Card management with CardOne

Card Services with CardOne

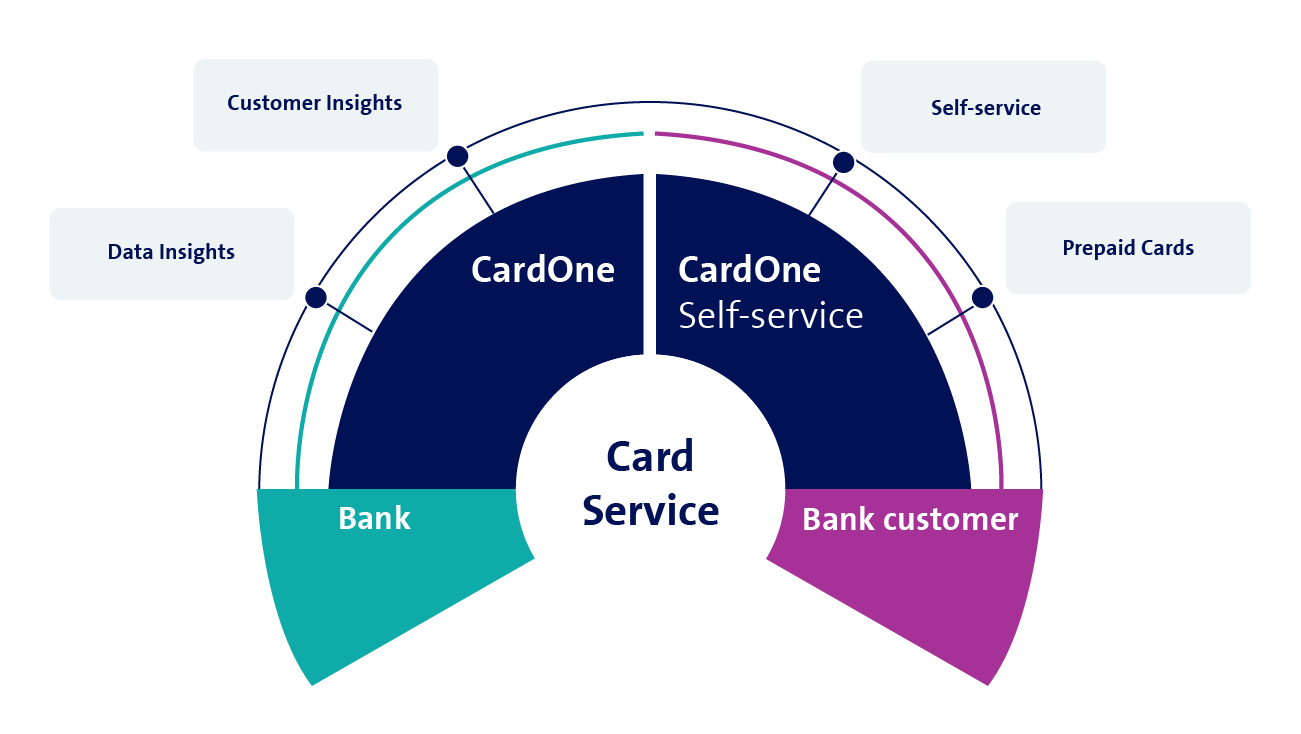

CardOne groups the interfaces between core banking systems and card issuers for banks.

Minimise your costs for card management and interface maintenance. With a single tool, you can manage payment methods and respond more quickly to the evolving needs of customers or the market.

When is it the right solution?

CardOne is ideal for banks seeking to automate and digitalise their processes while minimising the costs and administration associated with card management. Our solution’s interface seamlessly links card issuers such as Viseca, Swiss Bankers, SIX or JayWalker to core banking systems like Avaloq.

The first step

Three possible areas of customer need

Card management

Reduce your costs and complexity

Your challenge

Your administration costs are high, and your core banking system is overburdened by card management. To provide quicker, more competent advice, you also need the latest card master data.

Our solution

CardOne automates processes, increases processing quality, reduces error rates and bundles interfaces. All data is synchronised on a continual basis. Furthermore, customised business rules allow you to flexibly tailor CardOne to your needs.

Your benefits

This card management system improves the customer experience in the long term. You will not need additional user management to manage cards because your customers are onboarded online or through E-banking. New CardOne functions are launched regularly and can be used by your customers.

Interface bundling

Shorten your time to market

Your challenge

Customer requirements are evolving with increasing speed. When too many interfaces exist between card issuers and core banking systems, it is impossible to keep pace with new developments or to implement and offer new functions and products ahead of other banks.

Our solution

CardOne bundles the interfaces between card issuers and core banking systems. The standard solution can be configured specifically for each bank and will continue to offer a high degree of flexibility following its implementation.

Your benefits

Interface bundling relieves the pressure on core banking systems and significantly reduces time to market. Fully automated processes allow you to improve quality, reduce error rates, free up your workforce from routine tasks and launch new services more quickly.

Customer experience

Improve the customer experience

Your challenge

Card management is a lengthy process – routine tasks are time consuming and therefore expensive. Many of these tasks, such as blocking cards or increasing or reducing credit limits, could be completed by your customers.

Our solution

With the CardOne self-service solution, your customers can manage their cards online, add funds to prepaid cards or request a new PIN. By using open interfaces, the solution is compatible with many debit, credit and prepaid cards, TWINT and many other payment methods.

Your benefits

Your customers can manage their payment methods independently, even from abroad. This improves the customer experience and increases customer loyalty. Your employees have more time for value-adding tasks, such as advising customers. You also gain valuable card master data that can be used in risk analyses and to inform marketing campaigns.

Automation of card management

The 2-minute video explains how St. Galler Kantonalbank optimised its processes and saved money.

Benefits

- Fewer interfaces relieve the pressure on core banking systems and minimise administration

- Automated processes increase processing quality and reduce error rates

- The flexible standard solution can be configured specifically for each bank through the use of rules

- Operated in a highly secure data centre run by Swisscom or by a provider of your choice

- Self-service card management – anytime, anywhere – offers a high degree of flexibility

- The clear dashboard design facilitates independent payment-method management

- Your customers have immediate access to product innovations and developments

- CardOne can be seamlessly integrated into your standard customer portal

Card Services at a glance

Would you like to find out more?

Data insights

CardOne provides valuable data and insights into your customers’ transactions. Use the insights gained through the card management system to inform marketing campaigns or conduct risk analyses, allowing you to identify evolving customer needs sooner and optimise your services and processes accordingly.

Customer insights

You can see all payment methods and transactions at a glance, which means you can provide better advice to the customer. Automated processes ensure that changes are immediately synchronised with card issuers. CardOne is the simple way to manage all debit, credit and prepaid cards, TWINT and many types of travel money.

Self-service

The intuitive dashboard enables customers to manage their cards themselves, such as blocking, replacing or unblocking a card, adjusting their credit limit or changing their pin. CardOne can be incorporated into your E-banking or online portal and optimises the customer experience.

Prepaid cards

Customers can add money to their prepaid cards themselves and access the funds immediately. They are also able to order Swiss francs or foreign currencies for themselves.