Core Banking Radar

Development of core banking systems in Switzerland – a market overview

In cooperation with the Business Engineering Institute St. Gallen (BEI), the Core Banking Radar of Swisscom has been monitoring the system support of banks since 2017 and analysing the most relevant systems for the Swiss market using a comprehensive assessment model. In 2022, all systems previously interviewed were asked about changes they had made over the last four to five years. This article highlights the results of the update interviews against the backdrop of overarching trends such as embedded finance, event-driven services and platforms.

Text: Christine Popp, BEI, Pictures: Wendy Buck, Zense GmbH

27 April 2023

Emerging platforms influence the core banking market

The importance of platforms is growing for both banks and core banking system providers. Platforms not only connect suppliers with customers, they also connect suppliers from different industries and end customers with each other (multi-sided market). In this way, they can increasingly fulfil end-customer needs by means of event-driven services along the customer journey. So far, this has only been possible to a limited extent with the familiar multi-channel architecture.

Due to the focus on customer journeys, the banking industry is also increasingly using integration platforms and promoting Banking as a Service (BaaS). Possible designs include the integration of services that are partly external to the bank on an integration platform for banking or the passing on of customer data (with the relevant consent) in a network of trust between banks. In addition, many banks are open to embedding their banking services on other platforms within the framework of embedded finance.

The use of increasingly emerging integration platforms, such as bLink from SIX, Swisscom Open Business Hub or platforms from banks, requires open interfaces and an open architecture. Banks are therefore increasingly building integration competence and IT expertise and striving for more independence from their core banking system.

Core banking system providers are aware of these developments and are looking to build their own integration platforms to integrate and connect TPP (Third Party Provider) services and banks more easily. They have launched different initiatives to reposition and (partially) renew their system.

Exciting developments from the interviews

In 2017/2018, the Core Banking Radar examined the eight most relevant core banking systems for Switzerland using a comprehensive methodology. In 2022/2023, the interviews with representatives of these established systems in Switzerland were repeated in order to find out how the systems have developed.

In 2018, the core banking system providers announced their intention to develop the areas of customer data analysis, business process management, wallets for digital currencies, financing advice and client self-service over the coming years.

Over the last five years, the systems focused their developments on the following specific topics (sorted by number of mentions among the core banking systems):

- SaaS (Software as a Service):

Whereas on-site installation used to be the standard, many providers and system integrators now offer the systems, or individual modules of them, on the cloud if required. With some systems, specific modules can be purchased as services; with others only the entire system can be acquired. There are also systems that deliberately do not want to offer all modules as SaaS. - Customer Behaviour Analysis / Data Science / 360-Degree Customer View:

Several of the core banking system providers surveyed have invested in data strategies to acknowledge the increased importance of data driven by trends such as event-driven services and embedded finance. This includes ensuring the quality of customer data and data analysis to provide a 360-degree view of the customers and the forecasts of their needs. The use of life events for segmentation and pattern analysis to identify customer potential is also among the new functionalities offered by some core banking systems. In addition, automatic analyses are used to prevent fraud. - Consulting:

In the securities area in particular, core banking system providers have developed new advisory tools for relationship managers, including dashboards with a 360-degree view of customers for front teams in the banks. For the provision of functionalities in advisory, this often involved working with partners (e.g. for software development). - Open API interfaces / open platform:

All of the systems considered have worked on opening up their system and providing interfaces. Some offer APIs, others already have an API gateway. API development, also in the direction of Open API, is on the roadmap for almost all systems. - Digital assets / cryptos:

Some providers have invested in the crypto sector. The different designs range from a crypto-capable core, which provides the bank with an omnibus wallet, to a crypto-asset platform. - Instant payments (services):

Several of the systems offer instant payments as a new functionality of their own or deliver IP extensions in separate components installed alongside the core. Other providers buy these components.

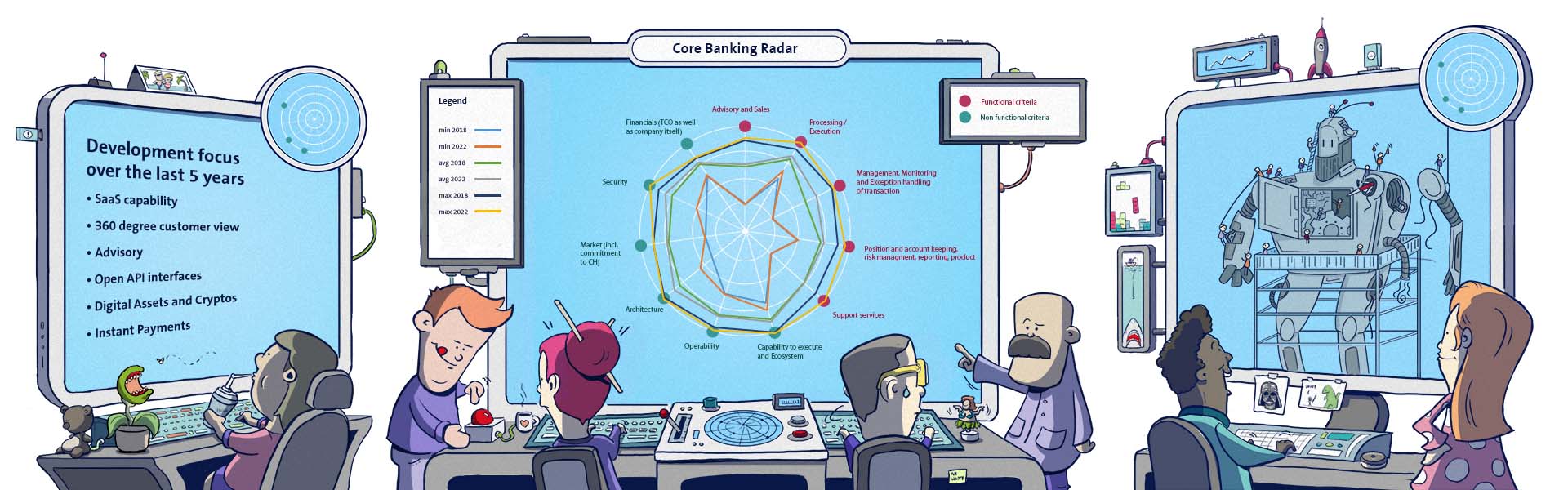

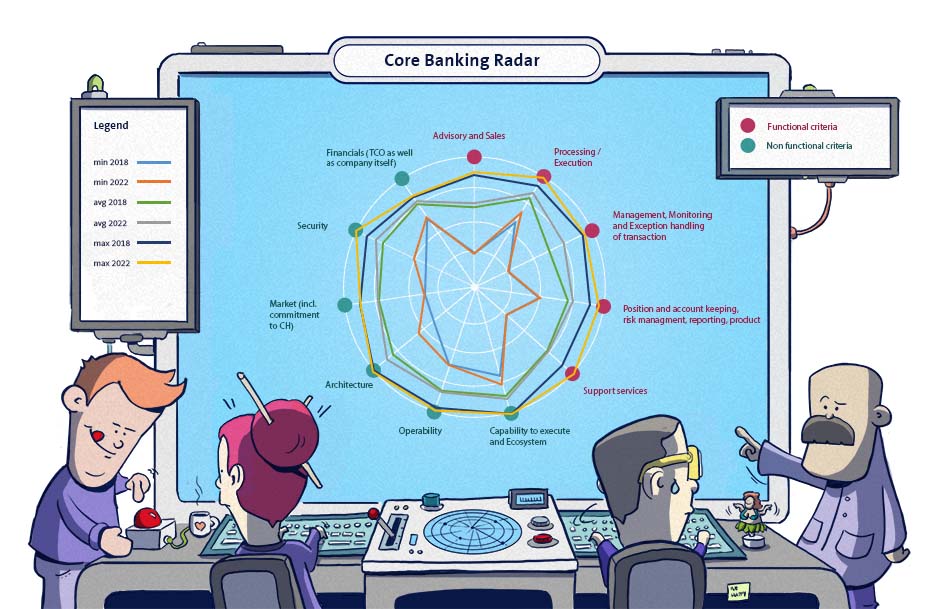

Despite the investments and further developments, the Core Banking Radar graph, which surveys 193 criteria in five functional and six non-functional categories (see methodology), shows only slight adjustments on average for the eight core banking systems examined:

Figure 1: Development of functional coverage: Minimum, average and maximum of the eight systems

Core banking systems have been engaged in four overarching activities in recent years, which are reflected in the graph:

- Gradual renewal of infrastructure and increase in cloud capability

While the usefulness of the cloud installations used to be questioned, the core banking system providers are now systematically working on supporting new infrastructure including cloud capability. This development can also be seen in the non-functional area of architecture.

- Optimisation of the system with selected innovations

The functional scope of the core banking systems has hardly changed. We are dealing with mature systems and an already comprehensive range of functions. All systems focus on optimisation, as evidenced by selected innovations aimed at improving and enhancing the security of ongoing operations (for example, to meet regulatory requirements in the area of execution and settlement or to increase traceability in the management, monitoring and exceptions of transactions). Only a few systems enter new areas, such as function extension to include insurance services. The non-functional area of security enjoys greater focus, which is visible in the graph. - Partnering and building a partner ecosystem for specific additional services

Architecturally, the systems focus on opening up, reflecting the non-functional architecture category. Opening up is essential when it comes to covering the specific additional services in the ecosystem. The understanding of the ecosystem has changed, for many providers coverage in the ecosystem category was already high in 2018, but at that time it was still very much focused on collaboration with suppliers, whereas today the term also includes customers, other partners and their environment to cover the Customer Journey. - Complementing specific services such as instant payments or digital assets

Complementing specific services such as crypto assets and instant payments uses a wide range of functionalities, which increases the coverage of different functionalities overall.

The different offers from the providers are still differentiated according to the profile and needs of each bank, as already shown in the article One Size doesn't fit all.

Figure 2: Development focus over the last five years

Where systems are heading in the future

According to the interviews, the focus of the providers on renewing the infrastructure, stabilising, partnering and supplementing specific services can also be expected to continue over the next few years.

Functional

Functionally, the systems are already so far advanced that there will be little focus on introducing new functionalities in the future. Of course, new regulatory requirements will be implemented, such as Instant Payment and the Swiss Data Protection Act. New functionalities being developed are hybrid advisory and portfolio risk management. Some schemes also aim to introduce further web-based front-ends (consulting, pension, etc.).

The addition of specific services will continue to be a focus in the future; digital currencies in particular continue to be among those areas of development explicitly mentioned.

Non-functional

In terms of architecture, the core banking system providers are talking about investing in new infrastructure support, cloud capability, SaaS and BaaS as well as opening up via Open API in the next few years. In the coming years, the provision of functionalities as part of embedded finance will also be an issue for some systems.

Microservices are on the roadmap for many providers, highlighting the focus on infrastructure renewal.

In the area of operability, the planned increase in the degree of automation as well as the reduction of downtime pay into the renewal and stabilisation account.

Figure 3: The proven systems are continuously renewed and allow additional services to dock at interfaces

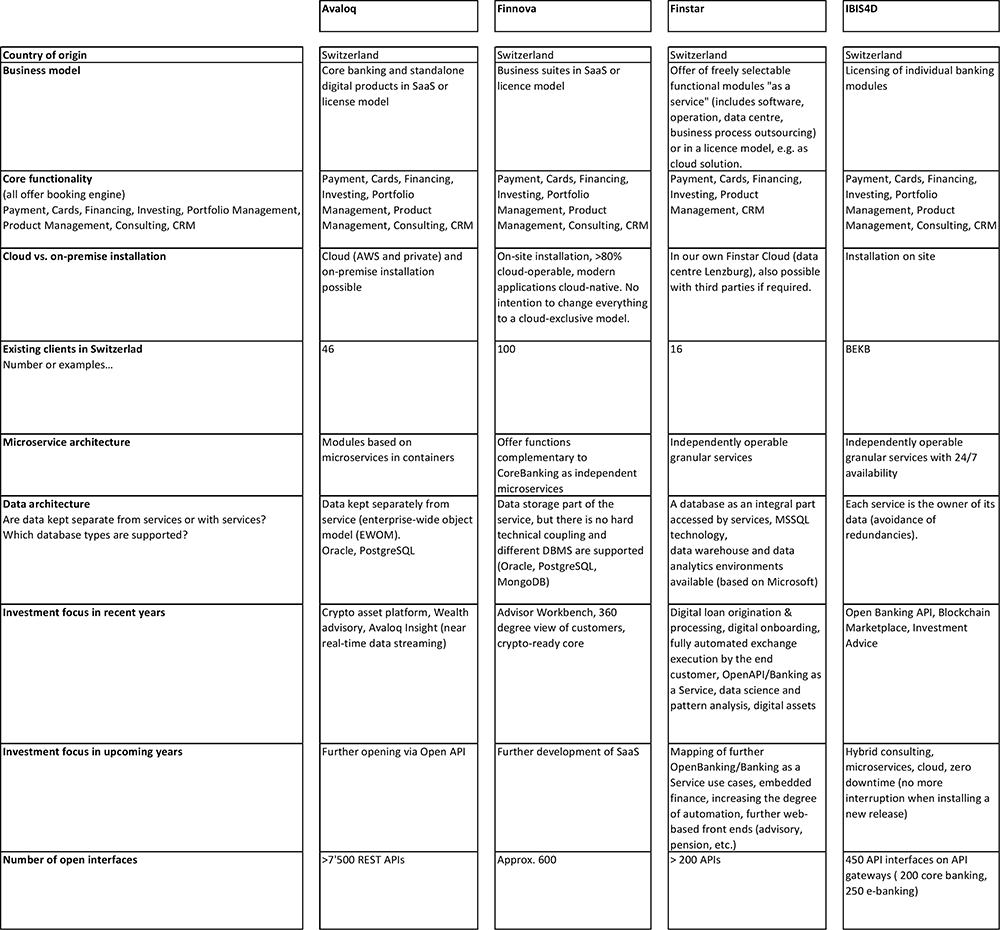

The systems examined within the framework of the Core Banking Radar

The following section gives an overview of the systems surveyed, each with a quote from the interview.

Avaloq

Avaloq serves 160 client banks with its comprehensive banking functionalities. Avaloq is increasingly focusing on open architecture and open interfaces. Some of Avaloq's suites, such as the front-end "Engage", can be used as stand-alone solutions or integrated into other systems - including core banking systems. Avaloq has also developed a crypto-asset platform and is increasingly building on cloud capability:

"We want to make the cloud the standard and play an active role in 15 markets. We will continue to leverage our synergies with NEC and global partners to enter new markets, including Japan and the US."

Finnova

Finnova is the second established Swiss solution and is used by more than 100 retail, regional and private banks. Finnova supports customer centricity with functionality to create a 360-degree view of the customer and segmentation based on transactional behaviour (such as frequent traveller). In addition to its core functionalities around transaction processing, Finnova is characterised by various partnerships in the ecosystem (for example SecuChat Suite by jemmic for customer communication or Loan Advisory by Inventage as fully integrated components) to cover customer-oriented functional requirements.

"We offer a separate and complete solution for Swiss customers. Every third bank in Switzerland runs on Finnova. For functionalities that we do not consider to be a task of the core system, such as market analysis, we are happy to work with partners in the ecosystem. We have come a long way with the open platform over the last four years, developing it, including an integration component and data warehouse and then taking it live with several customers."

Finstar

Finstar is an open Swiss core banking system that was built by the development team of Hypothekarbank Lenzburg with flexible parameters and in multiple languages. It isnow available to other banks and financial service providers as SaaS. Finstar relies on open interfaces and offers both fintechs and non-bank companies a wide range of services in the areas of accounts, payment transactions, credit initiation processes and cards within the framework of BaaS.

"The Finstar system was created in a unique collaboration between the technology and banking experts of a medium-sized Swiss regional bank (Ed. note: of Hypothekarbank Lenzburg, HBL). If bank-specific application questions arise during the sales talk with prospective Finstar services customers, we always bring in someone from the bank to answer them. It works because HBL is close to the Finstar product."

IBIS4D

IBIS4D, the core banking system that now belongs to aity (previously DXC), relies on a modular structure in which service containers group banking services. The open architecture allows collaboration with other platforms and the provision of platform functionalities. IBIS4D has its first multibanking experience in the area of business finance management. For BEKB, aity has developed a blockchain marketplace called SME|X for smaller public limited companies.

"IBIS4D is a compilation of decoupled applications and completely dispenses with mainframe and silo architecture. Thus, in the sense of best of breed, it allows the choice between in-house development and standard software."

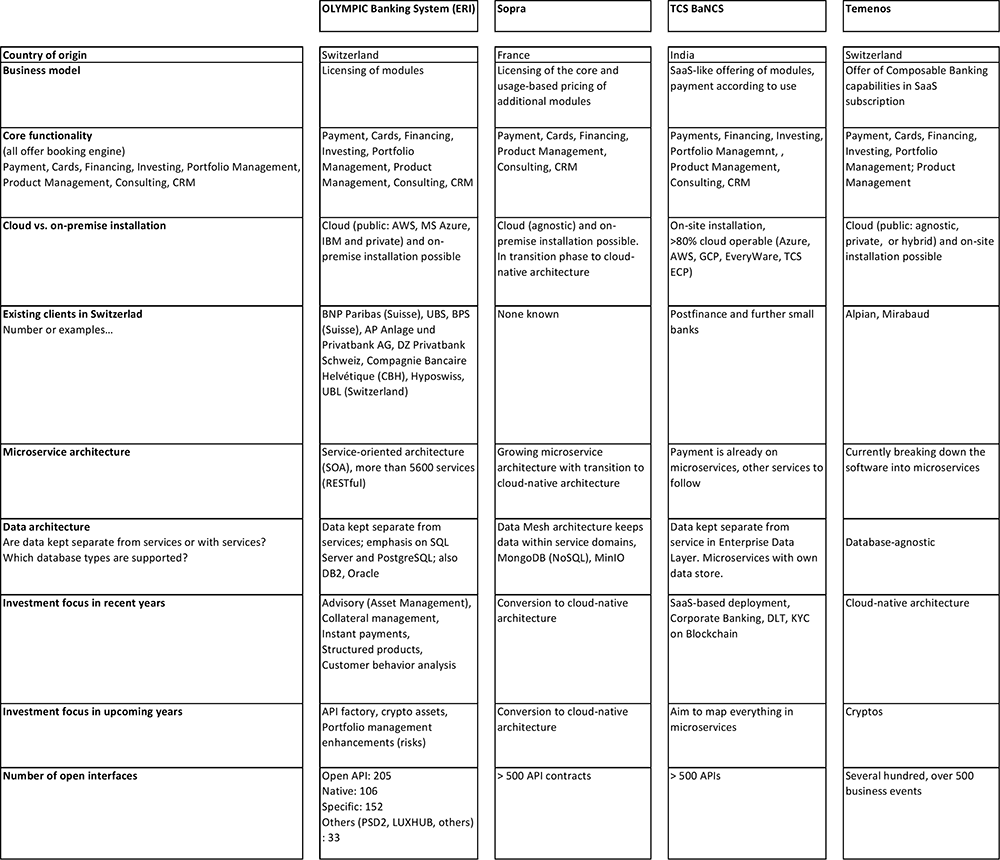

OLYMPIC Banking System (ERI)

OLYMPIC Banking System is a core banking system developed and sold by ERI to serve national and international private and universal banks. Coming from the classic licensing business, OLYMPIC Banking System is now also available to international banks as a SaaS offering. The service-oriented architecture around a grown core with over 5,600 services enables integration with other systems. For example, cryptos can be accounted for as assets. In the development of APIs, OLYMPIC Banking System adheres to industry standards.

"OLYMPIC Banking System runs in 65 countries, which is why, from a technological point of view, we do a lot of things differently to other providers. We provide banks with a comprehensive set of rules they can use to help design new financial products such as loans. If a bank can't build a specific product, we don't necessarily build the product specifically for them; rather, we improve the rules model so the bank can build the product itself."

Sopra

The French Sopra Banking Software is currently in the transition phase to a completely cloud-native architecture. In the course of the transformation, customers have the choice of remaining on the existing on-premise solution or gradually obtaining SaaS from the cloud. The core (booking engine and processing) of this new generation is standardised and not customisable, but it is cheap. Integrated peripheral systems and an open integration layer with partner marketplace allow customised functionalities to be added from the ecosystem.

"We want to help our customers automate as much as possible using artificial intelligence; in the area of credit checking, for example, that's a standalone cloud component."

TCS BaNCS

The core banking system of the Indian Tata Group claims to cover all functional requirements itself. The system has a high level of modularisation, is cloud-ready and offers a usage-based licensing model. In addition to banks, TCS BaNCS also counts insurance companies among its customers. The service area of numbers was most recently mapped in microservices; investing and financing are to follow. TCS has also invested heavily in distributed ledger technology and APIs.

"One in four people in the world has an account that is booked through TCS BaNCS. Our customers benefit from our global and regional presence and we meet local requirements through our strong capability to expand."

Temenos

Temenos offers Composable Banking, which

means that the bank puts together its individual solution by combining

functions from Temenos and so-called Exchange Partners. Each product defines

its own APIs (so-called open products). Individual modules can also be

integrated into existing system landscapes. The system runs on the cloud

(Temenos Cloud, private or public) or is installed on site, depending on the

bank's preference.

"When switching to a distributed system, banks place value on security, such as role-based access control. Security Everywhere is something we take very seriously."

Conclusion

Against the background of trends such as embedded finance and event-driven services, networking is becoming increasingly relevant.

Existing core banking systems are striving to catch up or not to lose out by investing in open interfaces and cloud capability, among other things. This is not easy due to their monolithic architectures, which have often grown over the years, and requires a realignment of the existing systems.

In addition to the gradual renewal of the infrastructure, it has been possible to see an increase in system optimisation and added specific services such as instant payment or cryptocurrencies. As part of the expansion of partnerships to support the customer journey, more and more functionalities are being developed outside the core, reducing the actual core's area of application.

All manufacturers are concerned with opening up their own systems, even if the degree of openness differs depending on the subject. Consequently, investment in an API management platform requires a clear positioning and the definition of one's own integration competence. For core banking system manufacturers, this means balancing or combining the following options:

Stage 1: Individual integration

Positioning as a provider without an integration platform that nevertheless coordinates API providers and consumers (fintechs and banks) and provides its own APIs for integrating into other platforms (BaaS services).

Stage 2: Integration platform

Offer a set of aggregated and combinable APIs on an integration platform (Finnova Open Platform or Swisscom Integration Layer).

Stage 3: API Marketplace

Provision of a platform or an API marketplace (via SIX bLink or Swisscom Open Business Hub, for example) where third-party providers can also place their services.

While the established core banking systems are catching up with technological developments, the neo-core banking systems, on the other hand, face the challenge of closing their functional gaps. It remains exciting to see which is easier and who will come out on top in this race in the medium term.

The Core Banking Radar continues to monitor and analyse developments in the core banking market in Switzerland. A future article will bring together the key factors for banks and core banking system manufacturers in the success of structuring a transformation.

Articles already published since 2019

- SolitX: Smart Financial Contracts als neuer Ansatz der Systemunterstützung für Banken (erschienen 11. November 2019)

- "The satisfaction of banks with their core banking systems: An area of tension?" (published 10 July 2020)

- «Mambu - a new generation of core banking system manufacturer relies on SaaS» (published 12 January 2021)

- From Modularbank to Tuum – a core banking system that's not only for banks (published 9 December 2021)

- Vault Core – a hyper-configurable neo-core banking system from Thought Machine (published 16 March 2022)

- Neo Core Banking Systems and their importance for the IT Architecture of the future (published 16 August 2022)

Business Engineering Institute St. Gallen

A long-term partnership exists between Swisscom and the Business Engineering Institute St. Gallen (BEI) within the “Ecosystems” Centre of Excellence. This centre deals with topics such as eco-systems, digitisation and transformation, as well as other issues relating to the structure of the financial industry in the future. In addition to its research activities, the BEI carries out projects related to the design and implementation of innovative, cross-sector business models.

Core Banking Radar methodology: https://ccecosystems.news/core-banking-radar-methodik/

https://ccecosystems.news/anwendungsbeispiel-referenzmodell-vom-bankmodell-zum-core-banking-radar/