Expert interview with Silvan Wirthner

“Our regulatory monitoring combines financial expertise with IT know-how”

The compliance experts at the core banking system operator, Swisscom, continuously monitor regulatory developments in the financial market sector for numerous Swiss banks and offer them a tool-based monitoring service via web application. Silvan Wirthner explains how this works and the issues that banks are currently facing.

Text: Florian Maag,

Banks have to deal with new and amended regulations on an ongoing basis. The extent to which a bank’s system landscape is affected and the best solution is often not clear. Banking systems may have to be adapted and further developed to implement the new or changed requirements. Existing processes may also be affected: they need to be reviewed and adapted as necessary.

Silvan Wirthner, you systematically monitor regulatory developments for banks. What should banks be preparing for currently?

Current topics include the revised legislation in the area of money laundering and data protection. We are currently in the implementation phase for these topics. Banks must ensure that the required changes to their banking systems and processes are implemented in time. Another topic on the regulatory horizon is the issue of sustainability in the financial sector, which requires analysis of the impact on systems and processes.

Do these changes always mean that systems or processes need to be adjusted?

No, an adjustment is not always necessary. However, a structured procedure is required to reach a decision on whether an adjustment is required due to regulatory changes. The first step is to analyse the new regulation in detail and understand its impact on the existing infrastructure. Then it is necessary to determine whether the requirements can be met with the systems and processes already in place. If not, a needs analysis must be carried out in a third step and an implementation proposal must be prepared for the attention of software manufacturers and discussed with the affected banks. This enables requirements to be implemented in time and to the required extent.

Silvan Wirthner, Compliance & RegTech Services Specialist at Swisscom

Swisscom now offers regulatory monitoring with the active participation of Finnova. How does this benefit the banks?

Swisscom offers a unique combination of expertise that differs from other regulatory monitoring services because we can combine financial market expertise with our wealth of experience in operating our clients’ banking systems (application management and application operations). We can therefore assess whether adjustments to systems are necessary in the event of regulatory changes. With Finnova’s active participation in the service as a core banking system vendor, we can simplify communication between the stakeholders involved. In addition to transparency, we can also create a community platform where communication and documentation is always up to date and accessible to all stakeholders.

Can you explain a little more about this service you offer banks to facilitate their IT system compliance?

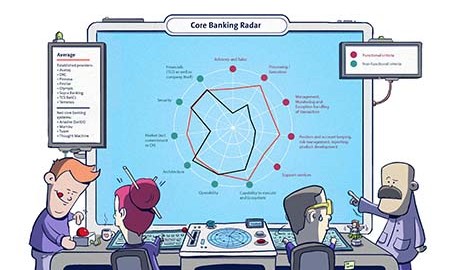

Our “regulatory monitoring” service enables clients to benefit from Swisscom Banking’s expertise, which this division has built up and continuously maintains for the provision of its services. Within this framework, we support clients via a web application by collating new or amended regulations and analysing the impact on their Finnova banking applications, infrastructures and processes. The service also includes the development of implementation concepts and in-depth discussions with our compliance specialists, as required. The client may also ask for the service to be extended to banking processes outsourced to Swisscom (BPO) and other banking applications.

How does the process work in concrete terms?

Regulatory monitoring brings additional quality to the analysis of new and changed regulatory requirements by combining our IT and compliance expertise and our close cooperation with Finnova and other software vendors. Any need for adjustments to systems and processes is therefore identified by the stakeholders at an early stage to enable better forward planning. Moreover, the community concept is at the forefront. This means that all participating banks can see which proposed solutions are being developed, including organisational ones and those outside of the applications. This provides them with a sound decision-making basis for the implementation of the regulatory provisions in their company. The regulatory monitoring service provides a web application in which relevant regulatory changes are recorded: from the wording of the regulation, through to analysis of the action needed and the technical implementation. All stakeholders of the bank can access it at any time to view the latest status of the discussion and obtain complete documentation of measures already implemented.

Can this save costs?

Yes. In addition to the advantages already mentioned, regulatory monitoring can also save costs. The necessary work is shared among the participating banks, for example, and thus reduced for the bank’s own compliance department. In particular, by involving the relevant external stakeholders, solutions can be developed and implemented more efficiently and effectively.

Regulatory monitoring in a nutshell

The service is provided by Swisscom’s Banking Compliance unit, which offers services for the implementation of financial market regulations in the IT environment of banks. This specialist unit acts as a knowledge carrier for financial market regulatory requirements and supports the client in their implementation of these through coordination with other Swisscom specialist units and with third parties such as Finnova. The client can obtain services that complement their own, in-house compliance services.

More information: