The best coverage, reimagined

Rental guarantee insurance

subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- No additional fees

- More financial freedom

Financial freedom

Your money stays in your account and can be used for other expenses or investments. Monthly payments

Instead of a high one-off payment, you can pay a manageable monthly premium. Easy to arrange

Rental guarantee insurance can be taken out quickly and easily online. Repayment

No repayment needed as you haven’t made a deposit with the bank. Savings

Your savings remain available at all times and can be used for other purposes.

Insurance

Flexible protection without tying up capital

Financial freedom

Your money stays in your account and can be used for other expenses or investments. The money remains in the account

Monthly payments

Instead of a high one-off payment, you can pay a manageable monthly premium. Premium payable monthly

Easy to arrange

Rental guarantee insurance can be taken out quickly and easily online. Sign up online in just a few minutes

Repayment

No repayment needed as you haven’t made a deposit with the bank. No repayment necessary

Savings

Your savings remain available at all times and can be used for other purposes. Your savings are always available

from 4.50 per month

The price of CHF 4.50 per month for rental guarantee insurance applies for a guarantee amount of CHF 1,000.

Bank deposit

Your deposit is tied up in a special savings account

Financial freedom

Your money is frozen inside a bank account

Monthly payments

High one-off payment

Easy to arrange

Often takes several days

Repayment

Repayment can take several weeks

Savings

Savings paid into a bank account

Details of cover

What does rental guarantee insurance cover?

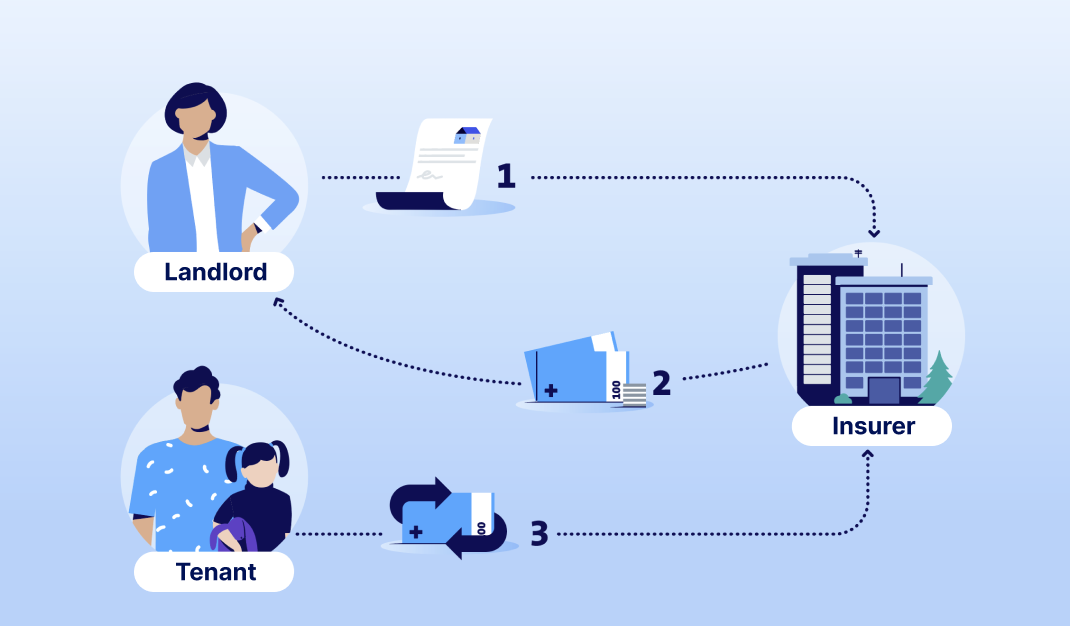

Rental guarantee insurance is a surety that gives you financial flexibility, while at the same time offering your landlord the same level of security as with a security deposit. You pay a monthly premium for this surety.

Example:

If you damage your rental apartment or fail to pay your rent, this insurance will reimburse your landlord. You will then have to repay this amount later.

Reliable protection - with Swisscom and AXA ARAG

A good feeling with every move.

With Swisscom's digital insurance subscription and AXA ARAG's tried-and-tested protection, you are fully covered – quickly, easily and reliably.

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

No additional fees

Whether for joining, administration or anything else. We won’t charge you any additional fees.

More financial freedom

Use your money for what’s important – maybe some new furniture, or something else you’re dreaming of.

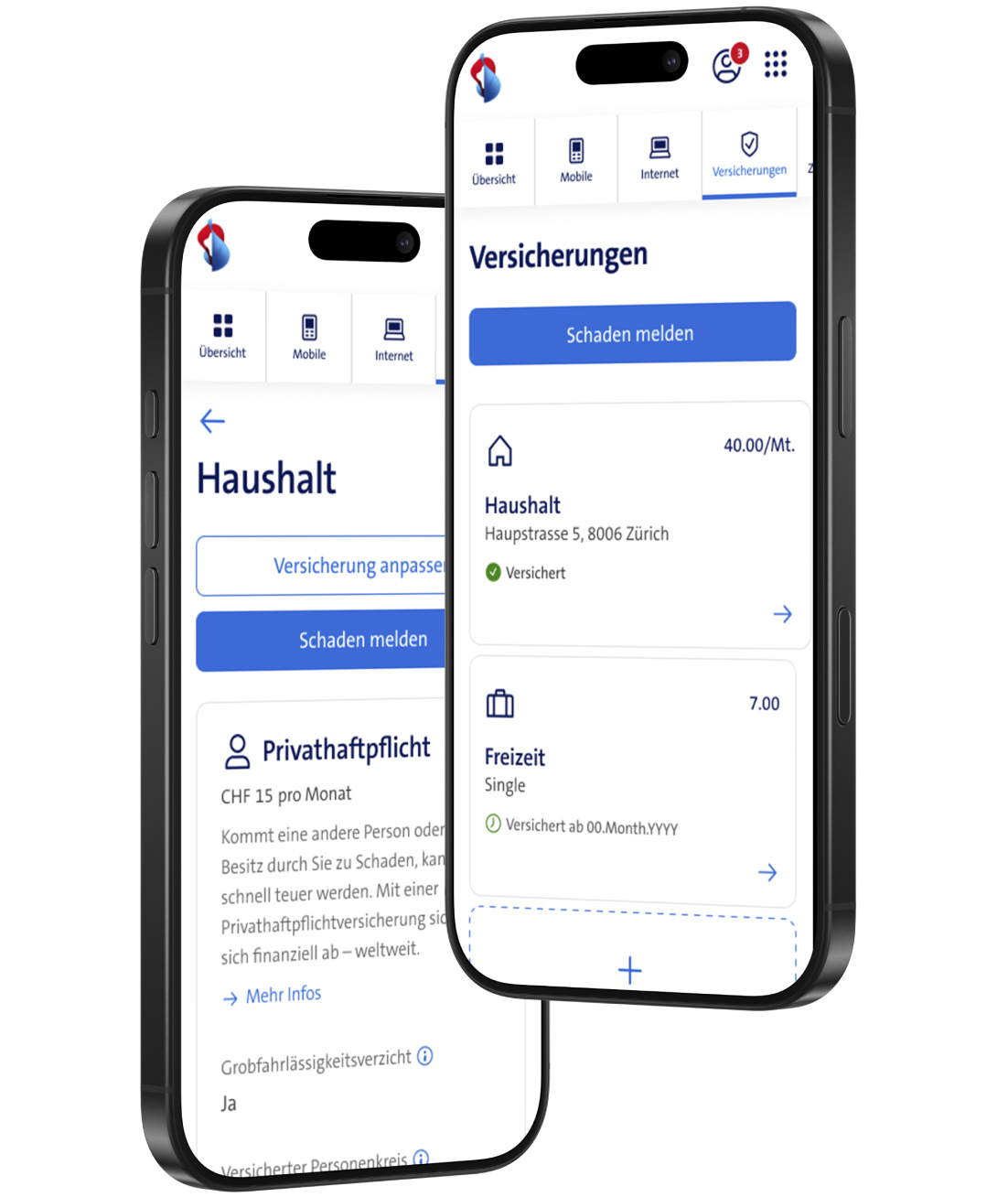

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

FAQs

What is rental guarantee insurance?

With rental guarantee insurance you don’t have to place up to three months’ rent in a security deposit account to move into a new apartment.

Rental guarantee insurance stands surety for you as the tenant. And your landlord receives a surety bond that is equivalent to a security deposit. All you pay is a monthly premium that is based on the amount of the security deposit stated in your rental agreement.

Security deposit or rental guarantee insurance: What’s the difference?

Security deposit:

You have no access to your money. Your money is locked away in a bank account for the entire life of the lease.

Security: A security deposit in an bank account offers the same security as rental guarantee insurance.

Cost: Depending on your bank, you may have to pay account opening and account closing fees. You could also be missing out on earning interest because you are not able to invest your money how you want.

Rental guarantee insurance:

Your money is not tied up in a bank account. You do not need to deposit any money.

Security: Rental guarantee insurance provides the same security as a security deposit in an escrow account.

Cost: 4% of the security deposit amount plus federal stamp duty.

Are my premiums used to pay off the security deposit?

No, the premiums you pay as a tenant are used to pay for the surety bond, which is a guarantee that the insurance will pay for damage to the apartment or overdue back rent owed up to the defined amount during the term of your lease. However, this is only an advance payment by the insurance. You will be required to repay this amount.

What are the requirements for taking out rental guarantee insurance?

You must be at least 18 years old to purchase rental guarantee insurance. We recommend that in addition to rental guarantee insurance, you take out personal liability insurance as well because it covers some of the damages caused as a tenant. For example, if you drop a perfume bottle in the bathroom sink and it cracks the sink.

Don’t have personal liability insurance? Find out more about what we can offer you here.

What data does Swisscom use, how and for what purpose?

You will find general information on data processing by Swisscom as well as information on additional data processing in insurance brokerage at www.swisscom.ch/privacy. You can find out how the insurance company processes your data in the privacy policy or read the insurance terms and conditions of the insurance company in question.

Benefit from our insurance subscriptions

Services and further topics

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.