‘Faster, better and more efficient’ – the impact of intelligent automation on banks

Intelligent process automation has long been more than just a short-term trend. In all industries, virtual software agents noticeably lighten the load on employees, ensure data quality and create scope for innovation. The experiences of St.Galler Kantonalbank and other players in the banking industry show how this works in practice and why automation is not synonymous with staff cuts.

March 2025, Text Tanja Dujic 4 Min.

The business world is in a state of flux

Rising interest rates, market uncertainty and rapidly advancing technology are changing entire industries. Companies in all sectors need to work more efficiently, cut costs and offer innovative services at the same time – a real balancing act.

The impact is especially pronounced in the financial sector: while regulatory hurdles are being increased, customers expect seamless, digital services in real time. IT decision-makers have to grapple with a key question: how can processes be transformed without losing flexibility? One answer lies in intelligent automation – not as a substitute for people, but as the key to greater innovation.

With these challenges in the spotlight, the Swisscom Business Days breakout session(opens in new tab) shifted the focus to intelligent automation. Experts from banks, hospitals and administrations shed light on how processes can be made more efficient – without compromising on quality or flexibility.

Below, we explore in more detail the key findings of the discussion – from the initial quick wins and cultural success factors to a look at AI-based automation approaches.

A morning at St.Galler Kantonalbank

Monday morning, 7.30 a.m. At St.Galler Kantonalbank, numerous reports are usually generated, checked and reconciled in the Avaloq core banking system. Anyone who has ever copied data into Excel lists or manually searched reports for errors knows how much concentration and time are needed.

‘It’s tiring doing a lot of the same thing. But a virtual agent never gets tired, no matter how tedious or uninspiring the work is,’ explains Benjamin Kern, Head of Automation at St.Galler Kantonalbank. ‘The new “colleagues” generate all the reports early in the morning, file them, check them and send an email if necessary,’ he says, explaining the process undertaken by the virtual agents each day.

As a result, employees no longer have to spend hours on repetitive checks. Instead, they can concentrate on more challenging tasks, such as handling complex customer enquiries.

Focus on people

According to Benjamin Kern, the fear that automation projects might eliminate jobs is unfounded. ‘We’re automating tasks, not people’ – this sentiment was repeatedly expressed during the breakout session.

Employees are happy that they no longer have to reconcile data for hours. Particularly in areas where a high level of concentration is required – such as data maintenance or quality control – monotonous work can lead to errors and stress. Virtual agents, on the other hand, don’t feel stressed or tired and adhere strictly to predefined rules. This makes them ideal for environments with high volumes of data and specific rules, as they minimise errors and maintain consistent process quality. Not as a substitute for people, but as the key to greater innovation.

Intelligent automation in banking

The banking sector in particular has many rule-based processes that are ideally suited for automation. Examples include:

- Quality checks and reports:

Routine daily or weekly tasks, e.g. generating countless data comparisons in the core system. If a report is blank, everything is usually fine; if there are values, someone has to take a closer look. A virtual agent can handle the time-consuming preparatory work and flag only the cases where action is really required. - Data transfers between legacy systems and new platforms:

‘Nobody enjoys copying data from one application to another,’ adds Kern. Virtual agents are ideal for such monotonous copy-and-paste work. This reduces errors and ensures consistent data. - Swift solutions instead of a major overhaul:

Core banking systems like Avaloq and Temenos can be monolithic. ‘Large IT projects for interfaces often take a long time,’ says Kern. Intelligent process automation, however, can be used to ‘build bridges’ without having to make extensive changes to core systems.

Culture as a success factor

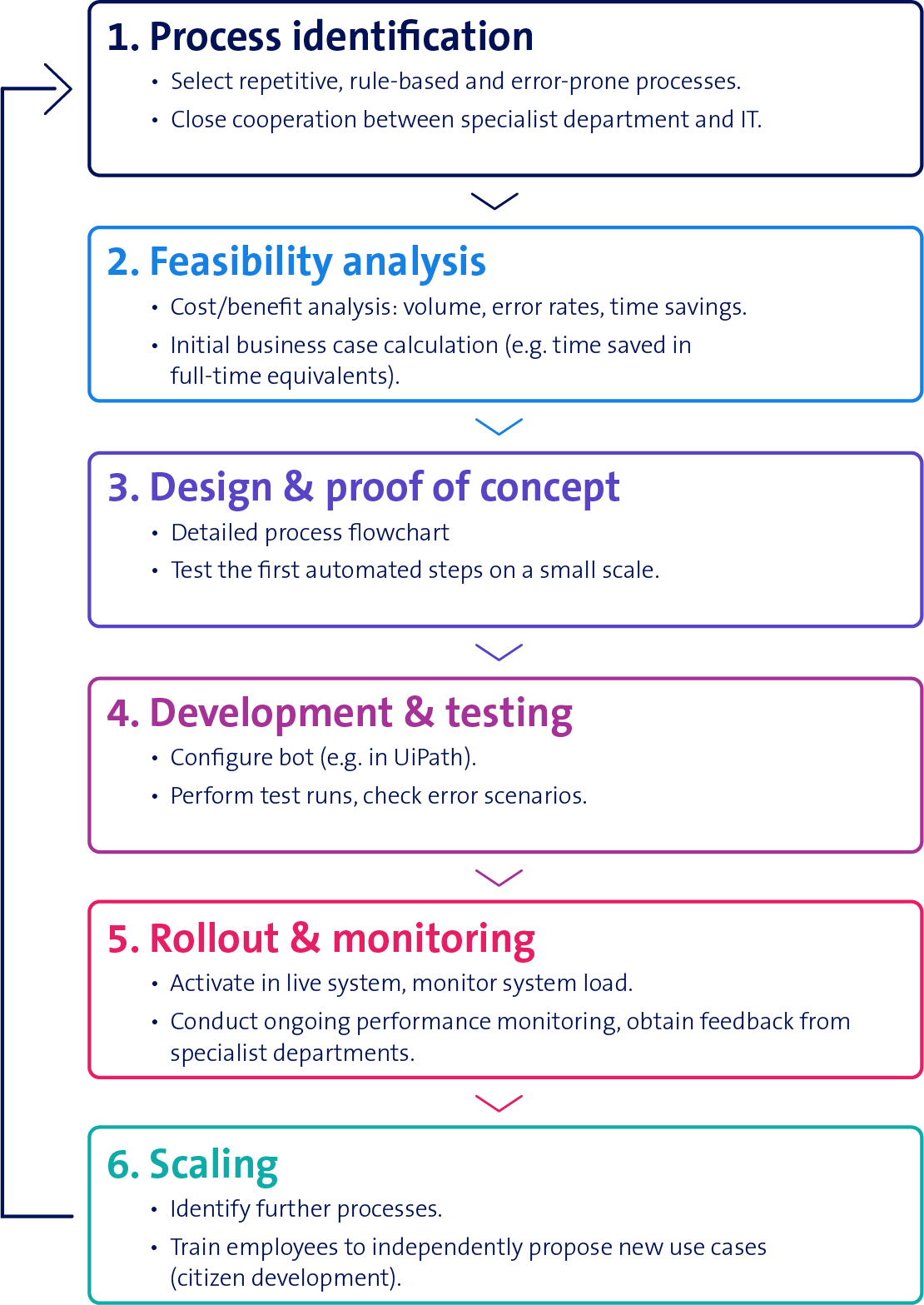

To successfully introduce intelligent automation, the workforce must be on board. A ‘central automation team’ or ‘centre of excellence’ can bundle expertise and tools. At the same time, it’s important to help employees in specialist areas to become citizen developers so that process knowledge is not solely in IT, but where it is created: close to day-to-day business.

According to the panellists at the session, a small completed pilot is often enough of a proof of concept to get people excited. Then lots of ideas swiftly come from the teams themselves. This spirit of participation, complemented by clear structures and quality assurance, contributes to success.

Outlook

Intelligent automation solutions are becoming ever more powerful – not least through increasingly high-performance and far-reaching AI models. In the near future, banks will make much greater use of AI-based process solutions and virtual agents to automate unstructured documents and complex processes in a more integrated way. The journey has only just begun, but the destination is clear: with ever-greater process efficiency and quality, businesses can continue to offer customers first-class service in the future.

Swisscom support

Swisscom supports companies in the banking sector from the initial business analysis and the broad-based operation of intelligent process solutions to manual processing of exceptions. A variety of use cases can be tackled quickly, reliably and comprehensively by combining process automation, business process management and traditional business process outsourcing (BPO). The result: a noticeable lightening of the load on employees, high-quality processes and satisfied customers.

Conclusion

Intelligent process automation in banking is much more than just hype – it is a practical tool for future-proofing the sector. At a time when resources are scarce, customer expectations are high and regulatory standards are complex, AI-based process automation provides a quick and pragmatic way to address urgent issues of efficiency, cost and quality. Businesses that start early will benefit from competitive advantages and can deploy resources where they are really needed: with the people who advise, decide and innovate.