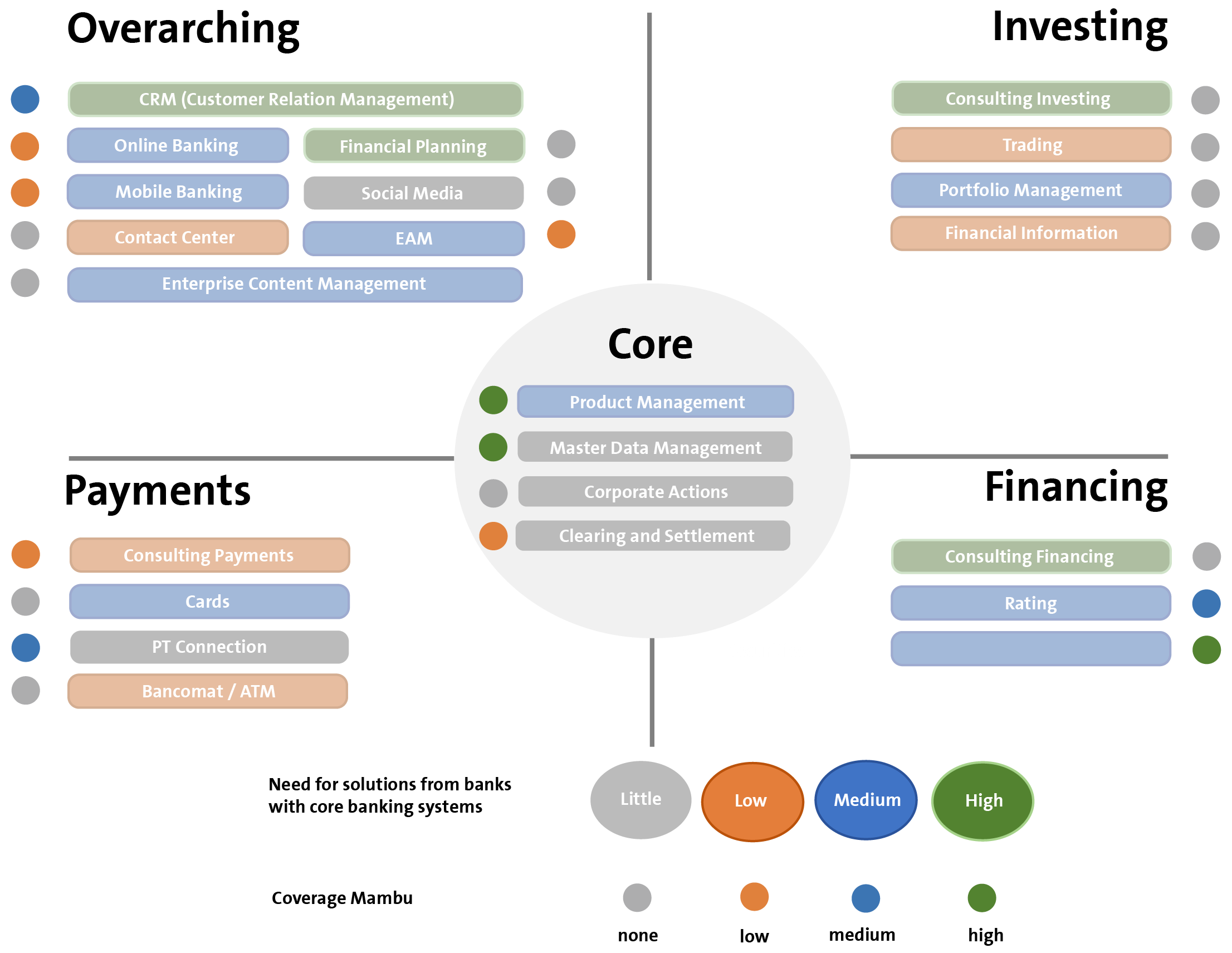

According to a recent survey of four banks in Switzerland as part of the Core Banking Radar, there is a particularly high need for solutions that provide overriding coverage of customer relationship management (CRM) and social media, and also support consulting in the areas of investments and finance. Mambu covers the basic functionalities of CRM, such as the underlying management and provision of banking-related customer information, as well as systematic planning of the customer contact. Mambu does not cover consulting and social media itself, but enables the connection of suitable peripheral systems through its openness.

Mambu’s coverage is high for collateral and in product management, with which an important requirement of Swiss banks is fulfilled.

Coverage of Mambu compared to demand in Switzerland

Whether Mambu is suitable for a bank depends on its size and strategy, among other things. When choosing a strategic direction, banks have conflicting priorities: their own governance and freedom to act versus participation in an eco-system that operates together according to agreed standards and is therefore contingent on the standards and acceptance of the others.

Mambu supports the strategic core elements in the development of such a strategy as follows:

- Openness

The basic concept of Mambu is the provision of a basic functionality that can be used transnationally in a standardised way and is integrated in a framework. This concept envisages networking with local system partners in terms of the eco-system in order to cover local requirements and conditions. Due to the central service provision, this only makes sense in an open architecture approach. Hence, the openness of the systems in combination with Mambu is a mandatory requirement. Current trends like open banking or open platforms can therefore be generally supported in eco-systems.

- Data

The consequence from the SaaS-orientated approach is cloud-based data storage. There is the possibility of transnational operation and hosting for data processing that satisfies regulatory requirements. In addition, there are new approaches in which the data is kept locally by Mambu alongside the SaaS guidelines. In each case, however, use of the data in a modular approach calls for a specific data storage and analysis concept in order to use the data of all applications in a bank and also beyond that. Mambu generally supports these approaches.

- Functions

In addition to the coverage of functionalities such as customer management, account, payment transactions, finance and support functions such as document management, Mambu relies on the integration of peripheral systems for more functionalities. The bank must be prepared to assume the costs for partner management and maintain a high level of integration expertise. That way the functional coverage can be handled flexibly.

- Processes

Tools for process automation and control (also interbank) exist via the extensive support functions. Efficiency and automation are certainly well supported with Mambu. The requirement here is also a high level of technical skill and process expertise in banking.

Conclusion

Generally, with Mambu, a universal bank should strive for a modular strategy (see the three strategies in the last article), which combines different functional components. In doing so, customer/account management as well as the underlying functionalities from payment transactions and financing are covered by Mambu. Additional functions are performed by peripheral systems that have to be integrated. That way, it is possible to fulfil current requirements in an agile way, such as the accompaniment of customer journeys.

For private banks with a pronounced primary focus on the investment and consulting business, the functional coverage still does not seem to be enough for the time being. It will be crucial here to see in which form a Product Factory 2.0 will support the flexible creation of products in the future. If it turns out to be comprehensive and strong, then there is nothing standing in the way of a modular approach as well in which advisory and customer support functionality is integrated via peripheral systems.

The following success factors must be taken into account for the implementation of a project to integrate Mambu:

- Market alignment

A first success factor for working with Mambu is priority-setting for differentiating services in the market and reliable partners that, for example, take over system support in the customer interaction.

- Architectural understanding

A high level of architectural understanding is required in the bank for orchestration of the integration and partner management; otherwise this can result in high overall costs.

- Profile change up to IT-minded employees

The establishment of extensive IT know-how in the bank is essential for a fast product launch time, and could possibly allow for the implementation of simple solutions with the bank’s own IT expertise.

- Successive migration

It will also be decisive to not aim for an immediate, complete migration, but rather to continue to develop the bank’s own platform in the context of the business orientation in a successive technological conversion.

- Open banking

On the whole, a business orientation is required that targets the development of eco-systems and the implementation of new business models in open banking.

If these success factors exist, then Mambu, with its composable banking approach, can by all means support the modular strategy of a bank in Switzerland as well. Perhaps banks will dare to test the effect of more agility on the customer experience with a smaller spin-off? The Core Banking Radar will stay on the ball in any case.

Articles already published in 2018/ 2019/2020

- Clever core banking system manufacturers are open to innovations from the outside (published 15 March, 2018)

- Expert interview – “We expect evolution rather than revolution” (15 March, 2018)

- Leveris: Bank support at the heart of the digital eco-system (published 23 August, 2018)

- “One size doesn’t fit all”: Core banking system manufacturers increasingly relying on digital eco-systems (published 30 May, 2019)

- SolitX: Smart Financial Contracts as a new approach to system support for banks (published 11 November, 2019)

- “The satisfaction of banks with their core banking systems: An area of tension?” (published 10 July 2020)

Business Engineering Institute St. Gallen

A long-term partnership exists between Swisscom and the Business Engineering Institute St. Gallen (BEI) within the “Ecosystems” Centre of Excellence. This centre deals with topics such as eco-systems, digitisation and transformation, as well as other issues relating to the structure of the financial industry in the future. In addition to its research activities, the BEI carries out projects related to the design and implementation of innovative, cross-sector business models.

Newsletter

Would you like to regularly receive interesting articles and whitepapers on current ICT topics?

More on the topic: