Interview with the experts: core banking

“We expect evolutions rather than revolutions”

Core banking will remain indispensable in future. Innovations often take place in the peripheral systems of core banking. Forthcoming innovations are in cloud-based core banking solutions and in new architectures based on microservices.

Text: Matthias Niklowitz, Images: Raphael Zubler, 15 March 2018

What does the future of banking look like?

Clemens Eckert: In our opinion, the idea that there will be banking without banks goes too far. We are convinced that there will still be banks in ten years time. Customers trust banks. However, banking will have to become integrated into digital ecosystems and customer processes; it will become simpler and faster, and there will be more self-service options. We will also see new business models.

Thomas Zerndt: Automation, exchange of information and a customer experience which goes beyond banking will make their mark on the banking business in the next few years. Retail banking will transform into an invisible process which is interwoven with consumption and which supports the consumer in their customer processes, therefore involving other industries as well. This will particularly apply to the area of payment.

Eckert: To put it in a rather exaggerated way, customers want to pay for their coffee quickly and on the go – ideally without even noticing the payment process. Customers want to buy goods, not to explicitly use a particular technological solution. Banks will still manage accounts in future, but I think that payment, and financing processes as well, will take a back seat. Want, click, have – as long as you possess the means to do so.

Zerndt: It’s not just payment and financing; the subject of investment will change as well. The possibilities of digital networking could bring about a resurgence of comprehensive coverage of financial questions – to avoid using the word bancassurance. I am also thinking of blockchain technology, which provide a different way to handle assets. The potential possibilities and effects of artificial intelligence cannot be foreseen at all yet.

Thomas Zerndt, CEO of the Business Engineering Institute St. Gallen (BEI)

If payment takes a back seat and investing will change this much, what does this mean for core banking systems and their manufacturers?

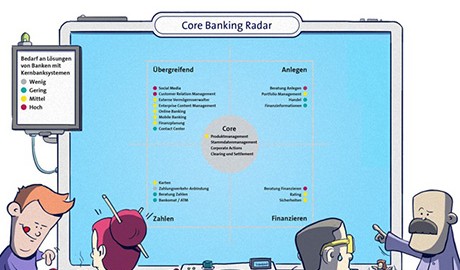

Eckert: Core banking systems cannot follow every trend and be completely remodelled. This means that manufacturers must work more with peripheral systems. All the manufacturers considered so far in our core banking radar are working on structuring their systems in a more modular and more open way.

Zerndt: It is impossible for core banking system manufacturers to cover all the future topics using their own resources. Manufacturers have to perform a balancing act: On the one hand, they must have stable operation which conforms with the regulations. On the other hand, they must press ahead with innovations, particularly in the area of customer interaction. For front-end applications, there must be much faster renovation cycles orientated to the end customer.

“To put it in a rather exaggerated way, customers want to pay for their coffee quickly and on the go – ideally without even noticing the payment process.”

Where do core banking manufacturers have most need for improvement?

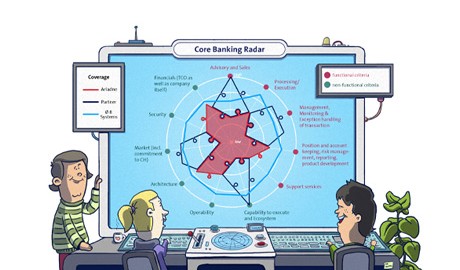

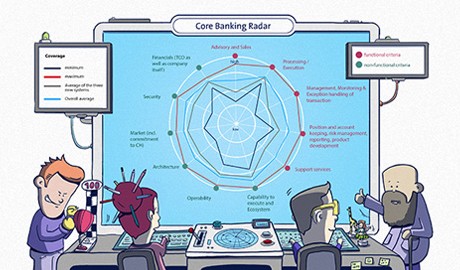

Eckert: Our surveys for the new core banking radar have revealed that there is hardly any functional difference between the core banking solutions of individual manufacturers. A core banking system is therefore chosen not on the basis of functional criteria but according to criteria such as total cost of ownership, the manufacturer’s reputation and the community of banks which are already using the software.

In my opinion, too little thought is currently given to the future development of business processes. One thing is certain: in digital ecosystems, customer processes will have to be covered holistically and operate in an integrated way.

Zerndt: We see great a great need for action in the further development of banks’ business models and the associated questions. One example is mortgages: in Switzerland, they have been constructed and sold in the same, unchanged way for more than 20 years. Other countries are much further ahead in terms of flexible repayment modes, for example.

As a rule, banks are slow to react to changes in customer and market demands. They need to transfer from a reactive to an active mode. Otherwise, an ever greater deficit will build up, which in turn will create greater need for action. At the same time, this makes them vulnerable to more agile competitors.

What are the main differences between the manufacturers?

Eckert: The main differences between individual manufacturers are in their strategies. For example, some manufacturers clearly pursue an international or global strategy. They have developed systems which work in different time zones and with different currencies. Manufacturers who only cover the Swiss market do not need such functions. With regard to the non-functional aspects – that is, how they secure their continuous operation, maintenance and support – the manufacturers included here are all very good.

Zerndt: You can see a clear DNA, as it were, of individual manufacturers. For example, Avaloq’s origin in institutional banking or the Finnova core banking system’s roots in retail banking run by smaller banks. Temenos has grown noticeably through acquisitions, and the Indian manufacturer TCS, because of its size, has the resources to set thousands of developers to work on an important problem.

Clemens Eckert, Head of Core Banking at Swisscom

Where are the biggest gaps?

Eckert: At the moment, we see two very specific gaps: firstly, the possibility of running core banking solutions from the cloud. This is already normal and possible in other countries. Manufacturers active in Switzerland are now in the process of making their solutions cloud-ready. A cloud-based core banking system will be possible in Switzerland, too, in the next few years. This will not only reduce overall costs, but also allow much more leeway for self-service and dynamic ways to source services, which means that the banks can adapt the services they use: e.g. they can integrate an additional environment on an ad hoc basis, or deactivate an environment overnight to save costs.

Secondly, we see great opportunities in architectures based on microservices. In these cases, the core banking system is composed of small modules which are separate from each other. When new releases come out, a bank now only has to test the patched modules and their interfaces rather than the entire core banking system. This considerably reduces the expense of testing and also enables DevOps on the core.

Zerndt: From the bank’s point of view, this leads to another important question, namely what is better developed together with a core banking manufacturer and what is better developed with partner companies.

“Banks are often slow to react to new customer demands and to changing market conditions. They need to transfer from a reactive to an active mode.”

What can be learned from fintechs with regard to core banking innovations?

Eckert: Fintech business models are often based on solving the problems of end customers. Core banking manufacturers already have comprehensive systems and have to keep these up-to-date and provide new functions in agreement with their customer banks. They are tied to their road maps. They also have a standing team of experts and pre-existing cost structures. Then there is the question of whether a core banking system manufacturer should be a disruptor. A fintech can be disruptive through radical focusing, willingness to take risks and completely different cost structures. Core banking system manufacturers will not be so keen to take risks. They are practically systemically relevant and “too important to fail”.

Zerndt: This is also about basic attitudes towards innovations. Core banking manufacturers and banks, as well, should adopt the agility of fintechs in their own companies. These fintechs and start-ups plan much more in the short term, and because they typically focus on one service, they are more agile and more market-oriented. When working together, we must remember that not all companies will survive.

Can a bank handle this development towards digitisation and automation on its own?

Eckert: Yes, in principle it could handle it on its own, but this entails a correspondingly large workload for an individual bank in order to build up the necessary expertise and infrastructure. It is easier if a bank approaches digitisation and industrialisation with a partner. An ideal partner accompanies a bank all the way from trend analysis (what innovations are there in total), via strategy (which strategies are currently relevant to this bank), up to suitable implementation in processes and systems. And this also includes the question of which systems and innovations can and should be covered by the core banking system in future, and which by the peripheral systems.

Zerndt: The vast majority of banks have outsourced their tech support. Banks have to be aware of one thing: they have the data and infrastructure which they need to work for their customers. Customers are paying for this. The result is that a bank is actually a technology company and should increasingly develop its technological expertise.

A further-reaching question concerns new cooperation models by banks with other banks. It is easy to imagine that banks might run digital marketplaces or platforms together. There are analogies to this, for example, in the travel industry.

Eckert: In reality, we have seen that it is very difficult to find the lowest common denominator for such joint projects.

What can we learn from neo-banks?

Eckert: Neo-banks have diverse forms of core banking systems: systems by new providers, modules by existing manufacturers and also their own developments. What all the approaches have in common is that the neo-banks have chosen a system which ideally suits them: both as a business model and in terms of culture, costs and knowledge. We also see that it is technologically easier to build a good solution for account management, payment transactions or financing than for the area of securities. For neo-banks, core banking is viewed once again as an important driver for innovation. This can be seen, for example, with the German Solaris bank: with its banking-as-a-service range, it has chosen a very different strategy from N26, for example, where payment transactions are the dominant topic. The Fidor Bank is different again: here, community banking and the corresponding software solutions are very closely adapted to each other. Culture, strategy, processes and systems fit together very well here. It is also clear that the bank is following current topics such as crypto-currencies. This means that the Fidor Bank is growing far above average, because it notices customer requirements and because its system enables a response to the desire for services and products.

Zerndt: Neo-banks have also found completely new interactions and transaction forms: for example, the bank’s customers are connected to each other by likes. Those who have a lot of likes, i.e. who have a certain influence via social media, receive better interest terms. This means that technology is used to support one’s own special brand and new business models.

“The blockchain technology and artificial intelligence are key technologies which will cause major changes in banking and also in the core banking systems.”

Will we see more core banking providers on the Swiss market in the near future?

Eckert: We will update the information in the core banking radar every six months. It is now already foreseeable that we will also take into account core banking solutions such as those of the Irish company Leveris, which have not been included so far. Leveris also supports entirely new, data-driven business models and, in particular, the analysis of data which they already have from and about the customer.

This is because a bank knows much more about its customers than Google, for example. From contractual conditions and payments, it knows precisely when a loan or a leasing contract will expire. It can then choose exactly the right moment for proposals for follow-up financing – and for a new car. The customer benefits in two ways: on the one hand, they receive individual advertising offers when they need them. And on the other hand, the bank includes them in the new revenue streams which are generated by this – so both the bank and the customer benefit.

Zerndt: We will also include in our radar particularly innovative business models and activities by foreign banks which are possibly considering entering the Swiss market.

Can you foresee a wave of renewal of core banking systems in Switzerland?

Eckert: Core banking implementations are expensive. The overall costs certainly amount to figures in the two-digit, and for large implementations, three-digit millions. A bank will only do that if it regards it as an absolutely necessary step – whether because of risk considerations (e.g. if a provider goes bankrupt) or if it can achieve new business models in this way. What we see more often today is the renewal of individual elements. The core banking software manufacturers have given themselves leeway to avoid replacement by their strategy of opening and modularisation.

Zerndt: An exchange of core banking software would not solve the major problems. The question which a bank must always answer in relation to its IT is how the system support should be structured in future, and which specific demands are made of the technology. Today, we are seeing a gradual renewal rather than complete displacements. We also can’t rule out the possibility that a completely new, far superior system might come onto the market in a few years.

Eckert: The IT will once more become increasingly differentiating, and parts of IT will be seen as strategically significant again. It will then no longer be outsourced. We expect the first displacements in three to five years, at the earliest.

Is there a next “big thing” in terms of innovation for core banking systems?

Eckert: Every manufacturer must give this some thought. Many providers have formed working groups for this topic and formulated plans for the future. However, we expect evolutions rather than revolutions. We see great potential in automation. The first experiences of this are very promising in their positive effect on banks’ cost structure.

Zerndt: The blockchain technology and artificial intelligence are key technologies which will cause major changes in banking and also in the core banking systems. However, disruptions can also be triggered by existing technologies, as the example of peer-to-peer loans shows.

Regulation and compliance are further topics which are very suitable for automation. It is very easy to process the majority of standard cases in this way, which means you then only have to take care of individual special cases. We can see a similar development in portfolio management. However, the core banking manufacturers would have to take the lead in these innovation topics.

Thomas Zerndt

is the chief executive of the Business Engineering Institute St.Gallen (BEI), Chief Financial Officer of CDQ AG and head of the competence centre Sourcing in the Finance Industry (CC Sourcing).

Clemens Eckert

heads Swisscom’s core banking and is a member of the Swisscom Banking Management Board. He is responsible for the operation and further development of the banking platforms of more than 50 banks.

Swisscom and the Business Engineering Institute in St. Gallen (BEI) have been in partnership for many years within the framework of the "Sourcing in the Financial Industry" expertise centre. The centre works with topics such as ecosystems, digitalisation, transformation and matters pertaining to the future structure of the financial industry. Along with its research activities, the BEI runs projects designing and implementing innovative, cross-industry business models.

Newsletter

Would you like to regularly receive interesting articles and whitepapers on current ICT topics?

More on the topic