Core Banking Radar

"One size doesn't fit all": Core banking manufacturers are increasingly relying on digital ecosystems

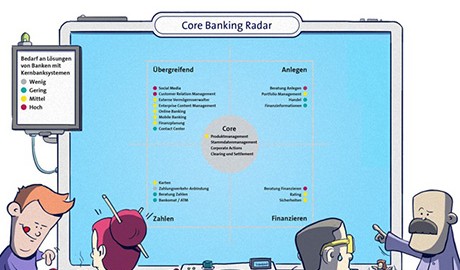

This article from Swisscom Banking has been created in collaboration with the Business Engineering Institute in St. Gallen (BEI). The article is part of the "Core Banking Radar" series, which represents the first systematic analysis of system support in the financial industry in Switzerland.

Our analysis of three further core banking systems shows that the opening up and orientation of banks is increasingly taking place in the context of the digital ecosystem. The core banking systems analysed in the course of the first investigation from Avaloq, Finnova, TCS, Temenos and Olympic, are functionally similar and only differ significantly in the areas of sales and advice, as well as in the use of peripheral systems. The systems described here are increasingly developing an independent functional profile and business model, oriented towards their ecosystem.

Text: Werner Gygax / Thomas Zerndt, Images: Zense, 30 may 2019

Banks still rely on their integrated core banking systems for the secure and efficient handling of the traditional banking business. As described in the first article in the Core Banking Radar the systems are continuously being opened up and modularised. The investigation into the systems considered in this article confirms that this development is associated with increased networking and involvement of Third Party Providers (TPPs). The TPPs are increasingly taking over the functionalities of traditional core banking systems and the manufacturers are increasingly concentrating on the prevailing trends of "connectivity" and "open banking as an enabler of ecosystems".

This article for the Core Banking Radar considers the Finstar, IBIS4D and Sopra Banking Software systems. Selection criteria included covering at least two of the three bank-related areas of payments, investments and finance, as well as operation in Switzerland, or the specific intention to do so. While Finstar and IBIS4D already operate in Switzerland, Sopra Banking only has the specific intention to do so – with the exception of individual modules.

The Core Banking Radar and the associated research work are one contribution to fulfilling the high demand for information relating to the future orientation of system support. As an independent system integrator, Swisscom Banking works with the Business Engineering Institute of St. Gallen (BEI). Both organisations contribute their own strengths: the BEI the methodical know-how and its neutrality, Swisscom the expertise in the implementation and operation of different (core) banking systems.

Convenience for the user and efficiency are the drivers for core banking manufacturers

With the huge flood of information about offers and services, customer needs are also changing. Convenience in operation, individuality in the fulfilment of needs and efficiency in satisfying needs are becoming increasingly significant. For this reason, manufacturers are increasingly relying on innovative technologies such as AI for data management and intuitive service offerings, networked in combination with TPPs.

A balancing act between TCO and networking

For core banking manufacturers this results in a balancing act which is increasingly difficult to manage. On the one hand there is the traditional, integrated solution for an efficient, secure transaction; this enables low overall costs (TCO = Total Cost of Ownership). On the other hand, opening up and networking are indeed a future-oriented answer to market needs, but they present a significant departure from the existing integrated concepts for system support towards a complex system architecture.

As different as their profiles are, the additional core banking manufacturers investigated here are characterised by the fact that, as with the manufacturers from the first round, they are actively dealing with the realignment. Like the first five systems investigated, the additional three systems described below are also primarily oriented towards the needs of private customers. SMEs or even the common needs of major customers can basically be supported with functionalities similar to those used to cater for private individuals. Specific developments are however already identifiable due to existing cooperation with TPPs in the area of investment advice, for example in the form of solutions which are oriented towards both private customers and SMEs, or consultant support in the bank.

In all three approaches, dealing with individual transactions and position management are not done from a single source; nor are the processing and monitoring of transactions in the three bank-related areas of payments, investments and finance.

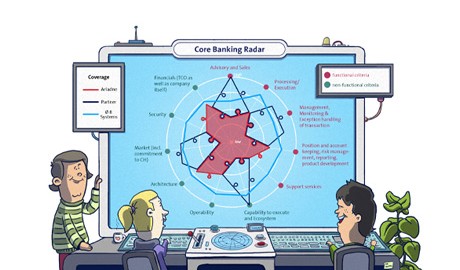

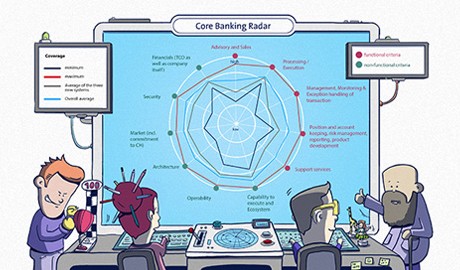

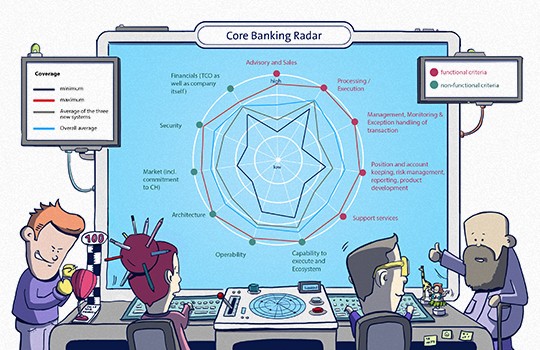

Core Banking Radar 2019: System support of banks: 11 analysed criteria

Differences are however identifiable in the characteristics of the range of functions. For example, one system which specialises in small banks, shows a different degree of automation when dealing with exceptions, with the same basic range of functions.

In the area of non-functional analysis it is apparent that the importance of network-compatibility and openness of the architecture is very high for all the systems considered. And this is regardless of the basic orientation of the system. The systems are also very similar in their operational capabilities in terms of control and maintenance, the roll-out of new releases, support and documentation. Here there are deviations resulting from the scaling requirements and the regional distribution, which are also reflected in the multiple usage (multi-client capability, multilingualism, multi-currency capability, time zone support). It is clear that the more international the orientation, the more comprehensive these product characteristics are.

If you compare the characteristics with those from the first article on TCS, Finnova, Avaloq, Olympic and Temenos in March 2018, it is apparent that the differences in the characteristics of the systems considered in March 2018 are not as major. The reason for this is probably that all manufacturers already have a comprehensive customer base. The differences particularly resulted from the differing level of international orientation. Differences resulting from the community and the respective ecosystem were considerably less significant here than with the systems now being investigated.

Significant differences in the manufacturers' strategies

The core banking systems analysed here reflect the different strategies of their manufacturers. If the system is aimed at a few small banks, the range of core functions is kept streamlined. On the other hand, if the system is aimed at many large, international banks, the range of core functions is broader.

The biggest differences in the functionalities of the core banking solutions investigated

The consequence of this is that as a result of their situation, systems with smaller communities are and have to be more open to cooperation with peripheral systems. This cooperation is particularly apparent in sales and advice (focus on investments and mortgages). While systems with a more streamlined core already cover these functionalities with peripheral systems, larger manufacturers cover these themselves in their own core banking system using acquisitions made from smaller manufacturers in the past. For system manufacturers with a small community, the functional configuration is oriented towards the needs of their largest customers.

The strong heterogeneity of the systems investigated here is also apparent for the non-functional criteria. While systems with a large, international community have a very comprehensive degree of coverage, systems with a small community focus on individual, differentiating, non-functional aspects. Different characteristics can be observed in all areas. Adapted to suit the specific target sector and the ecosystem the customer is aiming for, the architectures range from high-performance with flexible database support, to a very focused, streamlined, multi-client capable architecture. What all these developments have in common is that they present a departure from previously conventional interface concepts for the connection of partners and a trend towards integration using open architectures. There are smaller differences in the area of the delivery capacity and the ecosystem itself. Here all manufacturers have different focuses. Everyday operation includes control and maintenance, release management, support, documentation and training: here there exists a size-dependent cost awareness.

The most important functional developments in the next 12 months

There are clear differences in the functional developments. While one of the system manufacturers investigated is targeting new developments across all functional areas (sales and consulting, execution/handling, transaction-related, cross-transaction, support), the other two concentrate on software elements for sales and advice.

The most important developments in the core banking solutions investigated

The most significant developments can be expected in the area of sales and advice. The manufacturers are expanding the functionalities in the whole area of data management with a 360 degree view for the customer. Depending on the strategic approach, in some cases this is being carried out in collaboration with other manufacturers. There are differences regarding the expansion of the advice functionality. The available data gives the impression that it has not yet been decided whether the approach of continuous digital advice across all areas of payments, investments, finance and pensions will become established. Alternatively, there is another approach of decoupled advice with a development focus on investment advice, in some cases with the addition of portfolio management, pension advice and separate solutions for finance.

There is only a small amount of development in support processes. Traditional concepts for system support using peripheral systems in document management or financial accountancy are hardly changing at all. There are also few changes in processing, starting from an already very broad existing range of functions. This allows us to conclude that no system manufacturers are really planning for a departure from the integrated concept. Rather it is networking and peripheral systems that are set to fulfil the requirements for existing integrated concepts in the digital age. Consequently the balancing act between overall costs and networking will continue to exist.

New products and services: the differences are accentuated across the network

Innovations offer a great deal of potential for differentiation from the competition, especially in the service sector. For the individual service sectors, the following can be established:

- Payment: In the area of new services, little is happening among the manufacturers. The exception is the handling of cryptocurrencies. In order to offer these new services to customers, partnerships are being established with FinTechs. In some cases it also appears that the business sectors of mobile payment (Twint, ApplePay etc.), peer-to-peer payment and group payments are left to FinTechs or BigTechs. In an international context, this is certainly also associated with PSD2. Due to this new regulation, new payment service providers and account information processors are also at the ready in Switzerland.

- Investments: A combination of channel and product investments is emerging. New approaches can be found above all in hybrid advice (personal advice coupled with video sessions or technologically supported customer interaction), pensions (integration of insurance products from the Life sector) and in planning-based advice (finance / retirement / tax planning). The targeted customer segments are to be found in the areas of wealth management and family offices, as well as among affluent clients.

- Financing/loans: There is very little discernible movement among manufacturers in this context. It is understandable that success is not sought through new product innovations in these sectors. Instead, topics such as the relevance of the issue of housing are discussed from the perspective of the ecosystem for future system support.

- Overall, few efforts are being made relating to functional support of market places such as crowd-investing, peer-to-peer lending or property crowdfunding. This raises the question of economic relevance for banks. Looking at market trends, few profitable business models have yet been established. Once again it appears that the market is being left to FinTech.

Architectural features of the systems

All the systems investigated in this article consistently support multiple currencies (multi-currency). In terms of multi-client capability (multi-entity), the survey shows that two of the three systems have attributive multi-client capability (attributive = one database for all clients, replicative = one database per client).

There is a clear relationship in terms of time zone support: The bigger and more international a system manufacturer's community is, the more complete and automatic the consideration of time zones in processes and functions.

Country-specific characteristics for Switzerland (Swissisms) are only implemented by the manufacturer upon entry into the market. One such characteristic is the 3rd pillar account.

Three different strength profiles for three target groups

Finstar, Sopra Banking and IBIS4D all shape their profiles based on the target groups and their respective backgrounds.

IBIS4D particularly stands out due to the modular structure of the architecture and its high flexibility, for example in the case of multi-client capability, parametrisability and the implementation of security concepts. Functionally, it comprehensively covers banking functionalities in payment, investments and finance. In doing so, it invests in customer-oriented interaction functionalities and a 360 degree customer view, in particular. This is supplemented by video advice, for example. Services in the area of payment are comprehensively covered. Multi-payment, personal finance management and bill monitoring are being enhanced. Finance and pension planning complete the traditional services in the area of investment. In addition, there are marketplace functionalities such as crowd-investing and comparison options.

Finstar is a compact system focused on the 10-plus companies using it and is characterised by a low TCO. Architecturally, Finstar is shaped by an open architecture and a wide network for the collaboration and integration of FinTechs. Functionally, all areas are supported with scaling adapted to the target group. Besides the digitization and partial automation of the lending process (initiation, approval and settlement), new functionalities are emerging in the area of peer-to-peer functionality and the display of cryptocurrencies.

Sopra Banking also places great emphasis on the ecosystem and networking. It is characterised by a flexible release approach, which allows flexible, customer-specific system updates. As with the other systems, all three areas of payment, investments and finance are well covered, although a focus on investments can be seen for historical reasons. This is also evident in the existing and planned comprehensive functionalities in finance and pension planning, investment advice and Robo Advice. Sopra Banking is also investing in a variety of new services in the area of payment.

Something all three systems have in common is that no new services are planned in the area of finance.

All manufacturers still face challenges

The balancing act mentioned at the beginning of this article between "traditional, integrated solutions" on the one hand and "opening up and networking" on the other hand presents all manufacturers with challenges. The focus is on three key areas: overall costs, modernisation and market positioning.

The goal of core banking manufacturers is to keep the TCO of their systems as low as possible. For that reason, it is essential to strive for a high degree of standardisation along with ease of operation and testing. Nevertheless, it must be possible to customise the systems where banks require it. In addition, the maximum possible level of automation must be achieved in order to avoid expensive manual intervention. The result would be a high STP rate (rate of Straight Through Processing or continuous data processing).

In terms of modernisation, it is about appropriate modularisation and about partnerships for the purpose of opening up and developing the particular banking system.

Market positioning is the third key area. The focus is on new concepts such as mapping customer journeys in workflow management systems. This enables the perspective of the end customer to be given greater consideration. In this regard, it is necessary to work with the right partners to prevent the in-house system support from degenerating into a disposable service.

Conclusion: One size doesn't fit all – and yet everyone faces the same challenge

Based on the previous results of the Core Banking Radar, it is clear that "the best system" does not exist. System manufacturers and banks must become much more aware of the customer requirements that they have to meet. Ideally, the specific system support requirements should then be derived from this.

For example, in some circumstances a provider with a regional focus is more interesting for a regionally positioned bank than a large international manufacturer, if the focus of the bank's strategy coincides with the core banking solution and the costs can also be kept lower.

The Core Banking Radar will closely monitor further market developments and periodically update existing results. The next steps will be to present another newcomer, followed by an additional look at the topics of ecosystems and trends in peripheral systems.

Some reflections on future market development

Bank customers increasingly expect their bank to support their needs ("I want to buy a house and not a mortgage") and expect the bank to organise the optimum support in combination with the increasing technological possibilities of digitisation and the break-up of the value chain which has been progressing for years. This requires clear positioning of the banks in the strategic finance network. One much-debated possibility at present is the concept of the digital ecosystem.

The key background factor is still the answer to the question: "As a bank and/or manufacturer of core banking solutions, for which services and core value propositions are we the orchestrator, the leading provider or simply a barely visible supplier?".

This results in two versions of market development, as observed in other sectors:

- On the one hand, a major system manufacturer could emerge in the overall market, which develops into a dominant provider in the overall market (e.g. SAP in industry).

- On the other hand, the provider landscape could remain fragmented with no manufacturer emerging as the sole dominant provider over all banking areas. The overall market would be divided between several manufacturers.

The current development of the finance industry in Switzerland clearly points towards the second option.

Articles already published in 2018

- Core banking system manufacturers open up to FinTech innovations (published 15 March 2018)

- Leveris: Banking support is central to the digital ecosystem (published 23 August 2018)

- Interview with Thomas Zerndt and Clemens Eckert: "We expect evolutions rather than revolutions” (published 15 March 2018)

Outlook of upcoming articles in 2019

- Newcomer article: New approach to a core banking solution

- Customer perspective article: Future requirements of system support from the overall banking perspective

The profiles and orientation of the individual manufacturers

DXC

DXC was created by the merger of the HPE division Enterprise Services with CSC. With BEKB as currently the largest of three customers, the comprehensive replacement of the current core banking solution IBIS3G with the new IBIS4D was agreed. To prepare for additional customers, DXC relies on modular structures. Several hundred people are employed at the Bern location. In the medium term, the location is to be developed into a strategic banking hub in Europe and additional banking IT specialists are to be recruited. Selected strengths are: the modular structure of the architecture, the high flexibility (e.g. multi-client capability) and the implementation of security concepts.

Finstar

Finstar was developed by the mortgage bank Lenzburg as its own core banking system. However, it is also open to third-party banks and market success is particularly noticeable for smaller banks. Third-party providers can also be connected to the open banking platform via standardised programming interfaces. Finstar focuses on BPO. Initial services are already being offered in other sectors (e.g. Personalkasse of the SBB, Avobis as a real-estate service provider). As one of the Finstar banks, the mortgage bank Lenzburg has received the "Most Digital Bank in Switzerland" award. Selected strengths are: low TCO, open architecture, broad network for collaboration and integration of FinTechs.

Sopra Banking

Sopra Banking is a subsidiary of the Sopra Steria Group and, with over 700 customers worldwide in over 70 countries, one of the major global providers of core banking software. As a union of several solutions (including Thaler and Cassiopae), it covers all three customer processes. Currently only represented with individual modules at select companies in Switzerland, Sopra Banking is aiming for a long-term, sustainable entry into the Swiss market. Sopra Banking currently has around 4,500 employees and aims to be a global software leader. Selected strengths are: the flexible release approach, which enables flexible, customer-specific system updates, a high degree of internationality, strong networking and the importance placed on ecosystems.

Business Engineering Institute St. Gallen

Swisscom and the Business Engineering Institute in St. Gallen (BEI) have been in partnership for many years within the framework of the "Ecosystems" expertise centre. The centre works with topics such as ecosystems, digitalisation, transformation and matters pertaining to the future structure of the financial industry. Along with its research activities, the BEI runs projects designing and implementing innovative, cross-industry business models.

Newsletter

Would you like to regularly receive interesting articles and whitepapers on current ICT topics?

More on the topic