"The satisfaction of banks with their core banking systems: An area of tension?"

During the course of digitisation, many banks are concerned not only with which IT projects show potential in the area of tension between regulatory framework conditions, innovative trends and increasing operational cost pressure, but also with whether the core banking system used is up to the current demands of the business.

In cooperation with the Business Engineering Institute St. Gallen (BEI), in cooperation with the Core Banking Radar of Swisscom, has been monitoring the system support of banks since 2017, and analyses the most common systems in Switzerland at regular intervals using a comprehensive assessment model. However, since the analysis of the systems alone does not show the whole picture, this article includes findings from the survey of four selected customer banks, where three different core banking systems are in use. The results provide information on the current levels of satisfaction with system support from a bank's point of view, and show three basic strategies for the system support of tomorrow.

July 6 2020 9 min.

The challenges for banks begin with the customer

With increasing customer centricity and the paradigm shift from product-oriented services to demand-oriented services, new challenges have arisen which are leading to a growing need for action within the area of banking IT:

- Growing service diversity and decentralised service provision: Addressing end customers based on needs instead of a banking-specific basis leads to a broadening of the service portfolio, which goes beyond traditional banking products. Here, the integration of additional services along the customer journey is usually carried out via third-party providers.

- Eco-systems are formed - and the platform logic is increasing: Due to an increase in networking, more and more marketplaces are emerging, which bring providers and customers together. The customer journey represents the starting point here for the creation and coordination of services. Open platforms in the area of customer interaction enable the involvement of partners and lead to an opening and modularisation of the system architecture.

- Low total costs of ownership (TCO

Total Cost of Ownership

Use of peripheral systems

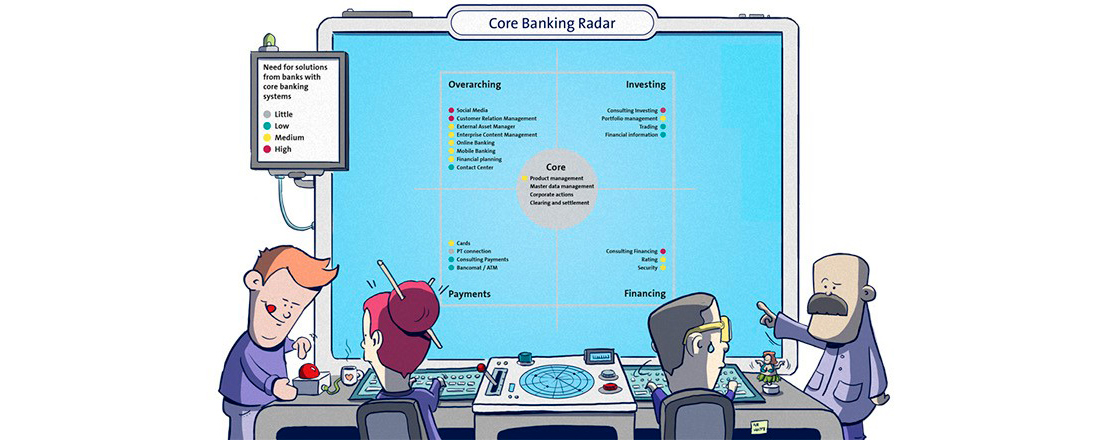

The "peripheral systems" heatmap shows the areas in which banks use peripheral systems or are looking for solutions for the future. The heatmap is based on the basic structures of the banking model.

Heatmap - peripheral systems

Interestingly, peripheral systems are often chosen, although the services can generally also be implemented using applications from the core banking system manufacturer itself. Overall, it can be noticed that the use of peripheral systems is more pronounced at the customer interface. One remaining issue here, however, is the lack of a consistent approach by many client banks. Should customer interaction be department-specific (in relation to payments, investing or financing), or does it make more sense to serve customer needs along the contact points of the customer journey based on the specific topic?

Satisfaction with the core banking system

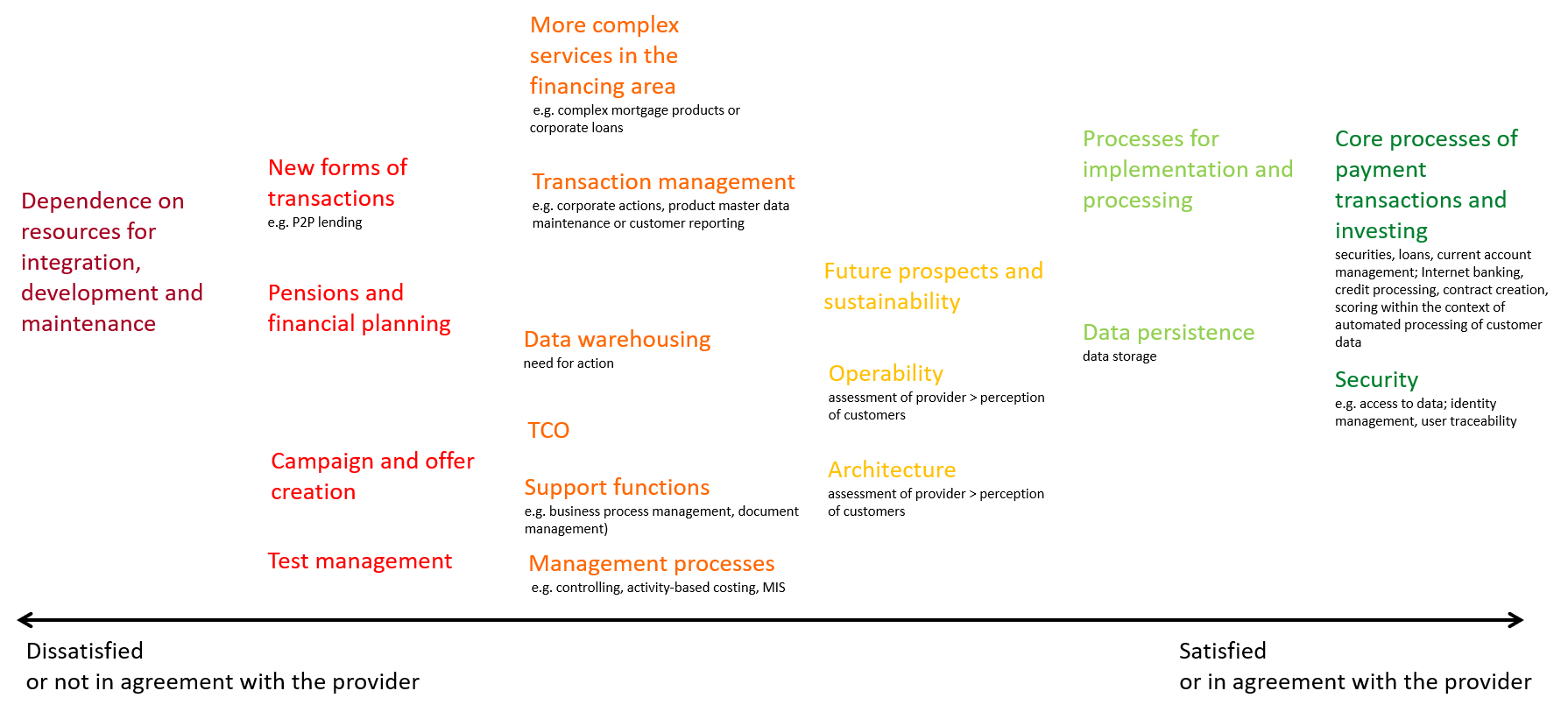

The satisfaction level shows how satisfied banks are with the core banking processes offered by their system. The greatest area of dissatisfaction can be seen in the dependence and availability of resources in relation to the manufacturer. It must however be noted that individual feedback was also received with a high level of satisfaction.

Area of tension regarding satisfaction with system support

Networking of functional support in eco-systems

Most of the customer banks surveyed do not currently offer services in eco-systems, but they did express the goal of positioning themselves as participants within the next three years. According to the current survey, the eco-systems of Living and Financial Provision are particularly interesting according to the customer banks, and preferably in relation to services along the customer journey such as "house purchase and mortgages". Further potential can also be seen in relation to an eco-system in the "retail" sector, which includes supermarkets or e-commerce shops, for example. The main argument for the banks here is the significant volume of transactions and the associated data.

A strategy for system support in the future must be formulated in view of this area of tension between new open business models, such as the one being promoted by the regulators in the EU with PSD2, and the operation of traditional product-oriented banking business.

Strategies for system support in the future

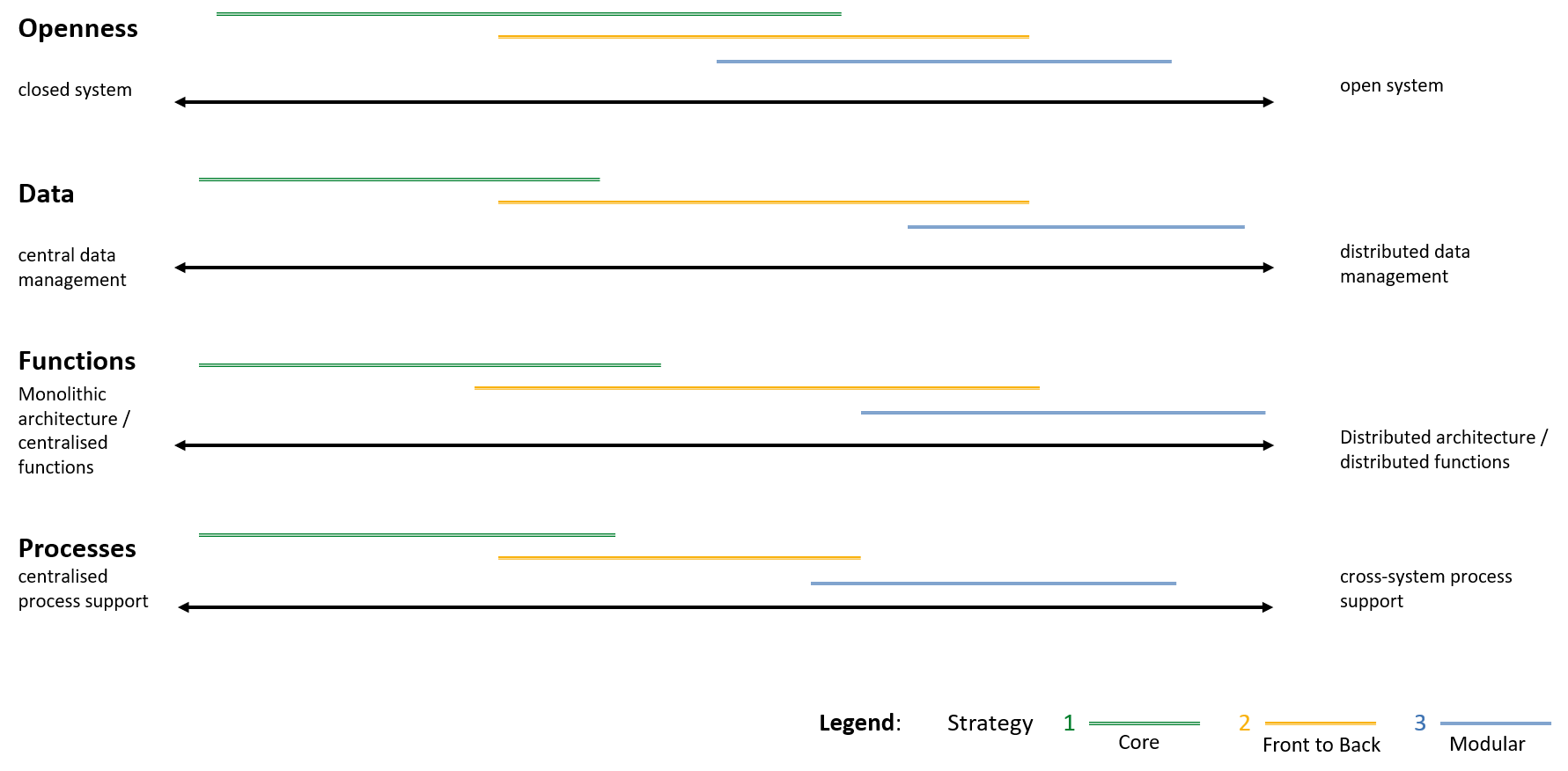

During the evaluation and development of a suitable strategy, four overarching core questions must be answered: Openness, data, functions and processes. These can be specified within the scope of the survey related to the area of tension of the challenges described above (service diversity, eco-system, low TCO). The answers then point the way to the change required for the future system support:

- Openness: Once the question as to which services meet specific needs along the customer journey has been answered, decentralised service provision through standardised user interfaces may become more important in the future. The core question here relates to how far one's own platform must be opened to the outside in order to be able to enter into partnerships and digital networking.

- Data: The database is often viewed from a centralised perspective in relation to master, transaction and inventory data. In the future, however, integration will become more dynamic and complex. This differentiation and linking of different data sources, also beyond the borders of the bank, therefore makes decentralised data organisation and integration necessary. The core question here therefore relates to the degree of centralised data storage and management.

- Functions: The demands on functionality can increase and lead to a "complexity trap" if monolithic systems are adapted. A reorientation must therefore be considered here. The core question here therefore relates to how functions in distributed architectures have to be maintained and integrated.

- Processes: Wherever functions are integrated along business processes, a greater distinction must be made between market-specific functional areas, such as front and back, which place different demands on IT. The core question here relates to how uniformly and consistently the processes within the bank and beyond are supported by IT systems.

Basically, three strategies for system support in the future can be derived in relation to the customer bank satisfaction analysis and the core questions of architectural design.

Strategy 1: Core

All functions are covered to the greatest extent possible by a core banking system and/or the extensions of the respective manufacturer ("Best of Suite").

Selected advantages

- The bank can generally rely on a standard solution provided by the core banking system manufacturer.

- Further developments are made by the manufacturer and are coordinated within a community of banks.

- The complexity of system support is reduced for the bank. For example, if e-banking is integrated into the core banking system, the bank does not have to worry about the consistent handling of transactions.

- Expenditure on the strategic further development of system support is eliminated for the bank to a large extent.

- If the entire range of functions of the core banking software is used, a low TCO should be possible.

Selected disadvantages

- The bank is highly dependent on the core banking system manufacturer, and must generally accept the decisions of the manufacturer and the associated banking community. (e.g. the time to market is partly dependent on the manufacturer's roadmap)

- Own strategies for market-oriented functional support can only be implemented to a limited extent.

- The modularisation of functional areas and the purchase of more suitable software for individual specialist areas makes little sense if they are already covered by the core banking system manufacturer. This is because the functionality would then have to be paid for twice due to the licence model.

- The implementation of an increase in the level of opening towards the market, and the associated networking driven by regulatory requirements such as PSD2, takes place in line with the manufacturer's strategy. Own open banking initiatives are more difficult to implement.

Overall assessment: The strategy is suitable for small and medium-sized retail, universal or even private banks, which pursue a follower strategy and have geared their business model towards traditional banking. This strategy is supported in Switzerland via various operator models.

Strategy 2: Front-to-back

The system support for customer interaction is provided independently by the bank. The core banking system covers as many other areas as possible.

Selected advantages

- The bank can use a standard solution in non-differentiating areas such as the back office.

- In many areas (e.g. also in the implementation of regulatory requirements), the bank can benefit from the core banking system manufacturer and the community.

- Market changes, such as the opening up of the bank, the development of eco-systems and the implementation of open banking in relation to PSD2, are carried out according to the bank's own business focus.

- System support for services that provide differentiation in the market is based on the bank's own priorities. Here it is often possible to implement simple proprietary solutions, which do not need to take the complexity of a core banking system manufacturer and its community into consideration.

- Further providers can be added according to the bank's own criteria.

- IT support for the implementation of the solution in line with the "Time to Market" requirements can be controlled at the customer interface.

Selected disadvantages

- The TCO tends to rise due to higher integration costs, which result from merging front and back applications.

- If the core banking system manufacturers have rigid licensing models, functionality may need to be paid for twice. However, it should be noted here that many licence models are modular, at least in part.

- IT know-how must be established within the bank, which in turn generates costs.

- Provider management must be performed by the bank for all front office systems.

- For the implementation of an open banking strategy, with the objective of opening up eco-systems and implementing new business models, the bank must either build its own platform or open up.

Overall assessment: This is the appropriate strategy for banks that strive for differentiation through technological service orientation and market positioning, and who independently align their customer interface with market conditions. However, the required cultural change is greater than with the first strategy.

Strategy 3: Modular

Modular system support for the entire bank based on requirements ("best of breed")

Selected advantages

- System support regarding customer interaction can be provided independently by the bank.

- Market changes, such as the opening up of the bank, the development of eco-systems and the implementation of open banking in relation to PSD2, are carried out according to the bank's own business focus.

- Dependencies on system manufacturers can be reduced to a minimum. The independence and autonomy in relation to future system support is increased to the maximum.

- System support for services that provide differentiation in the market is based on the priorities of the entire bank. Here, too, it is often possible to implement simple in-house solutions without taking the complexity of manufacturers into account. Depending on the situation, this may even be possible using the bank's own IT expertise.

- IT support for the implementation of the solution in line with the "Time to Market" requirements can be controlled.

Selected disadvantages

- The bank can only utilise a standard solution to a limited extent. The adoption of standard solutions is generally only possible for individual modules.

- The integration needs to be orchestrated, and requires a high level of architectural understanding.

- If the integration of the system architecture is not well managed, this can result in a high TCO.

- Extensive IT know-how must be established within the bank.

- For the implementation of an open banking strategy, with the objective of opening up eco-systems and implementing new business models, the bank must either build its own platform or open itself up, just like with strategy 2.

Overall assessment: This strategy is recommended for banks that are convinced they can use IT to differentiate themselves on the market. It can also be implemented in a community of like-minded banks. Different operator models are also conceivable. This strategy enables technology-supported market orientation - structured according to the bank's own needs. This strategy could well take standard solutions of a core banking system manufacturer into account for one specific area. This approach can be particularly successful and cost-effective if the vision of lean core banking systems with a focus on the function of a "booking engine" is realised.

Conclusion

The needs of the banks surveyed are very similar. With regard to the common functionalities and services, the surveyed banks are satisfied to a large extent with the system support provided for their core banking systems. However, the more complex and less standardised a function becomes, the less satisfied a bank generally is with the out-of-the-box solutions on offer.

All customer banks surveyed see coherent approaches to future customer interaction as a challenge. Should the technological support be specific to each department, or does a digitally integrated approach along the customer journey, or perhaps even the creation of an eco-system, make sense?

The surveyed banks are interested in solutions for the development of the eco-systems Living and Financial Provision. However, it is also apparent that these are not (yet) financially attractive and that the joint use of data often still needs to be clarified.

For core banking system manufacturers, low costs mean standardisation and modularisation. At the same time, banks are increasingly demanding that individual needs be covered.

This requires a strategy. The four core questions covered here support structuring. The degree of openness of a system depends on the services, the partners and the intended data use. The integration of the functions, as well as the degree of process support throughout the system, must be assessed.

Coverage of the core questions with the three strategies (ranges)

With each of the three clear strategies formulated here, the overriding core issues of openness, data management, functions or processes can be supported to a degree. It is, however, important that the banks have a clear strategy for their IT.

This requires flexibility and clear decisions regarding system support, both from the banks themselves and from the core banking system manufacturers. Furthermore, this also increasingly means solutions need to be searched for together, and it requires strong partnership relations in the future.

The Core Banking Radar will continue to follow developments in this area. Another important topic is this regard relates to the Neo core banking systems, which should be able to offer a completely modular approach according to strategy 3 (see above). So stay tuned.

Article already published in 2019

- SolitX: Smart Financial Contracts as a new approach to system support for banks (published 11 November, 2019)

A long-term partnership exists between Swisscom and the Business Engineering Institute St. Gallen (BEI) within the "Ecosystems" Centre of Excellence. This centre deals with topics such as eco-systems, digitisation and transformation, as well as other issues relating to the structure of the financial industry in the future. In addition to its research activities, the BEI carries out projects related to the design and implementation of innovative, cross-sector business models.