More efficient asset management

“The OpenWealth API has made us a good deal more future-proof.”

St.Galler Kantonalbank offers external asset managers a standardised interface to custodian bank services. It pioneered the development of the OpenWealth API – with Swisscom as a partner for the Open Business Hub integration platform.

Text: Anton Neuenschwander, BTK GmbH, Images: Michael Meier,

With Open Banking, financial institutions strive for secure and standardised data exchange with third parties. There is also a need for action in wealth management: until now, independent asset managers have had to log in via bank-specific e-banking portals in order to use custodian bank services. It is obvious that this involves a lot of work – with corresponding costs. Wouldn’t it be useful to be able to access custodian bank services from multiple banks directly via the Portfolio Management System (PMS)? Which interfaces would be preferred for this? St.Galler Kantonalbank (SGKB) asked these questions in 2019 as part of a market survey of asset managers and PMS providers. The response: entirely positive. And yes, with standardised interfaces throughout Switzerland, please. Otherwise it becomes too complicated.

The power of innovation from the community

SGKB is focusing strongly on digital banking. As early as 2018, it had put APIs (programming interfaces) into use for the accounting systems of its customers. “After evaluating our market study in the wealth management environment, we were convinced that the time was ripe for a significant digitisation push here as well,” says Falk Kohlmann, describing the initial situation. As Head of Market Services, he is responsible for SGKB’s digital banking, among other things. Together with Synpulse Management Consulting, Falk Kohlmann and his team launched the OpenWealth initiative in 2020, with the aim of defining a cross-bank API standard for wealth management and establishing it in the financial centre. In the meantime, well-known financial institutions, PMS providers and partners have joined the OpenWealth Association. “It was always clear to us that only a broadly deployed standard, which must be supported by many stakeholders, would lead to the achievement of our goal,” says Falk Kohlmann.

“Swisscom had shown that its Open Business Hub had proven itself in other use cases.”

Falk Kohlmann, Head of Market Services and Member of the Executive Board, St.Galler Kantonalbank

Open Business Hub – the central API interface

The project continued. SGKB chose Swisscom as a partner for the platform, which provides the API: the Open Business Hub is ideal for the secure, standardised networking of applications and service partners. “Swisscom had shown that its Open Business Hub had proven itself in other use cases. What’s more, Swisscom impressed us with its clear product orientation, and it is also ideally positioned in the financial sector,” comments Falk Kohlmann. However, a partner was still needed for connectivity between the API and the PMS. With bLink, SIX Banking Services provided a secure, standardised interface. One with additional added value, as Sven Siat, Product Leader for bLink at SIX, explains: “bLink enables a very streamlined onboarding of the PMS – with structured workflows for contracts, consent management and approval review.”

Falk Kohlmann, Head of Market Services at SGKB: “The time is ripe for a significant digitisation push in the wealth management environment as well.”

Built, tested and ready: the new API platform

The first OpenWealth APIs went live in mid-October 2021. “On schedule,” emphasises Falk Kohlmann. Cooperation between the project partners was outstanding. “Swisscom and SIX brought in the right people with the right skills. This helped us to creatively overcome the challenges, which were considerable: we broke new ground with our development, so surprises were inevitable. Findings from the OpenWealth Association and from the development project led to fruitful interaction time and again.” The end-to-end testing was also demanding: “We had to keep an eye on the entire chain: from the core banking system to the API, bLink and the PMS.” For Falk Kohlmann, the initiative and the hard pioneering work have paid off: “With the automated access for independent asset managers, we have become a good deal more future-proof. The efficient interface management with the Open Business Hub and the modern interface technology make attractive new offers possible. Our customers will benefit from more convenience as well as more efficient processes.”

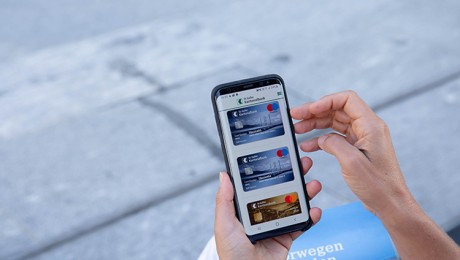

Open digital doors for independent asset managers: St.Galler Kantonalbank.

Swisscom Open Business Hub

The Open Business Hub offers providers from various industries central access to business API ecosystems, including the infrastructure. With it you can network applications and service partners in a standardised way, expand your core services with partner services, and extend your value chains for your customers. Applications are used in the form of Software-as-a-Service (SaaS) instead of being integrated. This reduces your investment costs while increasing your agility.

More on the topic: