e.foresight – the Swiss banking think tank

Recognise banking trends early with e.foresight

Innovation and digitisation are changing the banking market.

Business models and processes are being rethought and new competitors are emerging, including FinTech startups who are able to act quickly and respond to rapidly changing client requirements. Trend Scout e.foresight, the Swisscom think tank, is able to identify such changes at an early stage.

When is it the right solution?

Trend Scout e.foresight keeps you up to date on innovations and market changes and determines their relevance for banks, thus providing an overview of all trends and enabling you to make sound strategic decisions at an early stage. Our experts and analysts will be happy to provide additional information.

Request a no-obligation quotation

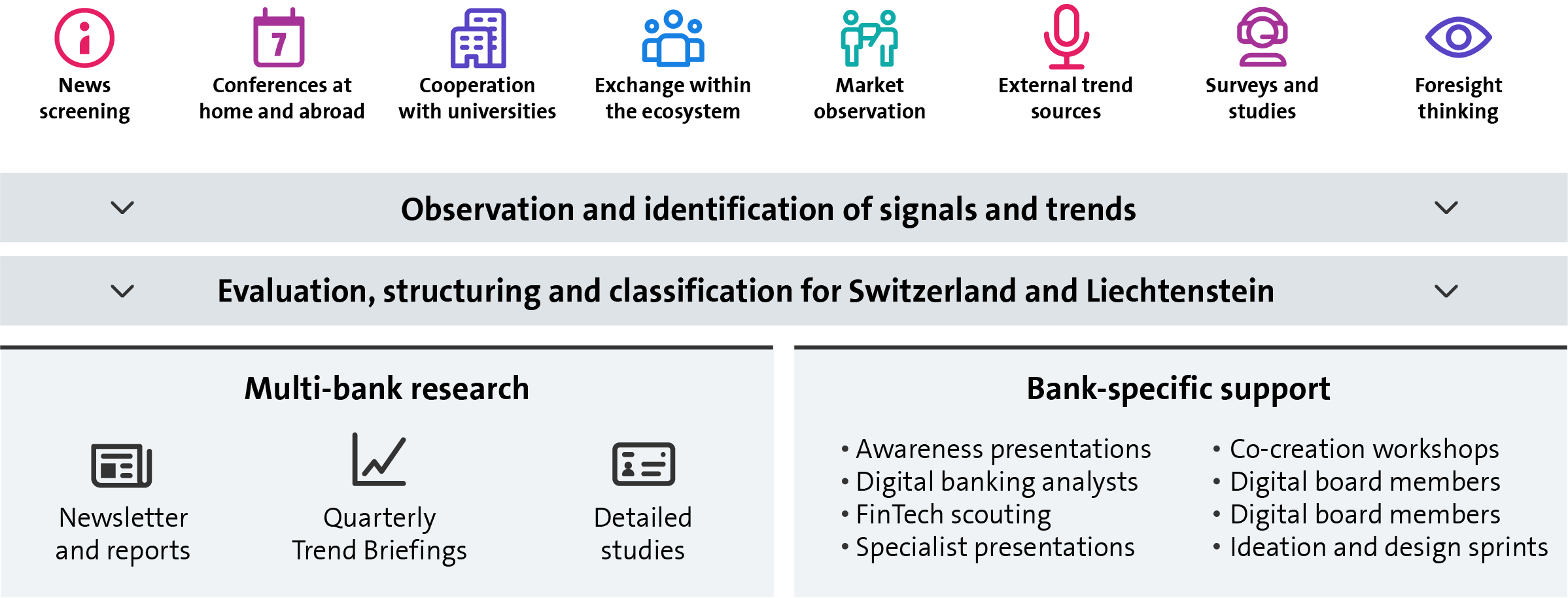

Trend Scout e.foresight offer

Discover innovations earlier than others

Trend Scout e.foresight analyses the markets, identifies relevant developments and recommends action.