Core Banking Radar

Core banking system manufacturers open up to FinTech innovations

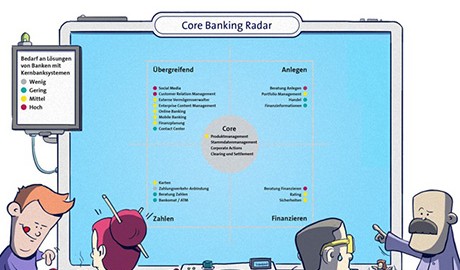

Swisscom Banking, in conjunction with the Business Engineering Institute St. Gallen (BEI), developed the “Core Banking Radar” forecasting tool to analyse the existing and future functions of core banking solutions in the finance industry.

Their analysis shows that the current systems in Switzerland are very similar with regard to classic core banking functions, but that there are striking differences in areas such as sales and consultancy, as well as in the use of peripheral systems.

Text: Matthias Niklowitz, Images: Zense,

Integrated core banking systems currently form the basis for efficient and secure business operation for many financial services providers. Digitisation and the associated changes to customer interactions, greater user convenience for clients and for the bank’s customer advisers, as well as topics such as cloud solutions and digital ecosystems, present challenges not only to banks but also to the established structures, release cycles and development methods of core banking system manufacturers. Technological developments enable transaction costs and the marginal costs of processing transactions to be reduced. In order to meet these challenges, relevant peripheral systems are assuming important functions more and more frequently.

How are core banking systems reacting to these developments? In many cases, they still act according to a “follower strategy” of developing solutions for specific customer needs or offering individual solutions. This brings us to another important question: will the manufacturers of core banking systems reconquer the functionalities taken on by peripheral systems or will they open up?

Much information is needed

Until now, there has been no comprehensive analysis in Switzerland of how support in the finance industry in general will be shaped in future and how core banking systems will have to be designed in order to support the finance industry and banks during the fast-paced digital transformation. From its position as a non-proprietary system integrator and in collaboration with the Business Engineering Institute St. Gallen (BEI), Swisscom Banking has therefore developed a “radar” for the coverage of existing and future functions in the finance industry. Both participants contribute their own strengths to the project: the BEI provides methodical expertise, technical banking reference models from the research consortium project CC Sourcing, and neutrality for the scientific treatment of the topic, while Swisscom provides expertise for the implementation and operation of core banking systems of various origins. The market overview will be regularly updated, starting with the first survey, which took place at the end of 2017.

The survey covered the core banking systems of the following manufacturers (in alphabetical order): Avaloq, Finnova, Olympic/Eri Bancaire, TCS/BaNCS and Temenos. The inclusion criteria for Stage 1 were as follows: licensing capability, coverage of at least two specialist banking fields and a positive track record as a core banking system in Switzerland. Stage 2, which will be added this year, will include detailed examination of other systems which are less established in Switzerland or are intended to be established there. These include, in particular, new system manufacturers with alternative solution approaches, such as Leveris or VaultOS from Ireland and England.

What all the systems chiefly have in common is that they are optimised and suitable for private customer business. From their origins, they have been historically less geared towards corporate customers, which is why accounting components now have to be built in retrospectively, for example.

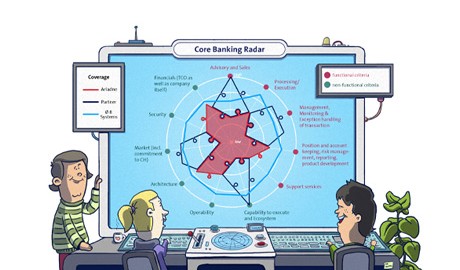

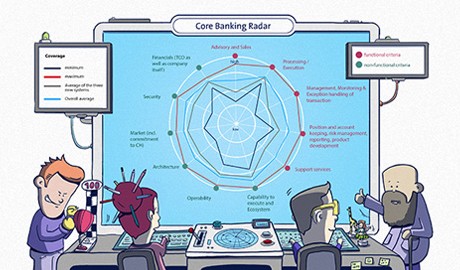

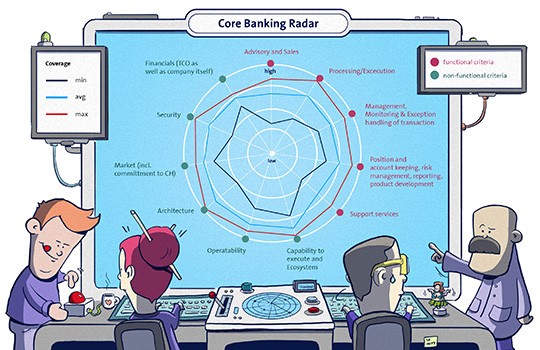

The survey shows that all five systems are stable in their core area. No core banking system manufacturers want to surrender the handling of individual transactions or any type of position management or monitoring. Additional functionalities are very comprehensively depicted in some cases, for example in the area of portfolio management.

Peripheral systems are currently used particularly in the area of support. Accounting stands out in this respect: functions which support financial accountancy and, depending on scope of function, company accounting, are often covered by peripheral systems.

The assessment of performance with regard to non-functional criteria shows that all systems place great value on networks, resource management and a flexible architecture. The systems are also very similar with regard to practical day-to-day work: banks retain similar packages for steering and maintenance, release approaches, support, documentation and training. With regard to multiple use (multi-client capability, multilingualism, multi-currency capability, time zone support), all the systems but one are very highly developed.

The area of sales and consultancy, including customer information and history, is the least-covered area, on average, in the five systems studied. While CRM basic functionalities for the management of customer data are available in all systems, 360-degree customer information combining internal and external data is not yet completely supported by all the solutions. It is precisely in this area of customer interaction that the system manufacturers in this survey have announced that they will make the most changes in the next 12 months.

The area of customer reporting, too, will see developments allowing customer advisers or even the customers themselves to carry out adjustments to their own reports, depending on the scope of service.

Alongside these commonalities, there are some differences between the core banking systems with regard to assessment functionalities such as customer and market analyses, and the integration of new services in the areas of insurance, marketplaces, social media (as a supplementary data source and customer interaction channel) and Wallets for the management of digital currencies.

Services: potential for new developments

In the area of service in particular, there is still great potential to stand out from other providers through innovation. For example, one manufacturer has added predictive analytics to its functions to predict future customer actions and enable more targeted interactions.

For individual services, the following was observed:

- Payment: Possible innovation topics are services such as peer-to-peer payment and handling of crypto-currencies, which are currently only available in a few cases. The integration of social media-supported payment or Messenger payment functions into payment transaction areas is another topic which has been hardly touched on. In a few cases, additional payment processing systems are provided via peripheral systems.

- Investing: The survey revealed that digital consultancy services such as robo advisers are partially covered by peripheral systems or by a modular acquisition and integration approach. Comprehensive investment advice and wealth management (e.g. financial planning) is now only partially defined as a functional area of a core banking system.

- Financing: All kinds of corporate loans and mortgages are generally covered very well. The same applies to more complex loan forms and simple leasing. Services for financing consultation are not yet well-established.

- Retirement provision: Services such as the Third Column for account management or non-cash items from life or property insurances are depicted, but there is virtually no functional support for provision-related services which go beyond this. This clearly shows up the border with developments in the insurance industry.

- Marketplaces: Crowd investing, peer-to-peer lending and property crowd-funding are not currently supported by the functions of core banking systems. However, more willingness to invest is shown in services such as real estate platforms or platforms for virtual goods.

Manufacturers: modularisation is central

In the case of the three most widespread systems in Switzerland – Avaloq, Finnova and Olympic/Eri Bancaire – their installations were largely created 10 to 25 years ago. All manufacturers are working on modularising their architectures and on open interfaces. Two reasons were revealed for the different development dynamics of the front and back end. Firstly, the stability of the core is important, which is why new services such as digitisation do not influence the functionalities and processes of core banking systems themselves, or only to a limited extent. Secondly, the systems do, however, aim to offer functionalities for customer interactions on the market. Modularisation at the front end enables flexible adjustments, and the manufacturers can also adapt better to banks’ acquisition strategies.

All five systems comprehensively support several currencies in parallel and have an attributive multi-client capability. Because of the strategies used by the manufacturers, some systems do not include fully automated, highly integrated transaction processing. Most of the systems support transactions in different time zones. Most systems contain an attributive multi-client capability, which means that only one data attribute says which data may be read precisely by which bank (the opposite would be replicative multi-client capability, where each bank has its own database). A minority of the systems is not comprehensively multi-client capable.

With regard to multilingualism, one system supports English, German, French and Italian. Another system has an even larger selection of languages. Three systems additionally allow languages to be added on the basis of self-created language files.

From monoliths to modularisable systems

The survey shows that all manufacturers are working on modularisation so that they act more flexibly on the market and in catering to banks’ needs. Strategically speaking, the system manufacturers have different approaches, either based on the core banking approach or on the banks’ purchasing strategies.

Whatever the choice of strategy, modularisation inevitably entails opening up to others, which increases the significance of cooperating with each other in the digital ecosystem and with peripheral systems. In the past, features of peripheral systems were initially conceived as standalone concepts; this was followed by closer integration with FinTechs. For example, consultancy elements such as a personal finance manager via peripheral systems are practically docked to the systems like a Lego building block. All this can now only work with a collaborative approach which did not exist before.

Functions which are prominently covered by external providers or suppliers in this survey are revealed in the areas of (digital) consultancy, customer loyalty, and information and data usage.

Opening up by means of APIs and internal orchestration of modularisation must continue to be initiated by the individual core banking system manufacturers. This involves coordination expense and challenges to the system architecture. New concepts such as the Open Banking Hub, which are intended to enable the fastest and most inexpensive integration possible, are an initial response to this.

We are excited to see how the systems will develop. From now on, the Core Banking Radar will track the changes. Semi-annual updates will ensure that the banks can respond swiftly.

The individual manufacturers have the following profiles or describe their positions and direction as follows:

Avaloq

Avaloq has developed a comprehensive core banking system covering diverse functions. The manufacturer is increasingly globally active and focuses on private banks as well as large retail banks. The core banking system’s structure is becoming increasingly open, with the aim of ensuring function requirements even when taking FinTech providers into account. This is achieved by means of an open marketplace (software exchange). Between three and five new customers are added each year. All the customers operate within four release versions, which take place semi-annually for the core banking system and currently every two months for the digital front applications.

Finnova

Finnova offers a comprehensive system with a prominent focus on small and medium-sized retail banks. The platform has an open structure and is currently constructing a digital ecosystem in order to meet customer-oriented function requirements. However, this excludes the core functionalities around transaction processing and booking engines.

Olympic/Eri Bancaire

Olympic/Eri Bancaire has a high penetration in the Swiss and Luxembourg banking market and is active worldwide. Its focus is on private banks and small to medium-sized universal banks. The original approach of covering all the functionalities with its own resources and without additional peripheral systems is continually supplemented by offers from a growing digital ecosystem.

Temenos

With its high-performing system and a broad global customer base, Temenos has achieved high modularisation among Tier 1 banks. Function coverage is also ensured by acquisitions and subsequent integration. This high function coverage enables individual separable modules to be inserted into an existing system landscape. In contrast to its high international distribution, there are only a few isolated installations in Switzerland.

TCS BaNCS

The TCS BaNCS solution is the comprehensive system by the Indian software giant Tata Consultancy Services, which aims to support banks in using innovative technologies and offering digital omnichannel services. This solution allows banks the necessary agility in the face of changing market circumstances and enables an API strategy for a partner ecosystem. TCS will be going live with its first installation in Switzerland in the next few months. With its globally distributed system, TCS relies on high modularisation and aims to cover all the function requirements itself.

Swisscom and the Business Engineering Institute in St. Gallen (BEI) have been in partnership for many years within the framework of the "Sourcing in the Financial Industry" expertise centre. The centre works with topics such as ecosystems, digitalisation, transformation and matters pertaining to the future structure of the financial industry. Along with its research activities, the BEI runs projects designing and implementing innovative, cross-industry business models.

Newsletter

Would you like to regularly receive interesting articles and whitepapers on current ICT topics?

More on the topic