The best coverage, reimagined

Household insurance subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- Make changes at any time

- Monthly cancellation option

Package

Personal liability

- Bodily injury

Liability for death, injuring or otherwise damaging the health of people.

Learn more - Property damage

Destruction, damage or loss of property, death, injury or loss of animals.

Learn more

Additional options

- Gross negligence

waiverInsurance companies are entitled to reduce benefits if damage was caused by gross negligence. This supplementary insurance also protects you in the event of gross negligence, as the insurance company waives such reductions.

Learn more - Driving third-party

vehiclesDamage that you, as the driver of occasionally borrowed motor vehicles, cause to these vehicles.

Learn more

Household contents

- Fire

Damage to household contents caused by fire, lightning or explosion. Damage through scorching and damage to insured property inadvertently exposed to heat or warmth are also insured.

Learn more - Natural hazards

The insurance covers damage to household contents caused by flood, inundation, storms (winds with a minimum velocity of 75 km/h uprooting trees or taking the roofs off buildings in the vicinity of the insured property), hail, avalanches, snow pressure, rock slides, falling stones and landslides.

Learn more - Theft

Damage to household contents due to burglary, robbery and simple theft. Simple theft is defined as perpetrators sneaking into the home, e.g. through an ajar window, and stealing insured property.

Learn more - Water

The insurance covers damage to household contents caused by liquids leaking from pipes and installations.

Learn more

Additional options

- Accidental damage to

electrical equipmentElectrical appliances belonging to the household contents. In other words, devices that are powered by batteries or sockets, such as cell phones, laptops, televisions or vacuum cleaners.

Learn more - Simple theft outside

the homeItems that you take with you when out and about and that are stolen.

Learn more - Glass breakage

(2 options)Glass furniture

Breakage affecting glazing on furniture or glass tabletops.

All glass

Breakage affecting glass furniture and building glazing as well as glass-like building materials in your home. In addition to glass components in furniture, also breakage affecting washbasins, ceramic cook-tops and, of course, windows.

Learn more - Frozen goods

Damage to your food that you store at home in freezers or freezer compartments if the appliance has failed due to a breakdown of the cooling unit and the food has spoiled.

Learn more

Choose package

Household

S

The no-frills essentials

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 13.90 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Household

M

More cover, fewer headaches

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 30.10 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Household

L

The comprehensive package

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 34.40 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Can’t find the right subscription?

Then tailor-make your own.

Any of the additional options can be added or removed according to your needs.

What does household insurance cover?

Personal liability

Bodily injury

What is covered

The statutory liability of the insured persons for bodily injury that they cause to other persons.

Example:

You’re riding your bicycle and hit a pedestrian. The person falls, breaks their arm and suffers bruising, requiring several weeks of medical treatment, including an operation and rehabilitation. They are also unable to work for several weeks.

Cost statement in the event of a claim

Emergency treatment and hospital costs |

12,500.– |

Rehabilitation and physiotherapy |

2,500.– |

Claim total |

15,000.– |

Deductible |

200.– |

Compensation paid by insurer |

14,800.– |

What is not covered

Damage to people living with you.

Example:

While playing a sport, you accidentally knock over your flatmate and they suffer a knee injury. Your flatmate’s treatment costs and any loss of earnings are not covered by the personal liability insurance because they live with you.

How we help you

The insurance covers the injured party’s justified claims up to the sum insured. If any unjustified claims are made against you, these will be rejected by the insurance (referred to as passive legal protection).

Policy excess in the event of a claim

CHF 200.–

Sum insured

Select either: CHF 5 million or CHF 10

Important

Many of these costs are covered by the statutory accident insurer, who will then reclaim them from the personal liability insurance. Uninsured loss of income and other costs are covered directly by personal liability insurance.

Property damage

What is covered

Destruction, damage to or loss of property; death, injury to or loss of animals.

Example:

When playing football with friends, you kick the ball too hard and it flies over the garden fence, hitting the neighbour’s window. The window pane is broken and needs replacing.

Cost statement in the event of a claim

Emergency replacement of window |

500.– |

Replacement of window pane |

1,500.– |

Claim total |

2,000.– |

Deductible |

200.– |

Compensation paid by insurer |

1,800.– |

Additional options

Gross negligence waiver

What is covered

Insurance companies are entitled to reduce benefits if damage was caused by gross negligence. This supplementary insurance also protects you in the event of gross negligence, as the insurance company waives such reductions.

Example:

You ride your bicycle through a red light at a crossing and collide with a car, causing significant damage to the car. Despite the gross violation of traffic regulations, the costs of the damage are covered in full.

Cost statement in the event of a claim

Costs of repairing the car |

4,500.– |

Claim total |

4,500.– |

Deductible |

200.– |

Compensation paid by insurer |

4,300.– |

What is not covered

The insurance will not apply in cases of gross negligence if:

the insured person

- is under the influence of alcohol,

- is under the influence of drugs,

- has abused medication.

Example:

You ride a bicycle while drunk, ignore a red light and injure a pedestrian as a result.

How we help you

In the event of a gross negligence claim, the insurance company will not reduce the benefits. Except in the case of the exclusions listed.

Driving third-party vehicles

What is covered

Damage that you, as the driver of occasionally borrowed motor vehicles, cause to these vehicles.

Example:

You borrow a friend’s car and hit a post when parking. There is damage to the car but none to the post.

Cost statement in the event of a claim

Cost of repairing the borrowed vehicle |

4,000.– |

Damage to the post |

None |

Claim total |

4,000.– |

Deductible |

500.– |

Compensation paid by insurer |

3,500.– |

What is not covered

Damage to vehicles

- Which you borrow more than 25 days per calendar year

- Weighing more than 3,500 kilograms

- To rental and shared vehicles.

Example:

Once a week, you drive a friend’s car to work and, when parking, you scrape against a small wall, scratching the car’s side doors.

How we help you

The insurance will cover the cost of repairing the damage you caused. If the vehicle being driven has comprehensive insurance, the insurance will cover the deductible and the loss of bonus.

How does cover for driving third-party motor vehicles work?

- If the borrowed vehicle does not have comprehensive insurance:

In this case, you would need to cover the entire cost of repairing the borrowed vehicle yourself (here: CHF 4,000.–). In such cases, the cover for driving third-party motor vehicles applies and covers the costs so that you are not left with the costs of the repairs.

- If the borrowed vehicle does have comprehensive insurance:

The vehicle’s comprehensive insurance covers the cost of the repairs. However, the following costs are incurred by the vehicle’s owner- Deductible: For example, CHF 1,000.–, which must be paid by the owner themselves.

- Loss of bonus The insurance premium may rise as a result of the claim.

Cover for driving third-party motor vehicles covers both the deductible and the loss of bonus.

When is this cover particularly important?

Cover for driving third-party motor vehicles is particularly relevant if the vehicle borrowed does not have comprehensive insurance. In the event of a loss without comprehensive cover, you would need to cover the entire cost of repairing the borrowed vehicle yourself. This cover protects you from high financial charges.

Please note that this supplementary insurance covers you if the vehicle is used for a maximum of 25 days per calendar year.

Household contents

Fire

What is covered

Damage to household contents caused by fire, lightning or explosion. Damage through scorching and damage to insured property inadvertently exposed to heat or warmth are also insured.

Example:

You are enjoying a relaxing evening; you light a candle and then your cat knocks the candle over. The candle starts a fire and suddenly your living room is in flames. Your sofa, coffee table and many personal items are damaged by the fire.

Cost statement in the event of a claim

Replacement of furniture |

5,500.– |

Replacement of curtains, carpets |

2,000.– |

Cleaning |

4,000.– |

Claim total |

11,500.– |

Deductible |

200.– |

Compensation paid by insurer |

11,300.– |

What is not covered

Damage caused by the effects of electricity.

Example:

Surge damage to household appliances or laptops, computers, etc.

How we help you

In the event of a claim, the insurance will cover the cost of repairing the damaged property or compensation for the destroyed property up to the agreed sum insured.

Excess in the event of a claim

CHF 200.–

Natural hazards

What is covered

The insurance covers damage to household contents caused by flood, inundation, storms (winds with a minimum velocity of 75 km/h uprooting trees or taking the roofs off buildings in the vicinity of the insured property), hail, avalanches, snow pressure, rock slides, falling stones and landslides.

Example:

After heavy rainfall, accumulating water seeps through the doors of your home, soaking the dining table, chairs, sofa and carpet and damaging personal items such as toys and a games console.

Cost statement in the event of a claim

Replacement of dining table and chairs |

3,000.– |

Replacement of sofa |

2,500.– |

Cleaning of carpet |

600.– |

Replacement of furniture |

5,000.– |

Replacement of damaged toys |

500.– |

Replacement of games console |

700.– |

Claim total |

12,300.– |

Policy excess |

500.– |

Compensation paid by insurer |

11,800.– |

What is not covered

Damage caused by water from reservoirs or other artificial bodies of water or the backflow of water from the sewerage system.

Example:

A reservoir wall breaks and floods your residence.

How we help you

In the event of a claim, the insurance will cover the cost of repairing the damaged property or compensation for the destroyed property up to the agreed sum insured.

Policy excess in the event of a claim

CHF 500.–

Note

Contents insurance covers damage to your contents such as furniture, carpets, electronics and your other household effects. Damage to permanent parts of the home, such as walls, doors or the floor, is covered by buildings insurance.

Water

What is covered

The insurance covers damage to household contents caused by liquids leaking from pipes and installations.

Example:

A water pipe suddenly bursts in your kitchen. The water cannot be stopped and soaks through your cookery books and food supplies. Furniture in the adjacent room, including your dining table, chairs and the carpet, are also damaged.

Cost statement in the event of a loss

Replacement of damaged cookery books |

500.– |

Replacement of damaged food supplies |

500.– |

Repair of dining table |

1,500.– |

Repair of four dining chairs |

1,000.– |

Cleaning and drying of dining room carpet |

600.– |

Replacement of sofa in the dining room |

2,000.– |

Claim total |

6,100.– |

Deductible |

200.– |

Compensation paid by insurer |

5,900.– |

What is not covered

Losses that are covered by fire and natural hazard insurance or damage caused by rainwater entering open windows and doors.

Example:

You leave the window open while you go to work. Rain gets into the living room, soaking the TV and rendering it inoperable.

How we help you

In the event of a claim, the insurance will cover the cost of repairing the damaged property or compensation for the destroyed property up to the agreed sum insured.

Policy excess in the event of a claim

CHF 200.–

Note:

Permanently installed items such as kitchen cabinets, parquet flooring or built-in electrical appliances that are part of the fitted kitchen (e.g. dishwasher or refrigerator) are part of the building and are covered by the corresponding buildings insurance. Contents insurance covers damage to your contents.

Theft

What is covered

Damage to household contents due to burglary, robbery and simple theft. Simple theft is defined as perpetrators sneaking into the home, e.g. through an ajar window, and stealing insured property.

Example:

You come home and realise that there's been a break-in. Jewellery, cash and your personal laptop have disappeared.

Cost statement in the event of a claim

Replacement jewellery |

5,000.– |

Replacement cash |

500.– |

Replacement laptop |

1,500.– |

Claim total |

7,000.– |

Deductible |

200.– |

Compensation paid by insurer |

6,800.– |

Note:

If you are the tenant of the property, the landlord is required to cover the cost of repairing the damaged window. However, the cost would also be covered by contents insurance, which is relevant for the apartment owner.

Additional options

Accidental damage to electrical equipment

What is covered

Electrical appliances belonging to the household contents. In other words, devices that are powered by batteries or sockets, such as cell phones, laptops, televisions or vacuum cleaners.

Example:

Your laptop falls from your hand and hits the floor. As you pick it up, you see that it is damaged beyond repair.

Cost statement in the event of a claim

Replacement laptop |

1,800.– |

Claim total |

1,800.– |

Deductible |

200.– |

Compensation paid by insurer |

1,600.– |

What is not covered

Equipment belonging to the building. Files such as photos or application programs on the damaged devices, or damage caused by biting pets.

Example:

You drop a heavy casserole dish when taking it out of the oven and damage the oven door.

How we help you

In the event of a claim, the insurance will cover the cost of repairing the damaged property or compensation for the destroyed property up to the agreed sum insured.

Simple theft outside the home

What is covered

Items that you take with you when out and about and that are stolen.

Example:

You go into town and while you are in a café you realise that your backpack has been stolen. Your camera, tablet and wallet containing important identity documents were inside.

Cost statement in the event of a claim

Replacement rucksack |

100.– |

Replacement camera |

1,200.– |

Replacement tablet |

600.– |

Replacement identity documents |

200.– |

Claim total |

2,100.– |

Deductible |

200.– |

Compensation paid by insurer |

1,900.– |

What is not covered

Cash, lost or mislaid property.

Example:

CHF 100.– is stolen out of your pocket while you are out and about.

How we help you

In the event of a claim, the insurance will cover the cost of replacing the stolen, insured items.

Note:

Your cash is not insured for theft when away from home.

Glass breakage (2 options)

Glass furniture (option 1)

What is covered

Breakage affecting glazing on furniture or glass tabletops.

Example:

While clearing the dining table, you drop a cast-iron pan. It hits the glass tabletop, which shatters into thousands of pieces.

Cost statement in the event of a claim

Replacement of glass tabletop |

1,000.– |

Claim total |

1,000.– |

Deductible |

0.– |

Compensation paid by insurer |

1,000.– |

All glass (option 2)

What is covered

Breakage of glass furniture and building glazing as well as glass-like building materials in your home. Besides glass furniture components, also includes broken washbasins, ceramic cook-tops and, of course, windows.

Example:

One morning, you drop a perfume bottle. It falls straight into the washbasin, causing a large crack.

Cost statement in the event of a claim

Replacement of washbasin |

300.– |

Cost of labour |

600.– |

Claim total |

900.– |

Deductible |

0.– |

Compensation paid by insurer |

900.– |

What is not covered

Damage to hand mirrors, spectacles and screens of all kinds (including mobile phones and other communication devices).

Example:

You sit on your glasses, breaking the lenses.

How we help you

In the event of a claim, the insurance will cover the cost of repairing the damaged property or compensation for the destroyed property up to the agreed sum insured.

Frozen goods

What is covered

Damage to your food that you store at home in freezers or freezer compartments if the appliance has failed due to a breakdown of the cooling unit and the food has spoiled.

Example:

There is a power failure and your freezer stops working for several hours. All the food stored inside goes off, including expensive meat products, ice cream and frozen vegetables.

Cost statement in the event of a claim

Replacement food |

800.– |

Claim total |

800.– |

Deductible |

0.– |

Compensation paid by insurer |

800.– |

What is not covered

Damage caused by deliberately switching off the cooling unit.

Example:

Before you go on holiday, you switch off the cooling unit to save electricity, forgetting that there is still food in the freezer.

How we help you

Compensation for the spoiled food up to the agreed sum insured.

Reliable protection – with Swisscom and Zurich

A good feeling with every claim.

With Swisscom's digital insurance subscription and Zurich's tried-and-tested protection, you are fully covered – quickly, easily and reliably.

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

Make changes any time

Need to make changes to your insurance cover? Not a problem. You can make changes to your insurance as quickly and easily as you took it out.

Monthly cancellation option

Lengthy contractual terms are a thing of the past. You can cancel your insurance subscriptions at any time to the end of the month, with no ifs or buts.

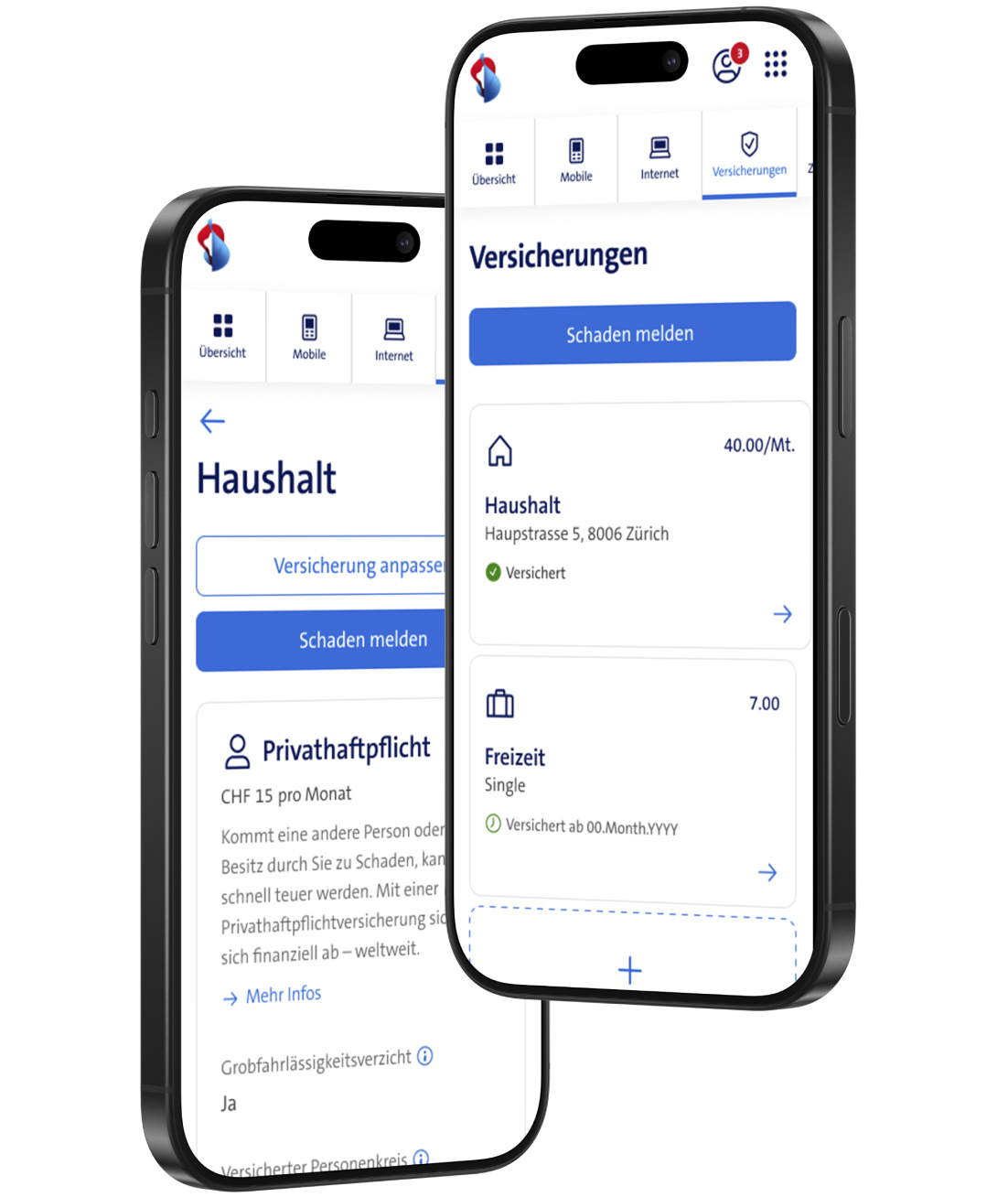

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

FAQs

What is personal liability insurance?

Personal liability insurance covers bodily injury and property damage for which you are liable to third parties. Bodily injury means accidentally injuring or even killing a person. Property damage means accidentally destroying, damaging or losing someone else’s property. By law, by reason of strict liability, you can also be liable for damage caused by your children or pets, for example. Tenant damage, that is damage and destruction of the inhabited rental property, is also covered by personal liability insurance.

Why do I need personal liability insurance?

Personal liability insurance protects you if you harm someone or damage someone else’s property. The insurance covers the costs that could be incurred, for repairs or medical treatment, for instance.

Is personal liability insurance compulsory?

No, personal liability insurance is voluntary. Nevertheless, it is one of the most important types of cover. If you harm someone, even if it is unintentional, you are liable for it. This can soon become very expensive. The insurance covers justified claims of the injured party up to the sum insured. If any unjustified claims are made against you, these will be rejected by the insurance (referred to as passive legal protection).

Personal liability not only pays out in the event of a claim, but it also checks whether you are in fact liable.

Does it make sense to take out personal liability insurance per person or for the entire shared accommodation?

As residents of shared accommodation can frequently change (move in and out), we recommend that you always take out personal liability insurance per person. This prevents anyone suddenly have no insurance cover after moving out.

Is damage caused by my pets also covered by personal liability insurance?

Yes, as an animal owner, you are covered, at no extra cost, for damage caused by your pets. However, in relation to damage caused by tenants, note that damage due to wear and tear (e.g. by a cat scratching doorposts) is not covered.

Does personal liability insurance apply worldwide?

Yes. Personal liability insurance offers worldwide cover.

Does the supplementary insurance also apply to damage caused to third-party motor vehicles abroad?

Yes, the liability insurance for private individuals applies worldwide. Note that this insurance only covers use of the vehicle for a maximum of 25 days per calendar year. Rental vehicles are not covered. Should you require this, we recommend that you take out ‘Rental and shared vehicles’ cover with our partner Zurich Insurance.

Why do I need contents insurance?

Contents insurance protects the personal belongings in your home from damage caused by events such as fire, theft, water damage or natural disasters. It helps you cover the cost of repairs or replacing the items if they are damaged or stolen. In a nutshell, contents insurance provides financial security for the belongings in your home.

Is contents insurance compulsory in Switzerland?

Contents insurance is not legally required in most cantons. However, it is advisable to take out contents insurance. It provides financial security when items become damaged or destroyed by certain events. In the cantons of Nidwalden and Vaud, cover for damage caused by fire and natural hazards is compulsory for residents. This insurance must be taken out with a specific body, the Cantonal Fire Insurance. In the cantons of Fribourg and Jura, this insurance is also compulsory, but the residents are free to choose their insurance provider.

What is classed as household contents?

If you were to move house tomorrow, what items would you hand over to the removal men? All of this counts as household contents and must be covered by the sum insured.

Our advice: when determining the sum insured, ensure that it would be enough to be able to buy the entire contents of your removal van again.

What is the sum insured?

The sum insured is the maximum compensation that the insurer will pay out in the event of damage to or loss of your personal property.

Please note that the sum insured is a maximum limit. If the total loss exceeds the sum insured, you may have to bear any additional costs. When choosing the sum insured, therefore, it is advisable to make sure that your property is adequately covered should the worst happen.

What is a deductible?

The deductible is the amount that you would pay out of your own pocket in the event of a claim or that the insurer would deduct from the compensation.

We live in shared accommodation – do we each need to arrange contents insurance or can we take it out as a group?

In principle, housemates can arrange a common contents insurance policy. This also applies for personal liability insurance. However, we recommend that each person takes out the insurance individually. This prevents anyone suddenly have no insurance cover after moving out.

What data does Swisscom use, how and for what purpose?

You will find general information on data processing by Swisscom as well as information on additional data processing in insurance brokerage at www.swisscom.ch/privacy. You can find out how the insurance company processes your data in the privacy policy or read the insurance terms and conditions of the insurance company in question.

Benefit from our insurance subscriptions

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

Report claims by telephone. We will redirect your call to the Zurich Insurance Company Ltd.

Free 24/7/365