From Modularbank to Tuum – a core banking system that's not only for banks

Developed by former bankers and IT specialists in Estonia who had already been working together on core banking systems for years, Tuum combines an API-first approach with the goal of offering not only the core but also complete banking functionalities where possible. Its financing functions are used not only by banks but also by customers in other industries.

Text: Christine Popp, Images: Wendy Buck, Zense GmbH, 09. December 2021 13 min.

In cooperation with the Business Engineering Institute St. Gallen (BEI), the Core Banking Radar of Swisscom has been monitoring the system support of banks since 2017 and analyses the most relevant systems for the Swiss market using a comprehensive assessment model(opens in new tab).

After Leveris, SolitX and Mambu, this article describes Tuum, a fourth neo system that is striving to enter the market, and discusses how this system reconciles standardisation, modularity and internationalisation in the process.

Introduction – from traditional licensing solutions to the cloud

Established core banking systems work and provide stability, but the introduction of new products and functions can take a very long time. This also means banks that want to offer new services to their customers quickly will need to look at neo core banking systems, which enable much faster product launches. Neo core banking systems will typically be cloud native, feature a modular structure and will be built around a microservices architecture, whilst pursuing an international SaaS strategy.

One area of tension that arises with pure SaaS (Software as a Service) solutions in the cloud is that the SaaS provider must provide a high level of standardisation in order to achieve the desired economies of scale and therefore highly competitive prices.

In contrast to customised solutions, this means for SaaS customers that they will hardly be able to influence the roadmap of the products to be developed by the core banking system manufacturer. In particular, specific needs such as those related to "helvetisation" (process-related particularities in financing, payments or investment products for example) must therefore be solved by SaaS customers with peripheral systems or limited parametrisation based on standards.

It is true that interface concepts are changing towards open architectures in order to enable flexible alignment with a bank's needs. However, complexity also increases with integration.

Against this background, the question arises regarding the neo systems: can they really be a solution for banks in Switzerland? Using the specific example of Tuum, we would like to deal with possible answers to this question.

Origin and structure of Tuum

Estonia, which became independent in 1991 and therefore had to be built up from scratch, is now a digital society thanks to the lack of legacy issues. The vast majority of transactions, signatures and tax returns are done online.

The five-member founding team of Tuum, including banking experts, IT specialists and entrepreneurs, had already been working side by side in the management team of Icefire for eight years before Tuum (then Modularbank) was founded. The former was a Nordic consulting and development company co-founded by Vilve Vene, now CEO of Tuum, which had built core banking infrastructures for 15 banks since 2002 and which was sold by the founders to Checkout.com in January 2021.

In summer 2018, the founding team, also driven by customer input, decided to put their knowledge into their own platform and started their first sales talks. In January 2019, they registered the company Modularbank and gained their first customer, a lender operating in 23 countries.

In the first two years, they financed the company and the products with their own cash flows; the first round of late seed financing was dealt with in November 2020.

The name Modularbank soon turned out to be deceptive, because many of the interested parties are not banks but, for example, companies from the retail or energy supply sectors that want to offer loans to their customers. For this reason, the young company changed its name to Tuum, which means "core" in Estonian, at the end of September 2021. This underlines the company's ambition to stand for a versatile core (banking) system.

Tuum now has around 70 employees in Tallinn, Berlin, London and Malaga, and this number is growing rapidly.

As the original name suggests, Tuum offers loosely coupled functionality modules that can be combined or used individually depending on the needs of the customers (e.g. card management, credit suite, ...). In doing so, Tuum strives to offer customers solutions that are as complete as possible with many banking functions on an intuitive user interface. Programming skills on the customer side are only needed for the integration of additional, non-bank-specific functionalities (e.g. CRM) via the open API interfaces. The system, which is based on microservices, can run on the cloud as well as on-premise.

A key principle of Tuum is the architectural strategy, which is to leave the platform open and as extensible as possible so that any kind of partner can be connected via plug-n-play while, at the same time, supporting a wide variety of future use cases.

What differentiates Tuum as a neo system is its planned coverage of as many banking functionalities as possible, as well as its market positioning with non-bank customers in the form of "embedded finance use cases".

Prominent features of Tuum

Customer structure and market positioning

Tuum currently has up to 200 users from different companies: universal banks, global lenders, fintechs, neo banks, platform providers like Nets, but also SMEs from other industries.

One of the largest card processors in Europe, the Danish company Nets(opens in new tab), which recently merged with Nexi from Italy, relies on Tuum's card management system to issue both physical and virtual cards.

Finland's largest universal bank processes all of the financing activities through Tuum, while other service areas continue to run through the legacy core banking system. According to Tuum, the successful integration of the modern neo system into the existing architecture required about 150 integrations (booking engine, treasury, scoring systems, payment gateways, ...).

Thanks to its embedded finance use cases, where financial tools or services are used by non-financial providers, Tuum is also positioning itself in other sectors. Tuum's banking core module, for example, processes the transactions of the 700,000 registered loyalty card users of a Nordic retail group and allows the allocation of an overdraft limit, which customers can repay by invoice at the beginning of the month.

Tuum has just signed a contract with a Geneva-based licensed payment institution to support cross-border transactions in multi-currency wallets, payments and foreign exchange through Tuum's Banking Core, Payments Module, Banking Circle and Currency Cloud Connector.

Tuum conducts its business with (prospective) Swiss customers through its operations in Berlin, from which it also services the wider DACH region. "Helvetised" or specific Swiss modules have not yet been implemented.

Tuum's individual modules for non-bank customers (embedded finance use cases)

Functionality of Tuum

In 2021, the functional scope of Tuum covers the areas of account management, payment transactions, deposits and financing for both private and corporate banking.

In the area of payments, Tuum covers different payment methods (cards, SEPA, SWIFT). In addition, it supports e-wallets as well as the exchange of data storage media for the secure transmission of payment data between companies and banks directly via ERP.

Tuum supports standard financing services such as loans and mortgages. Collateral postings and allocation of the collateral to a specific loan, including determination of the percentage rate and validity as well as the review of existing debts, are also possible. In addition to this, business loans can be obtained from Tuum, and investment loans and syndicated loans should be added before the end of 2022.

Functionalities in the area of investing should be introduced in Q3/2022 at the latest, or perhaps earlier depending on customer demand. Tuum is also working on the introduction of digital assets as the company is convinced that they will play an increasingly important role in the future.

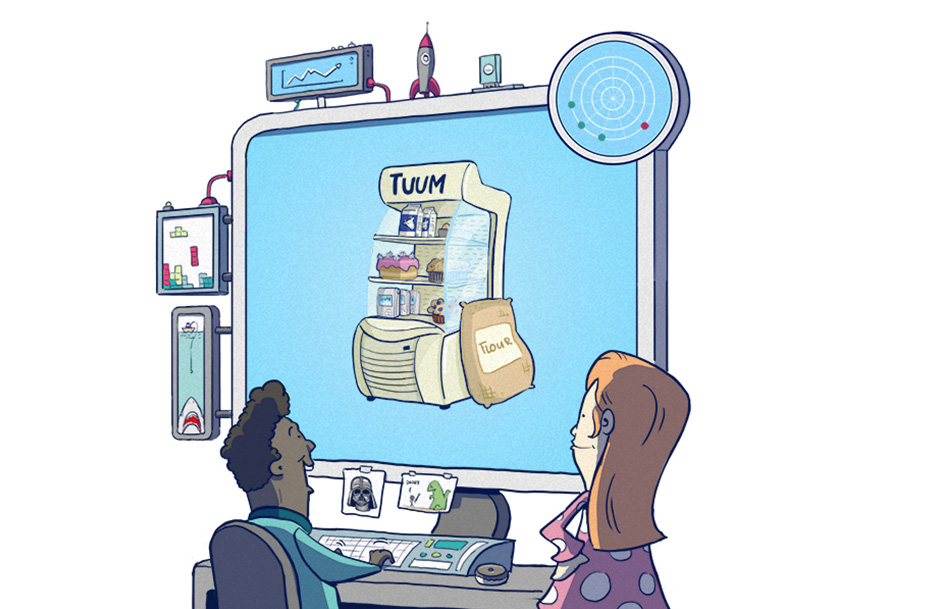

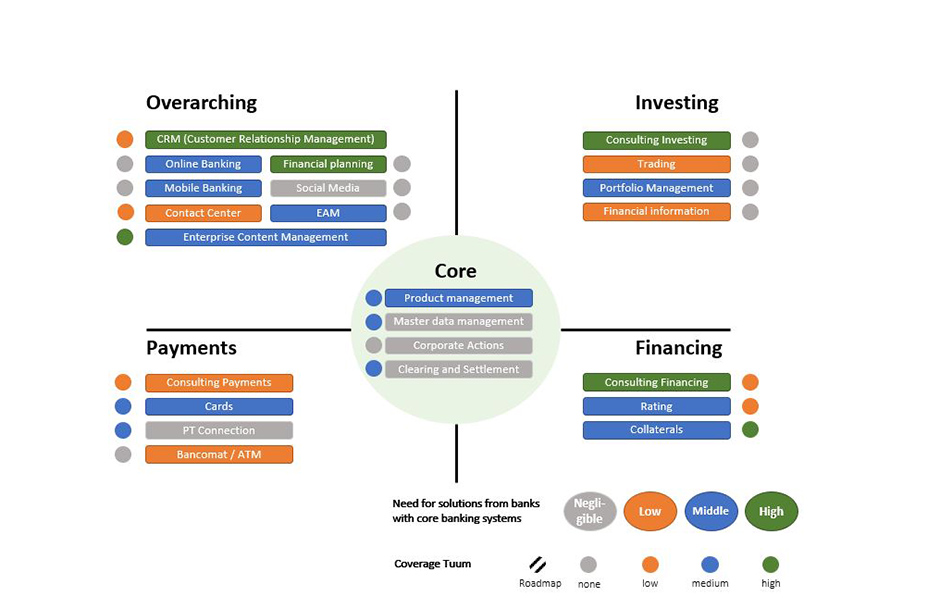

Functional and non-functional coverage of Tuum in the payment and financial service areas

To a large extent, Tuum allows the entry, release and checking of payments and foreign exchange orders as well as their processing (triggering, booking, determination of payment route).

In account management, order management is workflow-supported. In its process orchestration module, which is based on the open source platform Camunda, Tuum provides its customers with predefined processes for the licensed functionalities and also orchestrates call-outs, for example, to verification systems, KYC or AML (anti-money laundering) solutions. In document management (enterprise content management), it is possible to store templates in the system, dynamically populate them with data from processes, transmit them via adapters to key output systems (e.g. e-banking, print, mobile, etc.), and track the status of documents (e.g. "awaiting customer signature").

The possibility to electronically record the customer's signature in the customer meeting directly, or to accept it later on electronically, is a nice example of Estonian digital DNA.

Some products (prioritised based on market research) are available to customers pre-configured for the introduction of new products. In addition, customers can define and parameterise their products themselves on the user interface using configuration-based design (drag & drop). A quick market launch is therefore possible without programming knowledge, but this also results in a certain dependency on the core bank system manufacturer, since the implementation of very specific products, in particular, requires the involvement of Tuum itself.

Initially, Tuum also wanted to include prefabricated front-end templates in its offer but decided against this after it became clear in customer discussions that banks want to design the customer journey themselves. The front-end functionalities of Tuum are therefore made available to customers via APIs, end customers use the respective front-end (e.g. app) of the bank, and bank employees use the middle and back-office UI of Tuum.

By covering all functionalities, including the core as far as possible through different modules and their extensions, Tuum, unlike some other neo core banking systems, does not only rely on a best-of-breed approach, but also tries to combine the advantages of a modular strategy with the core strategy (best-of-suite solution).

Tuum's banking core with its booking engine functions as an independent and interchangeable module. This means it can operate as a separate service just as Tuum's other modules which can run with any other core banking system independently of Tuum's banking core.

Non-functional support

Delivery capability

Like most neo systems, Tuum focuses on the extensive use of new technologies and has sufficient resources to further develop, integrate and maintain the system. At the moment, various evaluations are being completed by interested parties who are considering using one or more of Tuum's modules. What's more, four implementations of Tuum will be running as of the end of 2021.

Operability

Interruption-free maintenance is guaranteed by the microservice-based architecture, and batch jobs for daily updates have been eliminated by Tuum thanks to its complete real-time processing. The release cycle is designed to provide a release every fortnight. Technical operation is supported by integrated documentation and an e-learning platform in which the data models and the system are described extensively. This information is also updated regularly.

Architecture

The architectural strategy allows for both cloud-based and on-premise implementations. Each module of Tuum can be tested independently and uses its own database. Duplication of data is prevented by referencing (e.g. for a customer with a savings account and a mortgage, the personal data in the CRM is kept up-to-date with a reference to the respective products). The different modules feed a centralised data lake, which also provides the data for reporting whenever it is needed. Customers who have their own data lake or want to use their own data warehouse can access Tuum's data in real-time via webhooks.

Thanks to the fully implemented Open API concept, the individual modules can be expanded as required, and requirements such as PSD2 can be fulfilled easily.

Multiple use by different clients, different currencies and different languages are guaranteed, and multiple time zones are supported in a way that is automated to a large extent.

Business model

Tuum's market strategy is guided by "land and expand", i.e. use small steps to leave footprints in the form of big impacts on the business of the respective customers, and then expand further step by step. To support growth, Tuum invests over 50% of its turnover in further development.

Pricing takes the customer size and growth curve into account. Based on the predicted business volume, predefined tier levels are applied per module—for example, the larger the number of loans at a universal bank, the more favourable the unit price will be. Tuum offers a completely transparent mapping of process costs as well as comprehensive cost management support, and it proactively establishes contact between prospective and existing customers.

Tuum estimates their integration costs to be average by Swiss standards. The advantage is that customers only pay for the modules they actually need.

Future system support with Tuum

Tuum aims to offer a platform that is as complete as possible, and already offers a relatively wide range of functions despite only being in existence for just under three years. More are likely to follow in the future.

This differentiates it from the lean approaches of other neo systems and follows a similar product strategy to Eri Bancaire for its well-known Olympic core banking system: All necessary functions for a bank should be obtained from the manufacturer itself, or it should at least be possible. However, Tuum extends this with an API-first platform that is principally open.

According to a survey of banks(opens in new tab), the high demand for CRM is met by Tuum with basic functionalities such as the recording of customer interactions. When it comes to campaigns, Tuum, like most neo systems, recommends integration with CRM systems.

High coverage is provided by Tuum in document management (Enterprise Content Management) as well as for cards and collateral, meaning it exceeds the average demand. In product management, Tuum supports the migration of an existing product into a new generic product (incl. product configuration), which means it also covers average demand here.

Coverage of Tuum compared to demand in Switzerland

Tuum supports the core strategic elements that are described in the article The satisfaction of banks with their core banking system: An area of tension?, as follows:

Openness: Tuum's platform has a fully implemented API-first Open API concept to enable a wide range of use cases via third-party system connectivity. Due to the implemented openness of the system towards the cooperating partners, all connections basically work with access to their own data. This must be done in such a way that the bank's freedom to act is not restricted, so that the bank can really rely on the open standard and, furthermore, access to the data from different systems is guaranteed at all times. When integrating peripheral systems into core banking systems with an existing architecture, there is also the question of the extent to which existing systems support the integration of individual Tuum modules, as licence fees are lost in the process.

Data: Due to the architectural orientation of Tuum, which is to cover all banking functionalities itself, the system also holds the corresponding data itself and therefore increases the efficiency of data use. The distributed data storage in modules enables the integration of Open Data, such as the assignment of real estate data from the land survey register to a mortgage. Thanks to the possibility of on-site installation, Tuum meets corresponding regulatory requirements.

Functions: At this point in time, the functional scope of Tuum focuses on payment transactions (also cross-border), cards, document management, loans (also for businesses) and collateral. Tuum is still very young on the market and aims to grow into a stand-alone platform that only needs to access Tuum's growing network of integrated peripheral systems for satellite functionalities (AML, frontends, loan decisions, CRM).

Processes: Tuum has a process orchestration module that manages all predefined processes in Tuum. The fact that Tuum was developed by bankers with extensive knowledge of banking processes reduces the required amount of process expertise within the bank. This will be in greater demand when the use of peripheral systems, which deviate from Tuum's standard, increase.

Success factors for using a neo banking system like Tuum at a bank are, in particular:

- Integration and openness of the current system manufacturer

The connection of individual modules requires the provision of open interfaces on the system side of the bank, which the existing system manufacturer may not always be motivated to do, as this could result in a loss in licensing income.

- Role-based frontends

A specific frontend has to be integrated for customers, customer advisors and experts, and banks often want to continue using their existing frontend. - Cultural change

Promote the willingness of employees to deal with agile projects as well as ongoing project adjustments in an international context. - Distinction in terms of potential for standardisation

Differentiation between elements that follow Tuum's standard and elements that are market-differentiating for the bank and cannot, therefore, be standardised further (see also next point on helvetisation). To keep Tuum's standards as high as possible and the system efficient, the processes of other products should be adapted in line with those of Tuum as far as possible when they are introduced. To this end, an understanding of how to handle standards must be promoted and enforced among employees. - As little helvetisation as possible

Integrate products that are necessary in Switzerland, such as QR Bill or OASI statements, through peripheral systems; otherwise, do not "bend" the given templates if possible and avoid helvetisation in order to keep the need for integration low.

Conclusion

As described at the beginning, neo systems often rely on modularity and SaaS; the latter usually entails standardisation of the offering and internationalisation.

Tuum, which can be installed and used both in the cloud and on-site, tries to keep the need for integration low despite modularisation by aiming to cover a large number of bank functions. What's more, Tuum wants to be able to offer its functions to all of its customers in different countries. To achieve this balancing act, Tuum needs a high degree of standardisation, i.e. the products and processes are predefined to a certain extent, yet customers can create new products themselves based on product templates and by combining them (similar to the SaaS products in extensive use, such as Salesforce or SAP). Standardisation makes customisation more complicated, but it reduces the complexity of the IT developer skills required within the bank.

With regard to internationalisation, the question arises as to how much helvetisation a bank in Switzerland actually needs. Even local core banking system manufacturers are increasingly turning away from mapping each individual product in the system and instead are offering different types of loans (e.g. agricultural leases in Switzerland) in the form of comprehensive, uniform functionality bundles (lease, guarantee) here as well. Nevertheless, it is important to map Swiss-specific functionalities such as the QR Bill, for example, in payment transactions.

Tuum works well in Switzerland, if the needed capabilities of the platform are adopted, only those Swiss-specific functionalities that are really mandatory are integrated, and if the bank's processes are adapted, as far as possible, in line with the respective standards set by Tuum. This means that, for example, regulatory reporting is also carried out with peripheral systems (for example, Tuum is currently creating integration options for Bearing Point Abacus).

Universal banks that opt for Tuum will generally pursue a modular strategy and first connect individual or several modules, such as card or financing modules, to their existing system via Open APIs (based on their requirements), in order to generate quick wins in the form of a fast time to market for innovative products. Based on customers' experiences with Tuum and Tuum's continuous introduction of new functionalities, the addition of further modules of Tuum up to the booking engine is conceivable.

For private banks, the use of individual modules could become interesting as soon as corresponding functions are available in the wealth area.

In fact, we also see potential with non-bank customers that want to offer financial options (e.g. payment in instalments) themselves, as Tuum is a lean solution with an intuitive user interface.

At the moment, and perhaps also in the future, the needs of Swiss banks when it comes to using new systems, especially in the area of investing, must be solved with peripheral systems. Only time will tell whether Tuum will start to offer wealth management coverage that is interesting for Swiss banks, or whether it will set its priorities differently.

Core Banking Radar will continue to monitor developments in the market over the next few years.

Articles already published in 2019/2020/2021

- Mambu - a new generation of core banking system manufacturer relies on SaaS (published 12 January, 2021)

- “The satisfaction of banks with their core banking systems: An area of tension?” (published 10 July, 2020)

- SolitX: Smart Financial Contracts as a new approach to system support for banks (published 11 November, 2019)

Business Engineering Institute St. Gallen

A long-term partnership exists between Swisscom and the Business Engineering Institute St. Gallen (BEI) within the “Ecosystems” Centre of Excellence. This centre deals with topics such as eco-systems, digitisation and transformation, as well as other issues relating to the structure of the financial industry in the future. In addition to its research activities, the BEI carries out projects related to the design and implementation of innovative, cross-sector business models.