Digital benchmarking for Swiss and Liechtenstein private banking

A new study provides insight into today's status of private banks' digitalisation initiatives.

Find out more about how you can become part of the study community.

December 2025, text: Simon Ruettimann, Prof. Dr. Anjeza Kadili 4 min.

Benchmarking the digital transformation: e.foresight's study series in private banking

For the second time, e.foresight (Swisscom's banking trend scout) has conducted a study on digital customer interfaces in private banking in collaboration with the Haute école de gestion Genève (HEG). This benchmarking study analyzes the current and future functionalities of 30 private banking players (private and universal banks) in Switzerland and Liechtenstein. Functionality coverage was determined using a systematic survey of 110 functionalities across various customer channels.

Furthermore, a representative survey of 520 high net worth individuals (>CHF 1 million investable assets) was conducted to measure channel preferences for 36 journey steps. This analysis covers physical forms of interaction and remote advisory channels (video consulting, telephone) as well as digital self-service elements.

As an additional topic, banks were asked about the implementation status of 27 use cases of generative artificial intelligence (GenAI). Information was also collected on embedding approaches such as AI agents, retrieval augmented generation (RAG), prompt design, and the parameterization of AI models.

Shape the future of private banking in Switzerland and Liechtenstein with the latest digital trends and strategies. We will clarify your needs and make you a customised offer.

The most important findings of the study:

Benchmarking of digital channels: Hybridization of customer interaction is progressing slowly

- The most digitized institutions are clearly moving toward a hybrid interaction model, with over 80% of the measured services accessible via digital channels. They also increasingly invest in digital services that support the core business (i.e., discretionary mandates and advisory mandates).

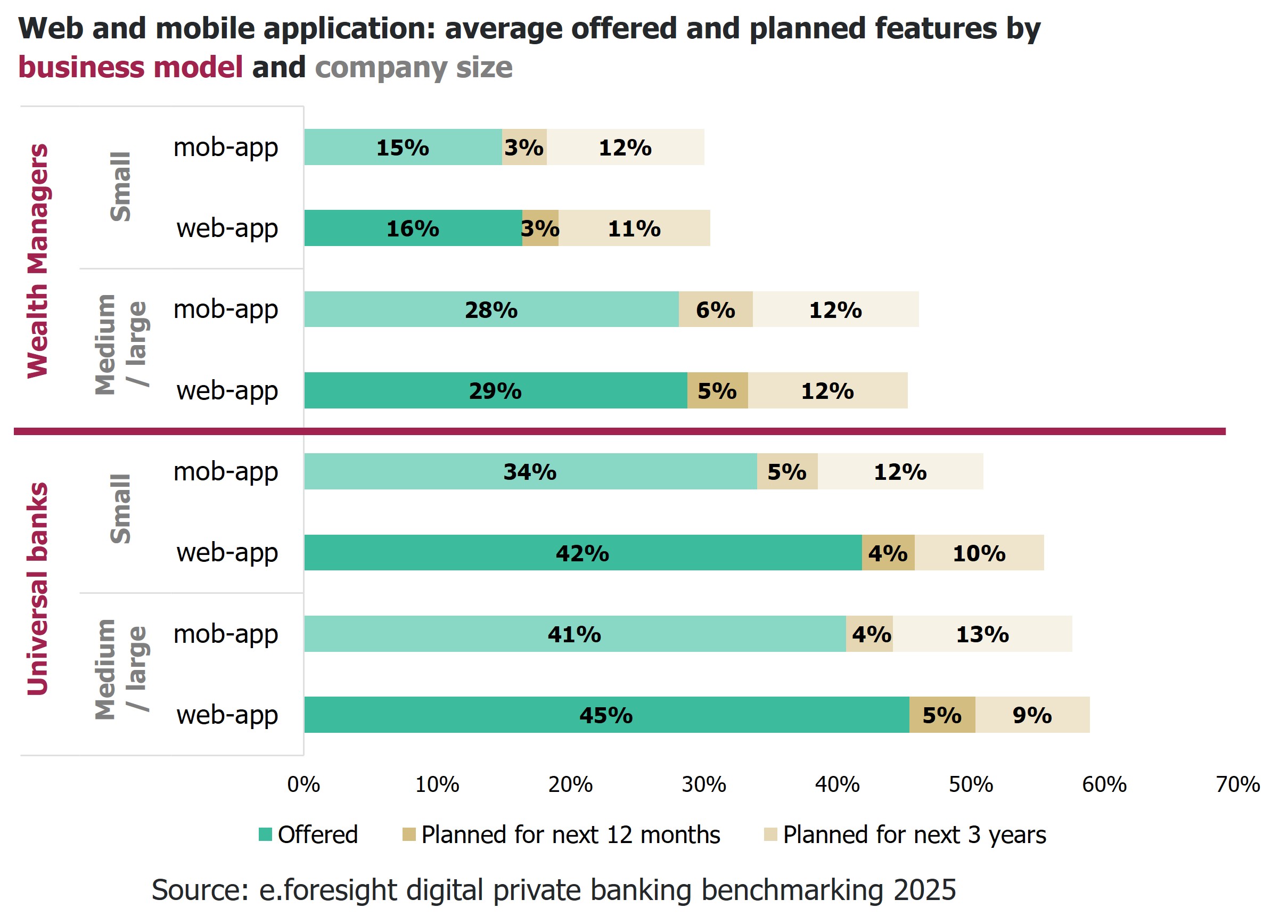

- About half of the players are sticking with a model that prioritizes physical interaction ("physical-first") for the time being. However, these players are also investing in new functionalities to improve the digital customer experience in certain areas. Universal banks remain the leaders in terms of digital functionality coverage. However, medium-sized and large wealth managers (incl. pureplay private banks) are likely to catch up significantly over the next three years.

Digital client preferences: Only a minority of banks meet client needs well

- Four clusters can be identified among HNWI customers with respect to different channel preferences. By far the largest group (57% of respondents) prefers physical advice for strategic steps of the investment journey (e.g. investor profiling, strategy determination), but digital self-services for administrative and transactional steps ("phygital" model). Merely 8% want to carry out most steps via physical channels, whereas only 10% want mainly digital self-service elements. In contrast, around 20% have a strong preference for advice via video call or telephone. The distribution of these clusters differs significantly from that of retail banking customers, as other e.foresight studies show.

- The largest customer cluster ("phygital") is well covered only by around half of the banks. Similarly, the second largest group (video and telephone advice) is optimally served only by some of the banks. Merely around 15% of banks serve the digital self-service cluster, whereas the physical advice cluster is widely covered. Overall, the preferences of approximately 75% of HWNI customers are optimally served only by a minority of banks.

GenAI implementation: Simple use cases dominate, while AI agents are still in their infancy

- The majority of banks are now active (at least with pilot projects) in generic use cases such as language translation or internal knowledge management systems. Wealth management-specific applications (e.g. market research, documentation of client meetings, generation of investment proposals) are, however, only being pursued by 15-40% of banks.

- On average, 25% of use cases that are productive or in pilot phases are based on retrieval augmented generation (RAG). Only 9% of such use cases are implemented via agents or multi-agent systems (agentic AI). The GenAI models themselves have hardly been parameterized so far (only 4% of use cases on average). However, prompt design is used in the majority (52%) of cases.

The complete study document is only available to participating institutions. If you have any questions or would like further information on the study results, please contact Simon Rüttimann (e.foresight, simon.ruettimann@swisscom.com).