What experts expect from a next-generation banking platform for 2030 and beyond

In cooperation with the Business Engineering Institute St. Gallen (BEI), Swisscom’s Core Banking Radar has been monitoring banks’ system support services since 2017 and analysing the most relevant systems for the Swiss market using a comprehensive assessment model. This article looks at the requirements of a next-generation banking platform (NGBP).

08.12.2025, Text: Christine Popp, Business Engineering Institute St. Gallen AG, Thomas Zerndt, Business Engineering Institute St. Gallen & Clemens Eckert, Head of Product Line Banking, Swisscom 12 min

Abstract

This analysis summarises the results of a survey of 25 IT managers from Swiss banks as well as in-depth interviews with six experts. The aim was to provide a clear picture of the expectations and requirements for an NGBP for 2030 and beyond. The NGBP is understood as the entire technological foundation that enables a bank to remain relevant and create added value in a connected world. The responses, collected in summer 2025, originate from representatives of various types of banks, including cantonal banks, regional banks, universal banks and private banks. The results show a strong consensus on a fundamental transformation: moving away from monolithic, closed systems towards open, modular, data-driven and AI-based ecosystem platforms. This article breaks down the findings into three main areas: customer interaction, data and service integration, and IT system design.

Introduction and methodology

Many of the core banking systems currently used by Swiss banks were introduced more than twenty years ago. Since then, neo-core manufacturers with state-of-the-art technologies have appeared on the market, but have not yet succeeded in establishing themselves in Switzerland. The rapid development of technologies continues; in banking applications, however, advances in user interaction seem to be overshadowed by complexity. As a result, banks are increasingly being forced to fundamentally review their technological foundation and think about the future design of the next-generation (2030 and beyond) IT banking platform.

We define the next-generation banking platform (NGBP) as ‘everything the universal bank will need in future in terms of functional IT support’.

To specify the requirements, a qualitative survey with 32 questions was first conducted among 25 IT managers from various Swiss banks (including representatives of major banks, cantonal banks and regional banks). In a second step, the results of the survey were reflected upon and refined in interviews with the following six experts (listed in alphabetical order):

Clemens Eckert (Swisscom), Claus Hintermeier (ZKB), Simon Kauth (LUKB), Falk Kohlmann (SGKB), Oliver Kutsch (BEI SG), Wolfgang Mair (LLB).

The same interview questions were also posed to an artificial intelligence system (Google Gemini).

This article evaluates the anonymised survey data, identifies key trends, points of consensus and dissent, and consolidates the results into a coherent picture of the NGBP.

The analysis is structured thematically according to the main question blocks in the survey:

- Customer interaction

- Data and service integration

- Design of the IT systems

Due to the sample size of 25 participants, this study does not claim to be statistically representative. However, it does provides a sound, qualitative snapshot of the expectations and visions of professionals at the forefront of the digital transformation of banking.

Results

Customer interaction

According to the survey, the key topics for further developing the business model in the interests of customers are the integration of services into the customer journey, the targeted use of artificial intelligence, the redesign of digital channels and the merging of user interfaces.

The bank as an integrated everyday companion

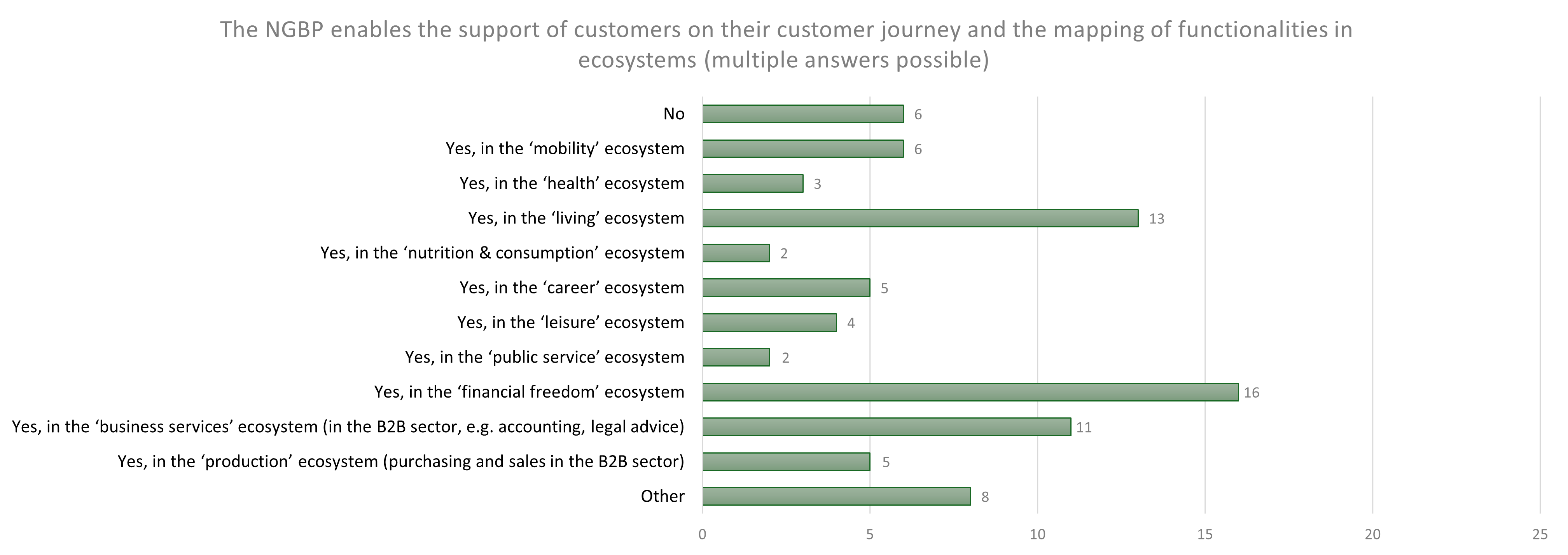

The survey shows a strong tendency to expand the role of the bank beyond traditional financial services. A clear majority expects the NGBP to enable the support of customers throughout their entire ‘customer journey’, facilitating integration into different areas of life – so-called ecosystems. The areas most frequently mentioned were ‘living’, ‘financial freedom’ and ‘business services’ (in the B2B sector, e.g. accounting, legal advice, etc.). This underscores the expectation that banking transactions will in future be seamlessly integrated into broader contexts such as real estate purchases, retirement provision and corporate governance. In the ecosystems of health, nutrition & consumption and public service, only a minority of respondents expect the integration of services in such a way.

Figure 1: ecosystems supported by the NGBP

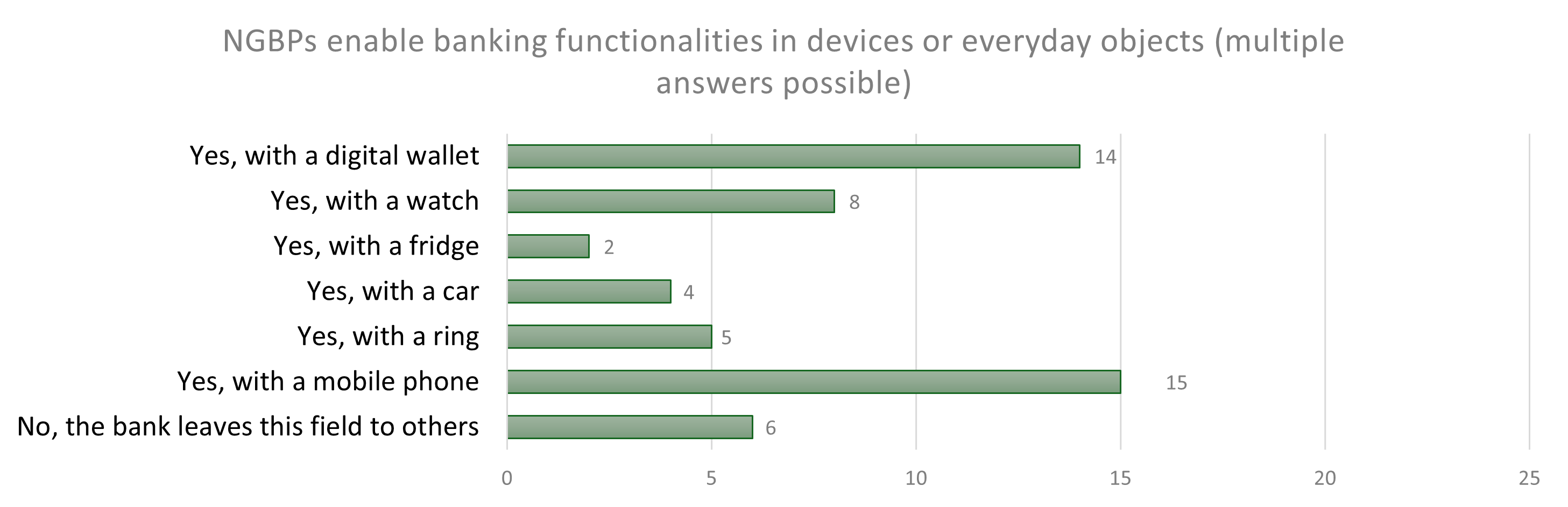

Less common is the expectation to integrate banking functions into everyday objects beyond smartphones. While payments and other banking functions via smartphone, digital wallet (payment app that stores cards for everyday shopping and is linked to e-banking) or smartwatch are considered established, the attitude towards more far-reaching integration (e.g. in cars or household appliances) is very cautious. Several participants suggested that banks should leave this field to specialised technology providers.

Figure 2: devices and everyday objects supported by the NGBP

The digital wallet will become increasingly important and could potentially expand into a central hub for identity and assets, although comprehensive standards and a high level of IT security are crucial here. The e-ID is considered an important security and convenience feature that is necessary for certain services and supports the development of new of new ecosystems. Smartphones remain the dominant device for customer-bank interaction, while other devices such as glasses and fridges are regarded as niche products and development in this area is slow.

Summary of the opinions of the experts that were interviewed

Artificial intelligence as a driver of efficiency and personalisation

The use of artificial intelligence (AI) is seen as a decisive factor for the future viability of banks. For the institutions themselves, the main focus is on efficiency gains and improving the customer experience. AI is intended to optimise processes and help provide faster and more tailored services. Autonomous AI decisions, particularly when it comes to risky processes such as lending, are viewed with caution, also with reference to regulatory hurdles such as the EU AI Act.

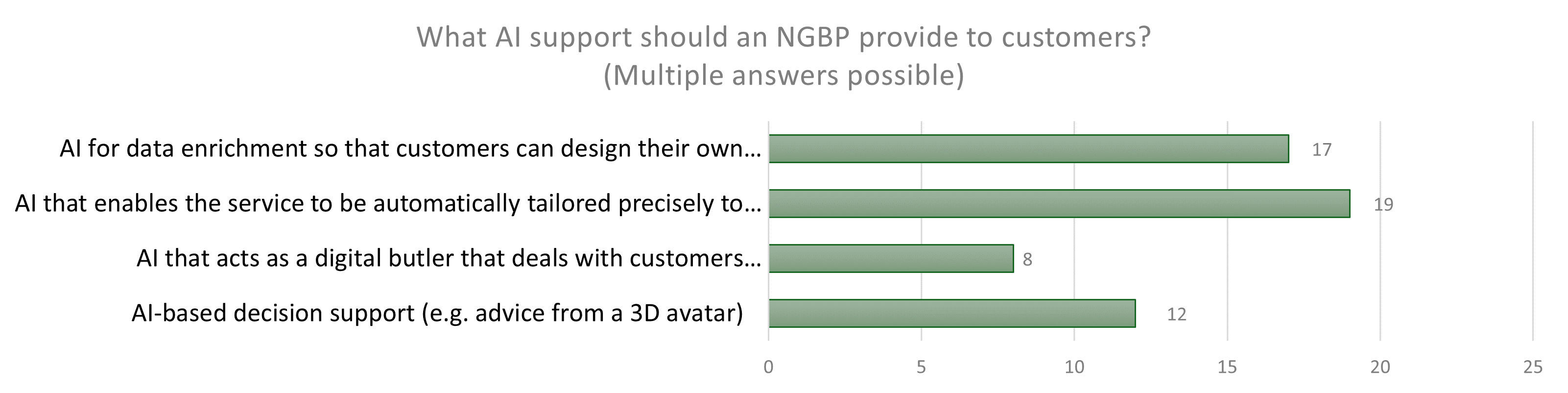

From the customer’s point of view, AI should primarily contribute to personalisation. The most frequently mentioned requirement is an AI system that makes it possible to ‘automatically tailor the service precisely to the customer’. Enabling customers to design their own services through data enhancement is also highly regarded. AI is seen as a tool for strengthening customer autonomy and creating a personalised banking experience, for example through digital assistants or advisory avatars. Only a handful of people expect AI to take the form of a digital butler that deals with customers independently of their banks.

Figure 3: AI support for customers used by the NGBP

The future of the digital customer channel

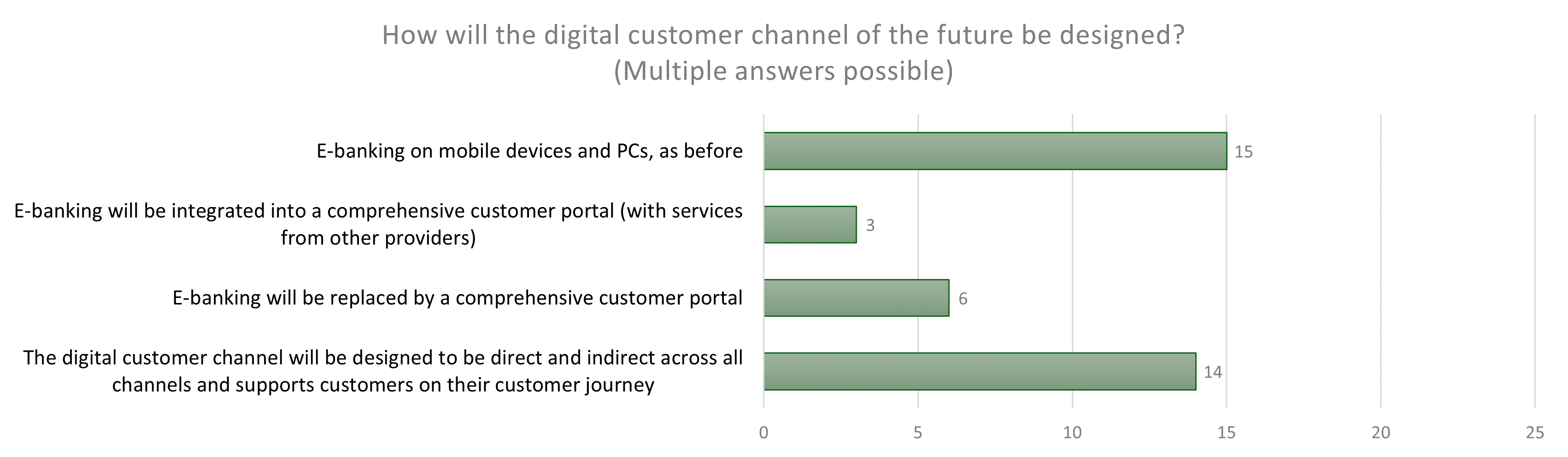

The outlook for digital access in the future is mixed. Although traditional e-banking on mobile devices and PCs will continue to play a role, almost as many respondents expect a cross-channel, integrated customer experience in the future. Interaction with the bank should no longer be limited to an app or website, but should take place directly (interaction with the bank) and indirectly (integrated with partners, visible or invisible to customers) wherever the customer needs it. However, only a minority expect a comprehensive customer portal for the entire customer relationship, with features such as product management across all divisions (including integrated services), multi-banking capability (integration of accounts from other banks), budget tools and self-service, e.g. for making appointments.

Figure 4: design of the digital customer channel in the NGBP

An indispensable new infrastructure technology that is highly valued by banks, AI is ‘here to stay’. The real power lies less in the current language models (LLMs), but more in the far-reaching potential of machine learning, whereby internal use to increase efficiency offers the greatest potential.

A digital butler that takes over certain automated tasks is conceivable, but the principle of ‘human in the loop’ will always be applied when making important decisions. AI prepares decisions for customers and customer advisers; for complex issues such as financial advice, however, personal consultation remains the norm.

Summary of the opinions of the experts that were interviewed

When it comes to the use cases of the digital channel for residential customers that an NGBP should support, multi-banking, personal finance management (PFM) and the aforementioned ecosystem services are especially popular in addition to standard services (payment transactions, mortgages, investments). The same applies to corporate customers, where there is also a high demand for functions such as dynamic credit line monitoring and invoice tracking.

Mobile banking and existing e-banking channels will remain an important and secure access point in the future. The type of interaction is headed strongly in the direction of complete personalisation, which agentic banking and voice-controlled AI interfaces support. Embedded or invisible banking, in which banking services are integrated into topic-specific ecosystems and the customer journey via APIs, is becoming dominant.

Summary of the opinions of the experts that were interviewed

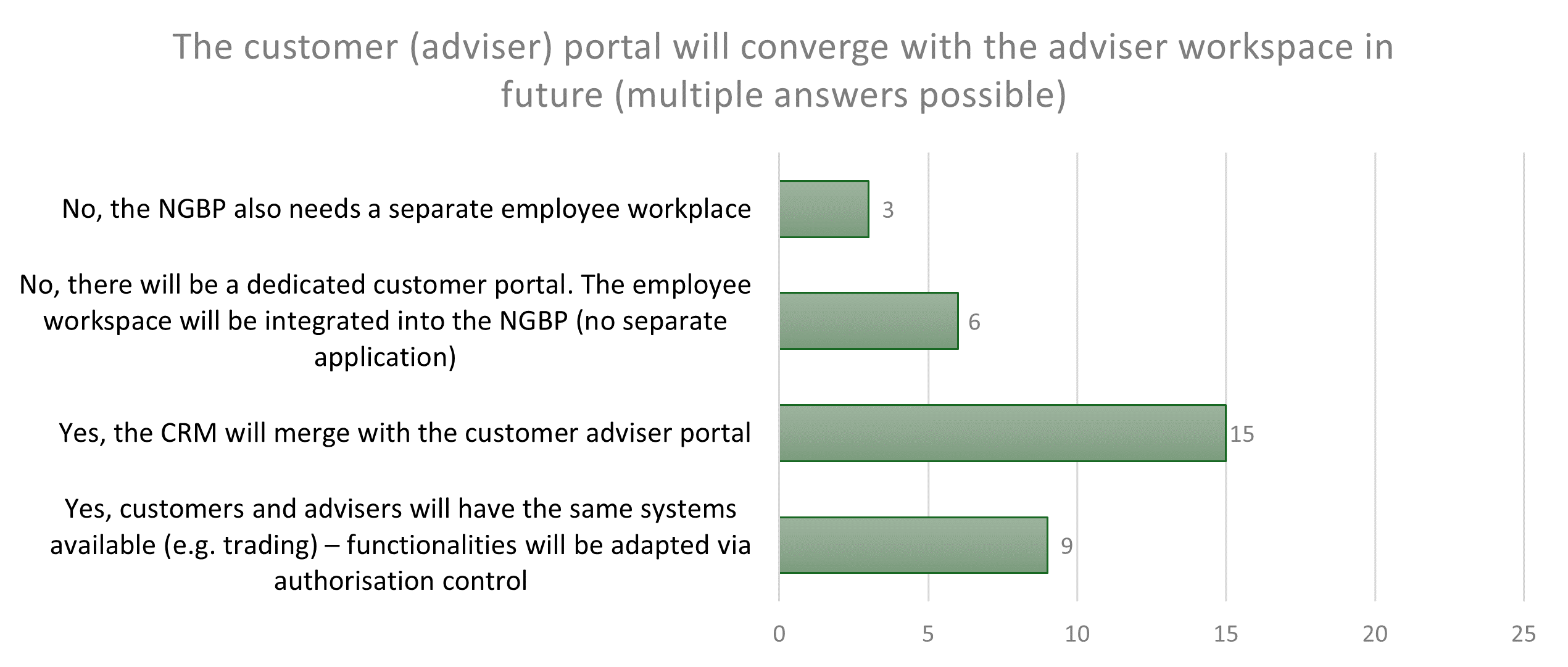

Interfaces: convergence of customer and adviser portals

Some respondents were in favour of a uniform solution where customers and advisers – controlled by permissions – access the same systems in order to promote transparency and collaboration. A slightly smaller group advocated for dedicated, separate systems, as the requirements and complexity of the tasks were too different for employees and customers.

Figure 5: convergence of customer portal and adviser workspace

There is broad consensus on the requirements for the user interface (UI). A future interface must be responsive, customisable and role-based. An integrated dashboard for the relationship manager is expected as standard. Almost all participants consider the combination of the graphical interface with AI-supported voice and text input to be essential, which points to more intuitive and dialogue-oriented interaction in the future. However, a graphical user interface will still be necessary; only a minority believe that the NGBP user interface will work solely with speech recognition and prompting.

Data and service integration

Banks’ business models are becoming increasingly interconnected, which is also reflected in how banks will strategically open up, use data and leverage new technologies such as quantum computers in the future.

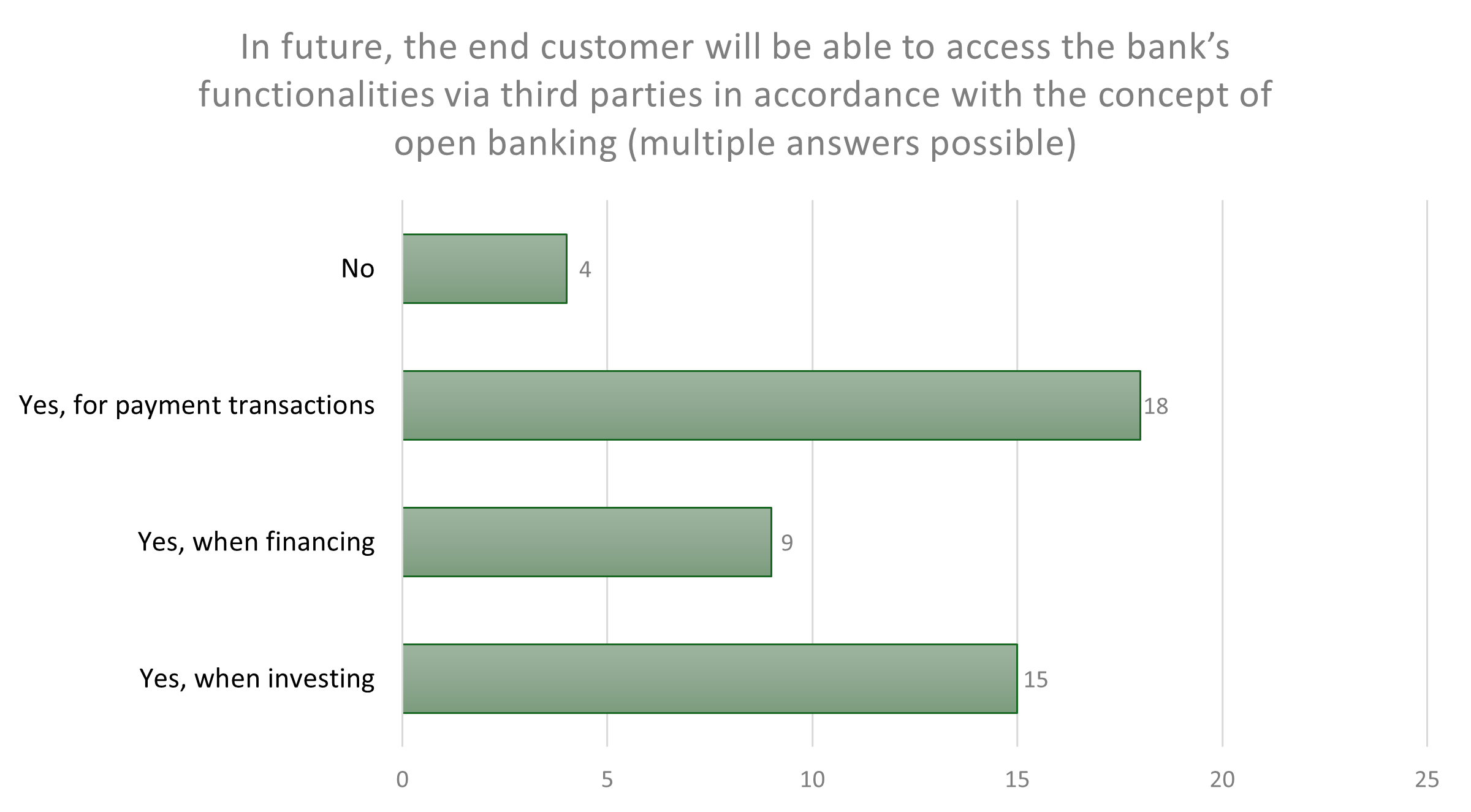

The era of open banking: strategic rather than totally open

The integration of third-party providers and fintechs is seen as essential for a modern banking platform. The survey shows that the greatest need for such integrations is seen in the areas of customer relationship management (CRM), portfolio management, e-banking, compliance & fraud and card management. This suggests that banks want to make targeted use of external innovations to improve core processes and enrich the customer experience.

Figure 6: third-party access to bank functionalities

At the same time, the concept of open banking, whereby end customers access banking functions via third parties, is viewed pragmatically. Support is highest in the areas of payment transactions and investments, and somewhat lower for financing. This reflects an attitude of strategic openness: interfaces will be opened up where there are clear customer benefits and business models. Simple open access for end customers via third parties is not envisaged, and the mandatory approval of third-party providers (TPPs) is also viewed critically – the banks do not want to relinquish control.

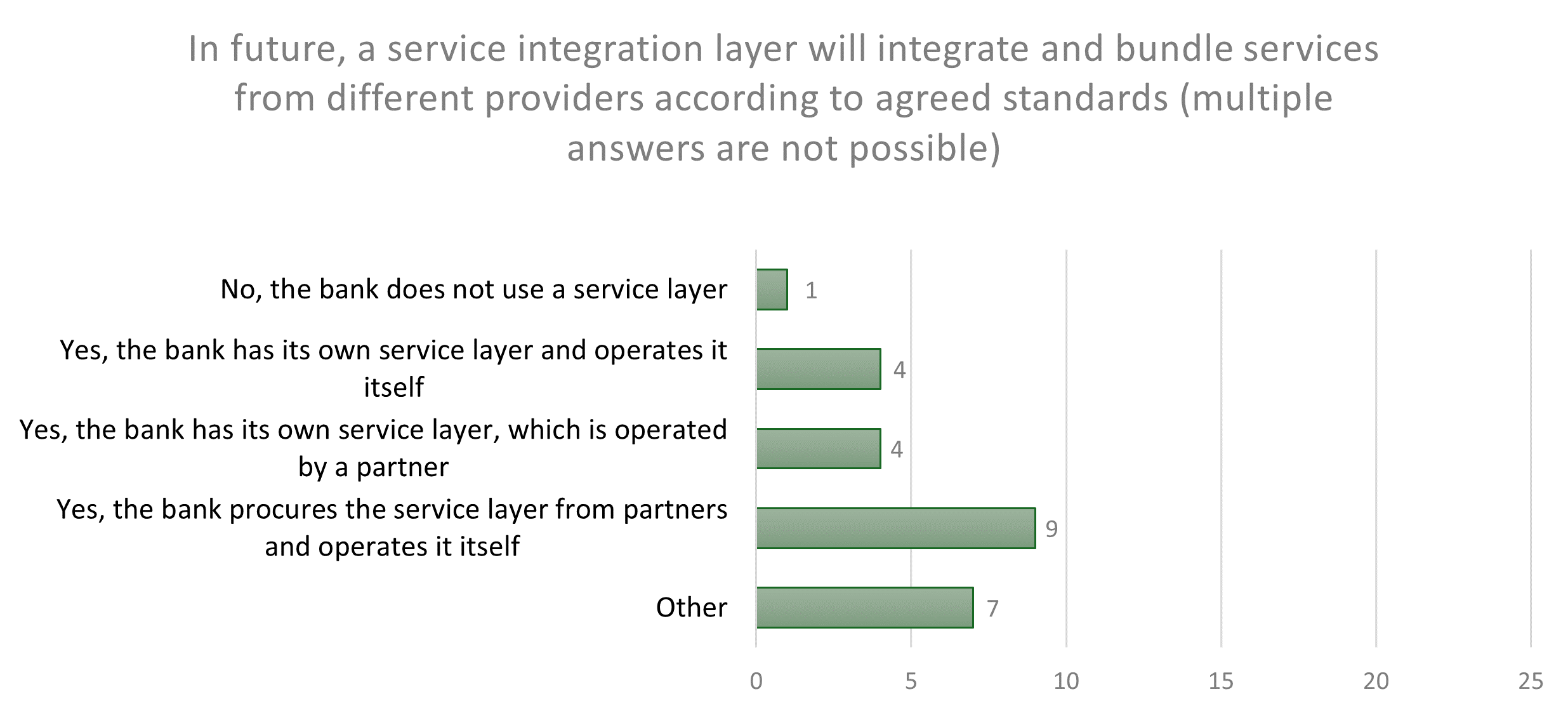

The service integration layer as a central hub

In order to manage the complexity of the connected internal and external services, there is broad consensus on the need for a service integration layer. This central layer is designed to bundle services from different providers and orchestrate them according to uniform standards. What is interesting, however, is the variety of operating models envisaged: the answers range from in-house operation to operation by a partner to the complete procurement of the layer as a service from a third party. It was also mentioned several times under ‘Other’ that there is no single best option here, but rather that the choice of model depends heavily on the individual IT strategy.

Figure 7: operation of a service integration layer in the NGBP

Business intelligence: the engine that drives data-driven banking

The use of data through business intelligence (BI) has been identified as a key lever for future viability. The most frequently selected, desired use cases for BI in an NGBP were:

- A 360-degree customer view: the targeted use of customer data for proactive and personalised support.

- Data-driven banking: supporting internal decisions to increase efficiency.

- Risk management and fraud detection: the analysis of data for credit assessment and anomaly detection.

Within the scope of BI, respondents expect an NGBP to support use cases such as customer data management, product performance management (revenue and costs per product, transaction volume per channel, etc.) and predictive analytics (credit defaults, scenario simulation for economic downturns or interest rate changes).

To achieve these goals, respondents are relying on modern BI approaches. First and foremost is self-service BI, which enables business users without in-depth IT knowledge to carry out analyses independently. This promotes a data-driven culture throughout the company. In terms of technology, the trend towards cloud-based and hybrid BI platforms (e.g. with a central data lake that enables comprehensive data analysis) is confirmed, offering scalability and cost advantages. In future, data sources will not only include data from our own applications, but increasingly also publicly available data and – with explicit consent – data voluntarily shared by customers and partner companies.

Data management as an indispensable foundation

Across all topics, there is overwhelming agreement on the importance of robust data management. Functions such as data lifecycle management and an operational data store are considered ‘very important’ or ‘important’. This underscored the awareness that advanced data analysis, data quality and compliance with regulatory requirements (e.g. targeted deletion of data) are only possible on a neatly managed and well-structured data foundation.

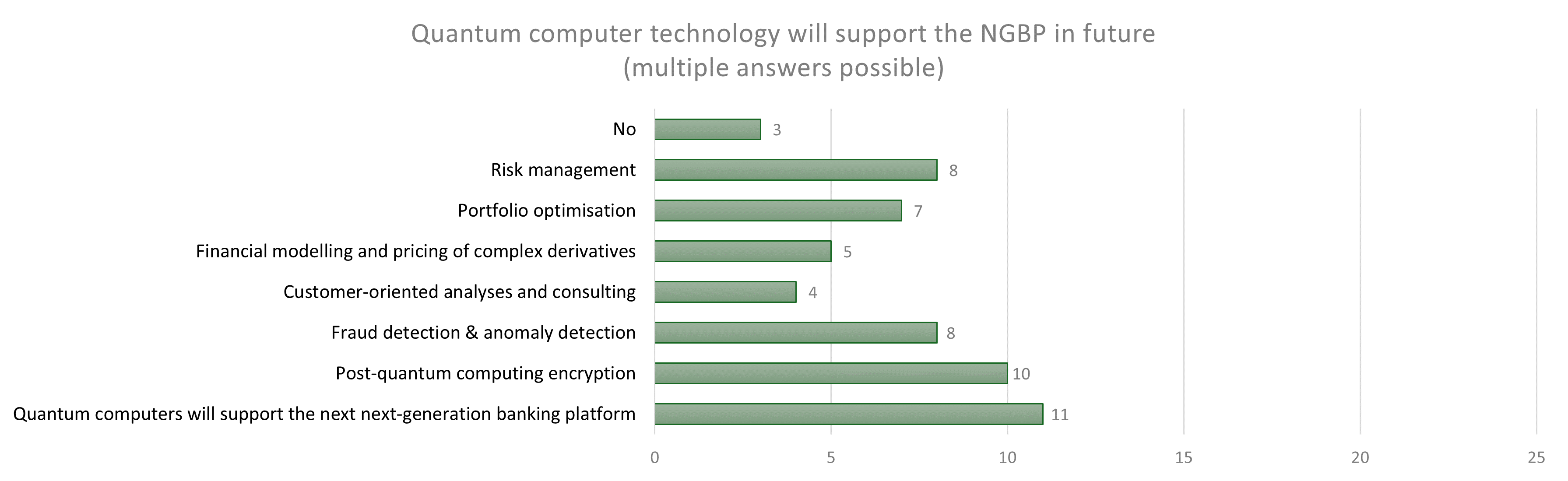

Quantum computing: dreams of the future with security-related potential

The role of quantum computers is widely seen as an issue for the future. A large number of participants believe that this technology will provide significant support only for the next next-generation banking platform. Its impact on the NGBP of 2030 and beyond is estimated to be low. The potential application scenarios are mainly in the management of highly complex computing operations such as risk management, fraud detection and portfolio optimisation. However, respondents see an immediate and urgent application in the field of cybersecurity, specifically in post-quantum cryptography, in order to secure data against future threats today.

Figure 8: support by quantum computers in the NGBP

Quantum computers represent a real risk, which, due to the potential decryption of today’s data, requires immediate action to ensure quantum resilience through post-quantum cryptography (PQC). This is despite the fact that useful application scenarios for quantum computers are still lacking and significant benefits are not expected until after 2035. Banks have to work with their technology providers now to build up inventories and secure their core banking systems, as the keys are not quantum-secure. The technical implementation is mainly carried out by the providers.

Summary of the opinions of the experts that were interviewed

Design of the IT systems

Analysis of the survey on the technical design of the NGBP shows an accelerated awareness of the need for new strategies (see also three strategies in this article), whereby, according to the survey, a closed core (strategy core) will be significantly inferior to the two other strategies (front-to-back and modular).

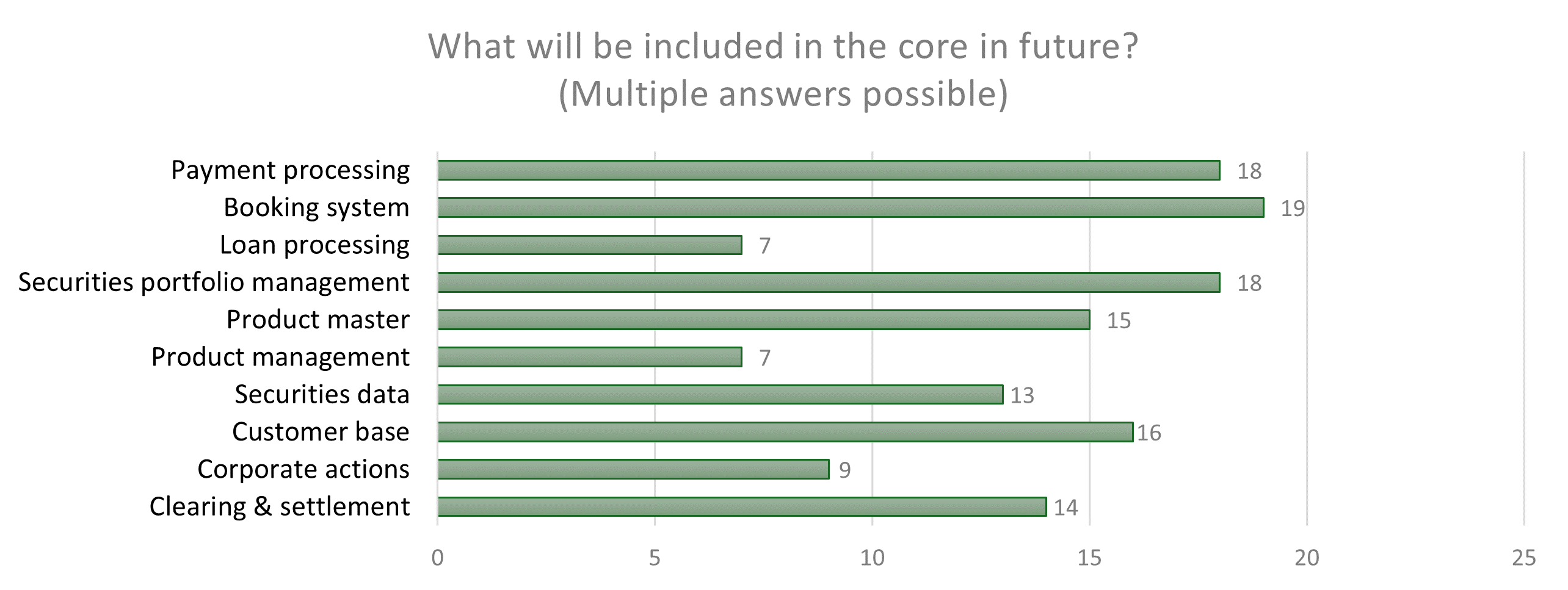

The core of the future: lean, stable and reduced to the essentials

The era of all-encompassing core banking systems is coming to an end. The survey results indicate a consensus that the ‘core’ of the future will be reduced to its essential functions. These undoubtedly include the booking engine for items that can be included in the balance sheet (general ledger) as a ‘single source of truth’ and customer account management with all transactions and securities account management (subledger).

Figure 9: core functionalities of the NGBP

The scope of the core will be reduced to a booking system with banking-specific features such as product and customer master data, payment transaction processing and securities account management. Workflows for loan processing, product and portfolio management are increasingly being separated from the core and integrated via APIs. The term ‘core’ and the operation of existing systems will remain in use for a long time to come. Banks modularise and fractionate their architecture themselves, thus maintaining their ability to make independent decisions and actively control their dependencies on the providers.

Summary of the opinions of the experts that were interviewed

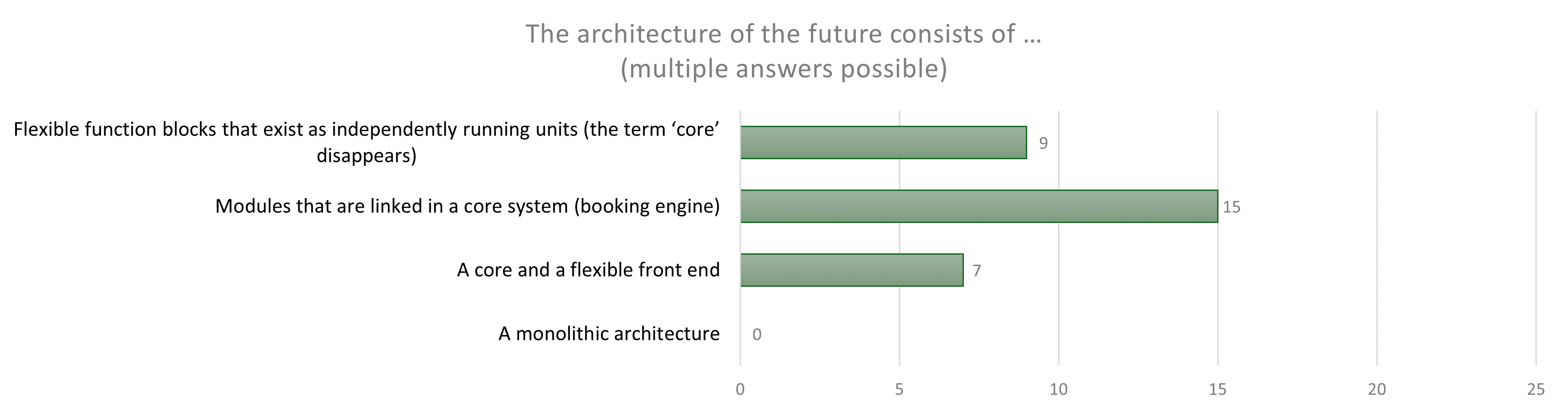

Architectural fork in the road: modular core or decentralised services?

Opinions differ when it comes to future architecture, even though the trend is clearly moving towards modularity.

- Model 1: the modular core. The majority of respondents favour an architecture consisting of modules linked to a booking engine. This model represents the further development of current systems, offering more flexibility without abandoning the concept of a central anchor.

- Model 2: decentralised architecture. A forward-looking minority envisages an architecture consisting of flexible, independently running functional modules in which the concept of the ‘core’ disappears altogether. This concept, which relies heavily on microservices and decoupled systems, promises maximum agility and scalability.

Figure 10: architecture of the NGBP

Regardless of the model chosen, one thing is clear: the future is modular. The monolithic ‘all-in-one’ solution has become obsolete.

The real-time imperative: a new standard prevails

The demand for real-time data processing is overwhelming, especially considering that banks are still a long way from achieving this today. A large majority of participants consider it imperative that transactions, positions and valuations are processed in an NGBP without delay, with real-time simulations also considered crucial. Although there are isolated individuals that still consider batch processing to be sufficient for certain processes (e.g. end-of-day portfolio performance reporting), the standard for customer-related and transactional processes should clearly be real time.

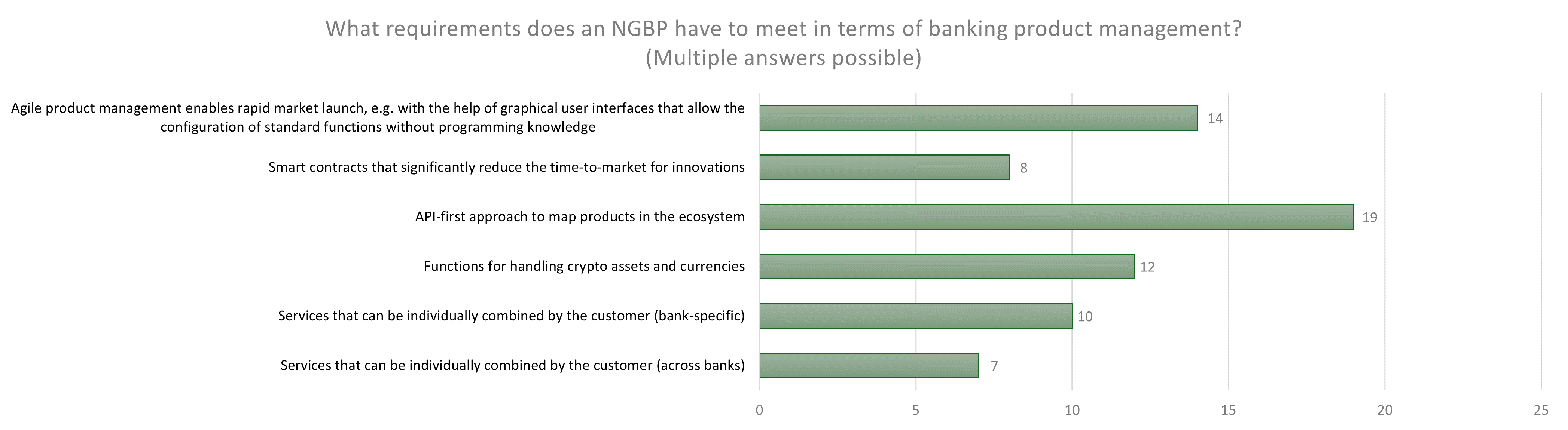

Product management: agility, APIs and crypto assets

The most frequently mentioned requirements for increasing the speed of innovation are an API-first approach, agile product management with low-code/no-code and support for new asset classes such as crypto assets.

Figure 11: product management requirements in the NGBP

The consistent development of interfaces (APIs) is a prerequisite for the seamless integration of products and services into ecosystems (see The bank as an integrated everyday companion). Banking professionals should also be able to configure products themselves using graphical interfaces, without the need for complex programming work.

Crypto assets as a separate asset class are establishing themselves as a permanent feature of future banking services. CBDCs (central bank digital currencies) and digital stable coins are expected to gain traction, both for investment and settlement purposes. In order to treat digital assets such as Bitcoin appropriately and fully integrate them into investment processes, we need new valuation models.

Summary of the opinions of the experts that were interviewed

The ability to manage crypto assets and currencies is seen by many as a new standard requirement for a future-proof system.

Less than half of respondents expect customers to be able to assemble their own services independently from a modular system – both within and across banks.

Conclusion

Analysis of the requirements of IT managers at Swiss banks for the next-generation banking platform (NGBP) for 2030 and beyond in terms of the overall functional coverage for a bank shows an expected transformation in all three main areas – customer interaction, data and service integration, and IT architecture design.

When it comes to customer interaction, the future customer interface will be dominated by two main trends. Firstly, embedded or invisible banking is becoming increasingly important, whereby banking functionalities are no longer just offered via dedicated channels, but are seamlessly integrated into the customer journey. The bank acts as an invisible but trustworthy everyday companion. Secondly, artificial intelligence (AI) will play a key role in interaction. AI is used not only to increase efficiency, but also to create a more intuitive and highly personalised user interface that enables customers to tailor services precisely and automatically to their individual needs. In future, customers themselves will become part of the service design. The merging of graphical interfaces with AI-supported voice and text input is becoming standard. Smartphones and digital wallets will serve as central devices supporting integration into the customer journey.

At the same time, banking IT experts recognise the need to strategically open up their business models. The focus is on the targeted use of external innovations to improve core processes and enrich the customer experience. However, this process of opening up is deliberately strategic and controlled for each service area: payments, investments and financing. Although banks are willing to open interfaces (APIs) for partners in order to integrate services, they are not pursuing a completely open approach. The aim is to ensure control over data and to improve the customer experience directly or indirectly (embedded) in line with service requirements.

Data and service integration: to manage the complexity of these networked services, a central service integration layer is essential and serves as a hub for orchestrating internal and external services. This is the prerequisite for ensuring a 360-degree customer view, implementing data-driven banking and comprehensive risk management.

Design of the IT architecture: the future IT architecture must ensure the agility and interoperability required by banks. This leads to a shift away from monolithic structures towards modular design. The ‘core’ of the future will be functionally reduced and will primarily serve as a ‘single source of truth’ for items that can be included in the balance sheet (general ledger), and customer account management and securities account management (subledger). Other functionalities will be outsourced. The future IT architecture will consist of flexible, independently running interoperable functional modules. Nevertheless, in line with economic logic and in order to avoid increasing complexity, purchases from core banking system manufacturers will not necessarily be rescaled. The customer interaction front end will be more functionally comprehensive than the core, with a focused booking engine for processing regulatory data from transactions and the general ledger for accounting purposes.As part of the Core Banking Radar, we will explore the key components of an NGBP in greater depth in future articles and outline the future architecture.