The best coverage, reimagined

Leisure insurance subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- Make changes at any time

- Worldwide protection

Number of persons

Cancellation costs

Cancellation costs are only covered for the directly affected person (if he/she or a close relative is ill or suffers an accident). SOS assistance

The costs of rescue, hospitalisation, repatriation to Switzerland, etc. are only covered for the directly affected person.

Leisure

Single

For solo travellers.

Number of persons

One person

Cancellation costs

Cancellation costs are only covered for the directly affected person (if he/she or a close relative is ill or suffers an accident). Reimbursement for the directly affected person

SOS assistance

The costs of rescue, hospitalisation, repatriation to Switzerland, etc. are only covered for the directly affected person. Reimbursement for the directly affected person

from 5.–

Leisure

Group

For friends travelling together.

Number of persons

Up to four persons

Cancellation costs

Cancellation costs are only covered for the directly affected person (if he/she or a close relative is ill or suffers an accident). Reimbursement for the directly affected person

SOS assistance

The costs of rescue, hospitalisation, repatriation to Switzerland, etc. are only covered for the directly affected person. Reimbursement for the directly affected person

from 12.–

Leisure

Family

For family and friends who live

and travel together.

Number of persons

Up to ten persons

Cancellation costs

Cancellation costs are only covered for the directly affected person (if he/she or a close relative is ill or suffers an accident). Reimbursement for the whole family

SOS assistance

The costs of rescue, hospitalisation, repatriation to Switzerland, etc. are only covered for the directly affected person. Reimbursement for the whole family

from 12.–

Can’t find the right subscription?

Then tailor-make your own.

For holidaymakers who travel frequently and want more comprehensive cover.

Details of cover

What does the leisure insurance cover?

Leisure insurance has two components – cancellation and emergency assistance cover. The two components can be taken out in isolation or combined as required for 1 to 22 days.

Cancellation costs

Cancellation costs in the event of the trip not being taken

The insurance covers you, up to the amount insured, for costs incurred as a result of the trip or event attendance being cancelled due to illness, accident or other unforeseeable event.

Cancellation costs incurred

If you have to cancel a trip, the tour operator will often charge you a fee. These cancellation fees are also covered as part of your insured amount.

Cancellation costs for curtailment

If you have to cut short your trip due to injury or illness, the insurance will cover the costs insured for the time remaining, i.e. the services you have not yet used.

SOS assistance

Search and rescue costs

Our SOS assistance covers costs in connection with search and rescue operations of up to CHF 10,000.

Additional costs for continuation of trip or premature return

If you have to interrupt your trip due to an incident, the insurance will cover the resulting additional costs of up to CHF 1,500.

Repatriation

The insurance will cover the costs of repatriation if necessary for medical reasons or even in the event of death.

Emergency transport to nearest hospital

In the event of a medical emergency, the insurance covers the costs of transport to the nearest hospital.

Advance on costs for hospitalisation abroad

If you need to go to hospital abroad, the insurance will provide an advance on costs to enable you to focus on getting the medical care you need.

Reliable protection - with Swisscom and ERV

A good feeling in any emergency.

With Swisscom's digital insurance subscription and ERV's tried-and-tested protection, you are fully covered – quickly, easily and reliably.

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

Make changes any time

Need to make changes to your insurance cover? Not a problem. You can make changes to your insurance as quickly and easily as you took it out.

Worldwide protection

Your insurance is valid in Switzerland and around the world.

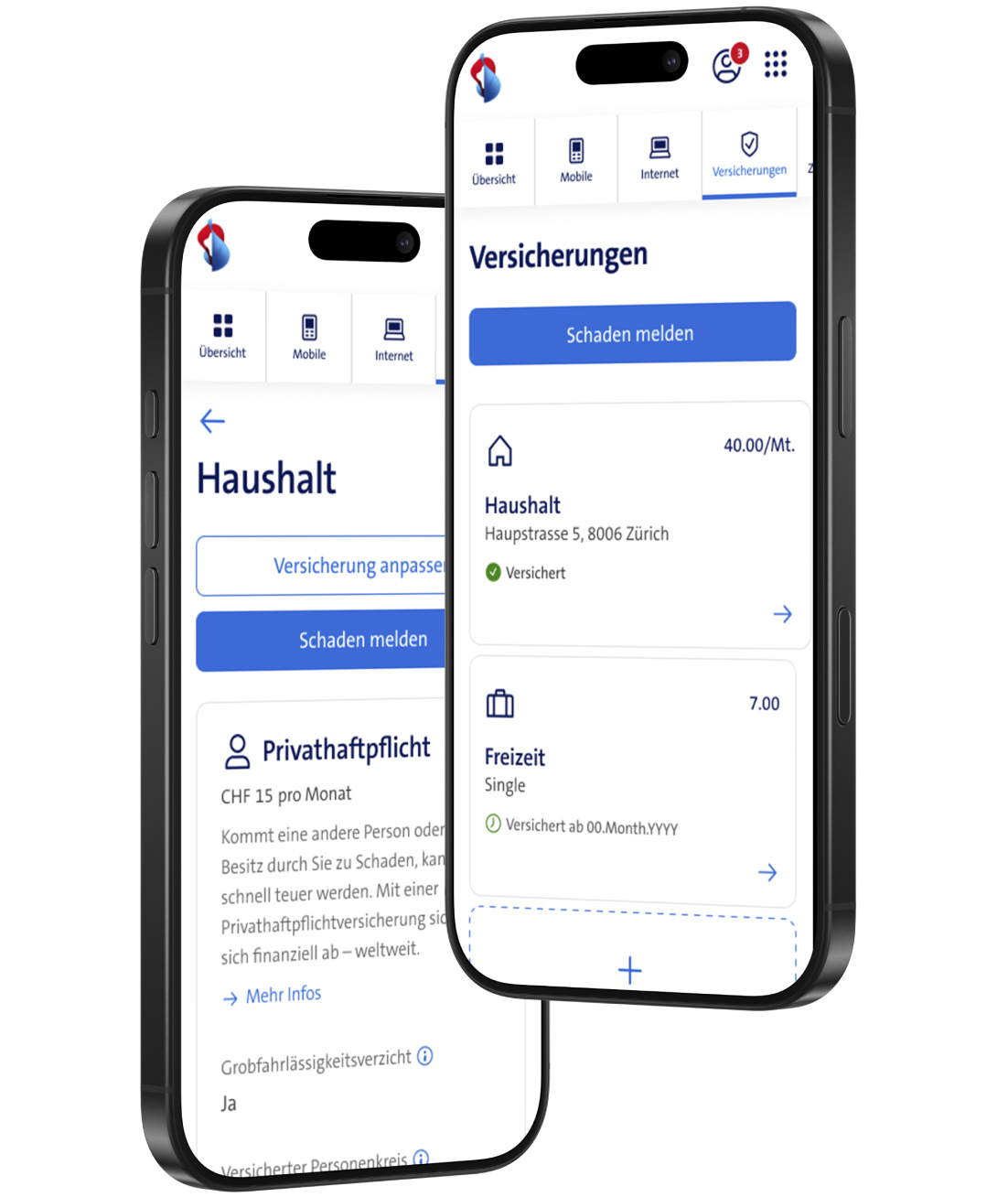

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

Frequently asked questions

Is leisure insurance from Swisscom a form of travel insurance?

Yes, leisure insurance is also a form of travel insurance. Cancellation cover and SOS assistance are provided for travel within Switzerland and abroad that cannot be commenced due to an insured event. The advantage of leisure insurance is that it offers flexible cover for the specific period of your trip or leisure activity (1 to 22 days) and does not require you to take out a policy for the full year.

When is leisure insurance recommended?

In life, unforeseeable events such as accidents or illness can happen at any moment. You may then have to cancel or curtail a trip or leisure activity or seek medical assistance. Leisure insurance covers you for financial loss following an insured event.

Are there any eligibility requirements for Swisscom sure insurance?

Swisscom sure insurance is available to Swisscom customers (telephone or internet) who reside in Switzerland and are aged 18 or over.

What does Swisscom sure leisure insurance cover?

Swisscom sure leisure insurance has two components (cancellation cover and SOS assistance). These can be taken out in isolation or combined. Depending on which components are selected, leisure insurance covers the costs incurred as a result of having to cancel or curtail a trip or leisure activity due to illness, accident or other unforeseeable event.

Can I take out leisure insurance at short notice?

Yes, you can arrange leisure insurance at short notice. SOS assistance becomes effective immediately. Cancellation cover does not commence until the following day.

Benefit from our insurance subscriptions

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

If you need to make a claim, you can contact ERV’s claims service directly.

Website: www.erv.ch/schaden(opens in new tab)

Telephone: +41 58 275 27 27

E-Mail: schaden@erv.ch