the best coverage, reimagined

Legal protection insurance subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- Make changes at any time

- Monthly cancellation option

Package

Personal liability

- Home & Everyday

Helps you with legal issues or disputes in connection with rent, property or everyday transactions, from shopping to privacy violations.

Learn more - Mobility & Travel

Your cover for legal issues and disputes in connection with vehicles, road traffic offences and travel.

Learn more - Health & Personal

InsuranceThis is the option for legal issues and disputes in connection with health, maternity, retirement or unemployment.

Learn more - Work

For all issues relating to employment law; helps you with legal issues and disputes in connection with work.

Learn more - Partnership & Family

Helps with disputes and issues in connection with school authorities right through to divorce.

Learn more - Taxes

Helps with legal issues and disputes with the Swiss tax authorities regarding income tax and wealth tax.

Learn more - Legal Advice PLUS

Receive three hours of legal advice per insurance year on all issues relating to Swiss law.

Learn more

Choose package

Legal protection

S

The essentials, no frills

Personal liability

-

-

-

-

-

-

-

from 12.95 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Legal protection

M

More cover, fewer headaches

Personal liability

-

-

-

-

-

-

-

from 29.80 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Legal protection

L

A comprehensive, no-worries package

Personal liability

-

-

-

-

-

-

-

from 37.20 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Can’t find the right subscription?

Then tailor-make your own.

Details of cover

What does legal protection insurance cover?

Home & Everyday

Helps you with legal issues or disputes in connection with rent, property or everyday transactions, from shopping to privacy violations.

Example:

Your heating has not been working for two weeks, but your landlord is refusing to have it repaired or reduce your rent.

Your claims

Rent reduction |

500.– |

Compensation for inconvenience (e.g. rental of multiple heating appliances, increased electricity consumption) |

300.– |

Costs incurred |

|

Legal fees |

400.– |

Accrued claims + costs |

1,200.– |

What you pay (excess) |

0.– |

Thanks to your legal expenses insurance, you’ve been awarded a reduction in your rent and compensation for inconvenience. You’ve also saved the costs of a lawyer.

Mobility & Travel

Your cover for legal issues and disputes in connection with vehicles, road traffic offences and travel.

Example:

You go on holiday with your two children, but when you arrive, the resort does not live up to its promises. The pool complex is closed and the surrounding area resembles a building site. Disappointed, you look for an alternative that meets your expectations, but the travel agency shows no understanding and refuses to help.

Your claims

Booking a new hotel at short notice |

2,300.– |

Additional costs (e.g. taxi to the new hotel) |

100.– |

Costs incurred |

|

Legal fees |

1,200.– |

Court costs |

500.– |

Accrued claims + costs |

4,100.– |

What you pay (excess) |

0.– |

Thanks to your legal expenses insurance, you’ve not only saved court fees but also the costs of hiring a lawyer.

Note

The "Health & Personal Insurance" module is recommended for disputes in connection with injuries resulting from accidents or illnesses.

Health & Personal Insurance

This is the option for legal issues and disputes in connection with health, maternity, retirement or unemployment.

Example:

Your health insurance company informs you that some of the post-treatment costs following your knee surgery are not covered. You’re faced with the challenge of having to pay these costs yourself, even though you believe they should be covered.

Your claims

Treatment costs |

750.– |

Costs incurred |

|

Legal fees |

1,200.– |

Court costs |

700.– |

Accrued claims + costs |

2,650.– |

What you pay (excess) |

0.– |

Work

For all issues relating to employment law; helps you with legal issues and disputes in connection with work.

Example:

You’ve been made redundant and your employer refuses to pay your outstanding overtime and holiday entitlement.

Your claims

Overtime payment |

4,500.– |

Holiday entitlement payment |

4,000.– |

Costs incurred |

|

Legal fees |

1,550.– |

Court costs |

3,000.– |

Accrued claims + costs |

13,050.– |

What you pay (excess) |

0.– |

Partnership & Family

Helps with disputes and issues in connection with school authorities right through to divorce.

Example:

You realise that there are hardly any outdoor activities at your child’s daycare centre, even though this was promised. What’s more, the children are left to their own devices for large parts of the day instead of being actively supervised and stimulated. Out of concern for your child’s well-being, you cancel the contract. However, the daycare centre refuses to refund the fees you’ve already paid in advance.

Your claims

Childcare costs |

1,600.– |

Costs incurred |

|

Legal fees |

950.– |

Court costs |

500.– |

Accrued claims + costs |

3,050.– |

What you pay (excess) |

0.– |

Taxes

Helps with legal issues and disputes with the Swiss tax authorities regarding income tax and wealth tax.

Example:

The tax authorities have rejected your deductions for further education costs and are demanding a high back payment. You wish to defend yourself against this demand and assert your rights.

Your claims

Saved back payment |

800.– |

Costs incurred |

|

Legal fees |

950.– |

Costs of appeal procedure* |

0.– |

Accrued claims + costs |

1,750.– |

What you pay (excess) |

0.– |

* The appeal procedure is free of charge. Court costs of around CHF 3,000 (depending on the value in dispute).

Supplementary service

Legal Advice PLUS

Always the right choice: Receive three hours of legal advice per insurance year on all issues relating to Swiss law.

Example:

You wish to draw up a will and have some legal questions about estate planning.

Costs incurred |

|

Costs for private legal advice (external) |

1,200.– |

Insured legal advice (3 hours) |

0.– |

Savings through legal advice PLUS |

1,200.– |

What you pay (excess) |

0.– |

Reliable protection - with Swisscom and AXA ARAG

A good feeling with every conflict.

With Swisscom's digital insurance subscription and AXA ARAG's tried-and-tested protection, you are fully covered – quickly, easily and reliably.

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

Make changes any time

Need to make changes to your insurance cover? Not a problem. You can make changes to your insurance as quickly and easily as you took it out.

Monthly cancellation option

Lengthy contractual terms are a thing of the past. You can cancel your insurance subscriptions at any time to the end of the month, with no ifs or buts.

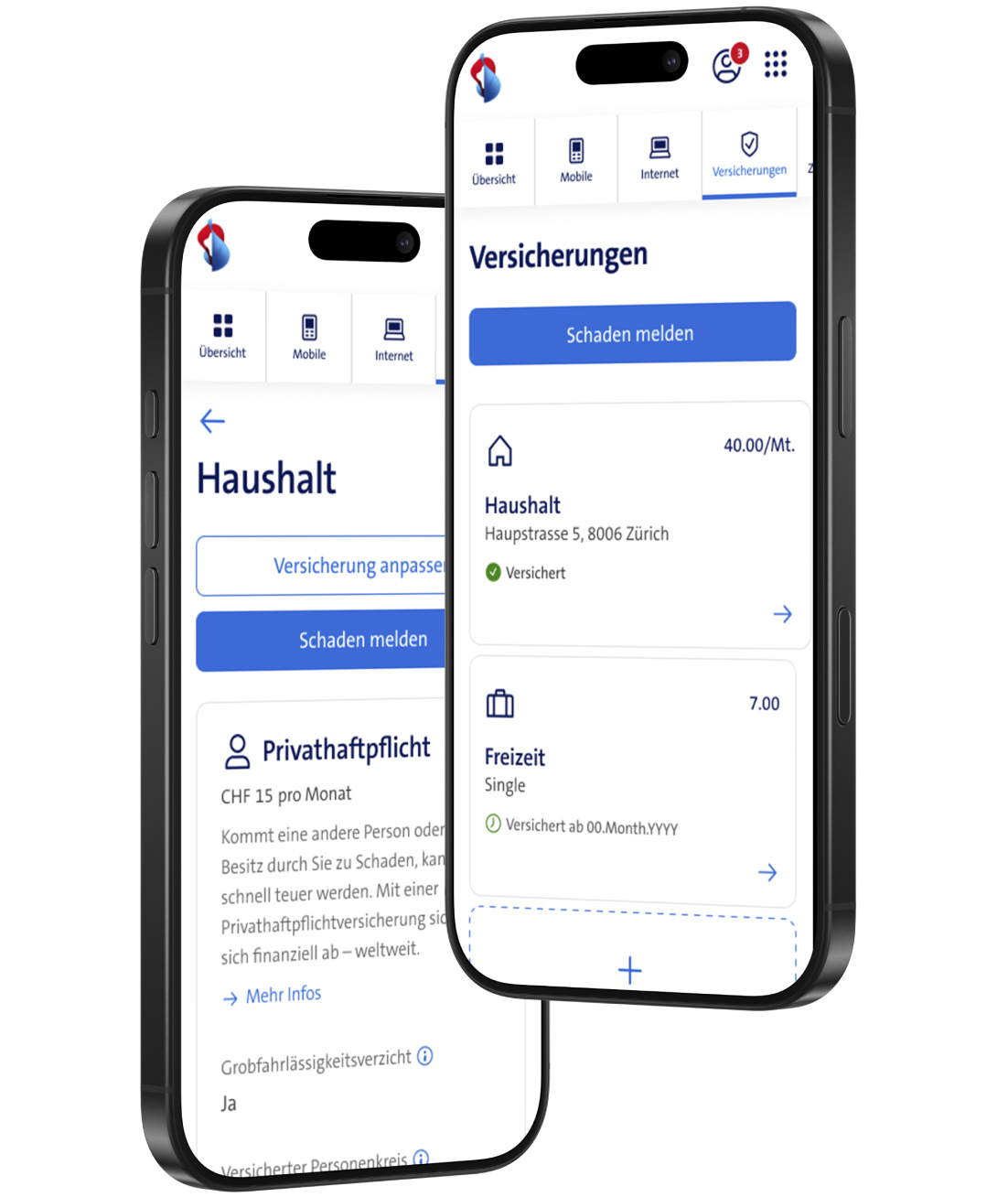

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

Frequently asked questions

Why do I need legal protection insurance?

When life doesn’t go as planned, you may find yourself involved in a legal dispute or in need of legal advice. Besides causing stress, it can also become expensive. That’s why we recommend taking out legal protection insurance. We would advise arranging legal cover for as many eventualities as possible. We therefore highly recommend the module Legal Advice PLUS. This module gives you three hours of legal advice per insurance year on all issues relating to Swiss law.

Does personal liability insurance not cover legal issues?

Personal liability insurance covers you for damaging property belonging to third parties or even harming third parties. In such cases, personal liability will examine third-party claims and is therefore a kind of indirect legal protection. However, liability insurance does not cover you if you wish to assert your rights as a claimant.

When can legal protection insurance help?

Legal protection insurance is there to help when life doesn’t go as planned and you have a legal issue or find yourself involved in a dispute. The support we provide ranges from legal advice to representation in a court of law. sure legal protection insurance allows you to choose from and combine the following modules: Home & Everyday, Mobility & Travel, Health & Personal Insurance, Work, Partnership & Family, Taxes and Legal Advice PLUS. You can find more information about the various modules here and in the Terms and Conditions(opens in new tab).

What’s included?

The legal protection insurance covers the costs of:

- Legal advice and processing of your legal case by AXA-ARAG lawyers

- Appointing an external lawyer

- Proceedings before state courts and authorities

- Expert opinions

- Mediation and arbitration proceedings

- Compensation for costs of proceedings and parties’ expenses

A detailed list of all the costs covered can be found in paragraph A.5. “What is insured?" of the General Terms and Conditions (GTC)(opens in new tab).

Is my entire family covered by the legal protection?

Yes, if you specify the additional persons by name when concluding the insurance, if these persons are registered at the same address (residence certificate), and you take out multi-person insurance.

What is the deductible for legal protection insurance?

sure legal protection insurance includes a deductible of CHF 0.–.

What is a waiting period or qualifying period?

The waiting period, also known as the qualifying period, is the amount of time you must wait after concluding insurance before some or all of your coverage comes into effect. Swisscom sure legal protection does not have a waiting period. If you conclude legal protection insurance with Swisscom sure, you are protected as of the next day.

I am involved in a dispute with a neighbour that has escalated to the point where it is going to court. I would now like to take out legal protection insurance to obtain legal support. Is this case covered?

No. This is considered a pre-contractual event. This is a term used to describe a legal case or legal dispute whose cause occurred prior to taking out a legal protection insurance policy. For cover to apply, the triggering event and need for legal protection must arise during the insurance term. With Swisscom sure, you are insured against future legal cases from the next day after arranging the cover. However, legal protection insurance from Swisscom sure still excludes coverage for pre-contractual legal cases.

Am I free to choose my own lawyer?

Our partner AXA-ARAG typically provides lawyers and experts to ascertain the legal position. However, in some cases it is useful to appoint an external lawyer. If the insurer considers this necessary, a suitable lawyer will be suggested to you. For more details, please see paragraph A.7. "How are the legal cases handled" of the General Terms and Conditions (GTC)(opens in new tab).

Benefit from our insurance subscriptions

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

Report your claim online or by telephone We will direct you to AXA‑ARAG.

Monday to Friday, 8 am - 6 pm

(charged at approx. CHF 0.08 per minute)