Easy Protection

Protect your mobile phone against damage and more

Protect your mobile phone against drop, display and water damage, and misuse following theft.

from 9.90 per month

Our partner

Easy Protection Insurance in collaboration with our partner AXA Switzerland AG

What does Easy Protection cover?

It only takes a moment for a mishap like a shattered screen or water damage. Easy Protection protects you from the financial consequences of repairs. We handle the process for you.

The extended warranty covers sudden, unexpected external damage. An excess of CHF 70.– applies per device and extended warranty claim if the replacement cost would be CHF 849.99 or less (excluding subscription) or CHF 100.– per device from a replacement cost of CHF 850.– (excluding subscription).

- Drop and display damage

- Water damage

- Theft (including loss) is not covered and is normally covered by contents insurance.

- 2 damage claims per contract year (per damage max. new price of the device)

Swisscom will pay up to a maximum of CHF 2000.– for the connection and call charges incurred by the customer following theft of the device due to misuse (call transmission, SMS, MMS, data transfer and data transmission, uploading and downloading of data, etc.).

All benefits at a glance

2 claims per contract year

Up to two claims per year are covered by the contract.

Low excess

Between CHF 70.– and CHF 100.– per mobile phone.

Can be taken out up to 30 days after purchase

You can take out Easy Protection up to 30 days after purchasing the device.

Pay monthly

You can pay for Easy Protection monthly through your usual Swisscom invoice.

How to order Easy Protection

You can take out Easy Protection insurance with Swisscom when you purchase a new mobile phone or up to 30 days after purchasing the device. Take the mobile phone to a Swisscom Shop and our employees will be happy to help.

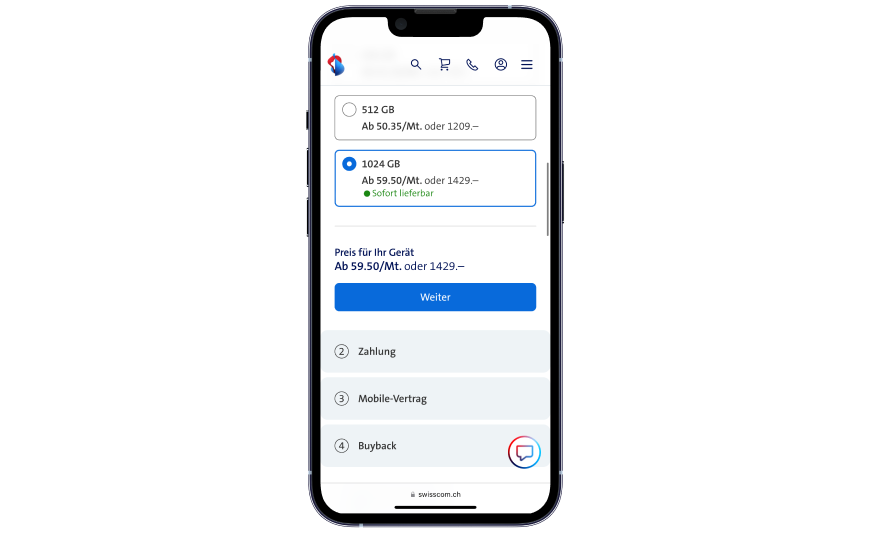

Select device

Select the mobile phone you want to purchase in the online shop.

Start the order process

You are guided through the order process where you can select details and specifications such as colour, storage capacity etc.

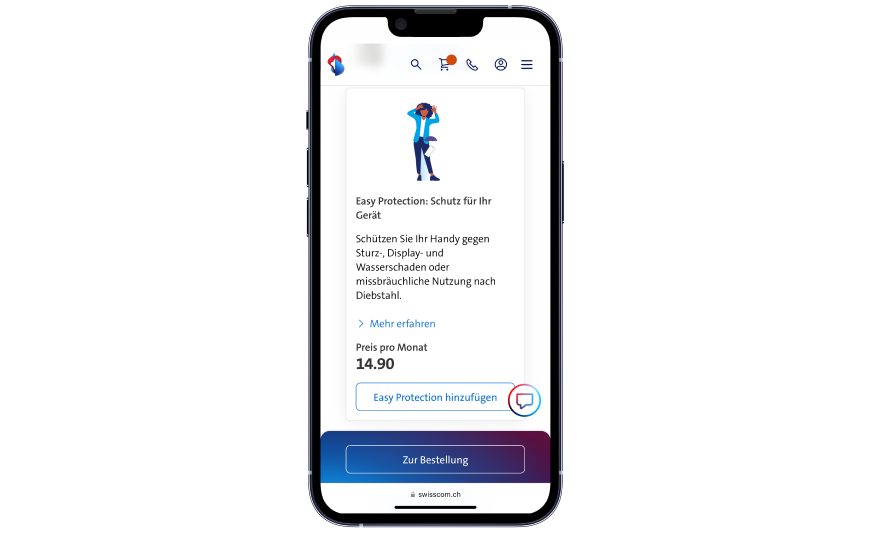

Select Easy Protection

You are prompted with the “Add Easy Protection” option before completing your purchase. Select this option and your mobile phone is automatically insured on purchase.

Any questions?

We will be happy to assist.

When can I take out Easy Protection?

You can take out Easy Protection insurance with Swisscom when you purchase a new mobile phone or up to 30 days after purchasing the device. Take the mobile phone to a Swisscom Shop and our employees will be happy to help.

Damaged mobile? Follow these steps

- Take your mobile phone to the nearest Swisscom Shop.

- We will repair or replace your mobile phone.

- You pay the CHF 70.– or CHF 100.– excess in the Shop or by invoice. Please note: The repair for a damaged device must always be arranged by Swisscom. This is the only way to have the costs covered by Easy Protection.

Stolen mobile? Follow these steps

- Block your SIM card within 48 hours. Here’s how:

- Report the theft and the IMEI number of your mobile to the police.

- In My Swisscom under ‘Current use and costs’, check whether call charges have been incurred since the theft occurred. Note: There is a delay in displaying call charges.

- Report the charges of misuse to Swisscom. Costs of up to CHF 2,000.– are insured with no excess to pay.

| | Theft (including loss) is not insured and is normally covered by contents insurance. |

How much does Easy Protection cost?

You can find the costs for Easy Protection and any promotions on the order page:

What does Easy Protection include?

Easy Protection provides cover for the following:

- Drop and display damage. Example: you drop your mobile phone and the display shatters.

- Water damage. Example: you drop your mobile phone in the bath and it no longer works.

- Call misuse following theft. Example: your stolen mobile phone is used to make calls. The resulting costs are insured for up to CHF 2,000.–.

- Free replacement device during the repair

- Max. 2 claims per year (per damage max. new price of the device)

How much is the excess in the event of a claim?

In the event of a claim, the excess is:

- CHF 0.– (for misuse of calls as a result of theft)

- CHF 70.– (with Easy Protection for CHF 9.90)

- CHF 100.– (with Easy Protection for CHF 14.90)

When does Easy Protection cover end before the expected term?

Easy Protection ends:

- If the cumulative amount of damage for two claims exceeds the maximum value of the device (customers can also pay the additional costs directly so that the max. amount is not higher)

- If the mobile is lost/stolen

- If there is an offence related to a claim

When can I cancel Easy Protection?

Easy Protection has a fixed term of 12 months (minimum contract period) and can be cancelled by either party with 90 days’ notice at the end of the minimum contract period. If you do not give notice of termination, Easy Protection will be renewed for an indefinite period and may be cancelled by either party upon giving 90 days’ notice.

Easy Protection terms and conditions

| | If an extended warranty claim arises or is reported in the first or second contract year, the minimum contract period is extended to 24 months. |

What is the procedure following call misuse?

Please contact Swisscom if you are the victim of call misuse after your mobile phone has been stolen.

Am I covered by Easy Protection at all times during the term?

You must pay your bill on time. If an extended warranty claim is made while you are in arrears with payment, you will not be entitled to repair services.

We offer more

Everything you need to know about Swisscom sure insurance services.

Internet legal expenses insurance comes to your aid if you fall victim to online crime or if your devices are infected by viruses.

Household insurance combines household contents and personal liability.