API banking

– the foundation for innovative banking services

- Access to the Swiss Open Finance ecosystem with API banking

- Innovation courtesy of embedded finance

- Improved service quality combined with lower costs

We're happy to help.

Stay responsive to and fully accommodate changing customer banking needs with Open Finance.

Banking customers today expect a seamless digital service and outstanding user experience as standard. Open Finance is helping the Swiss banking community to open up and actively shape this opening despite a lack of regulation.

Swisscom: the perfect partner for Open Finance

Swisscom offers a wide range of interfaces that require no special knowledge to use.

Rapid prototyping and sandboxing to facilitate product and process configuration and optimisation, and the swift integration of innovations.

Swisscom Security Management guarantees maximum data security across all interfaces.

With its extensive cross-sector expertise and experience, Swisscom offers connectivity far beyond banking.

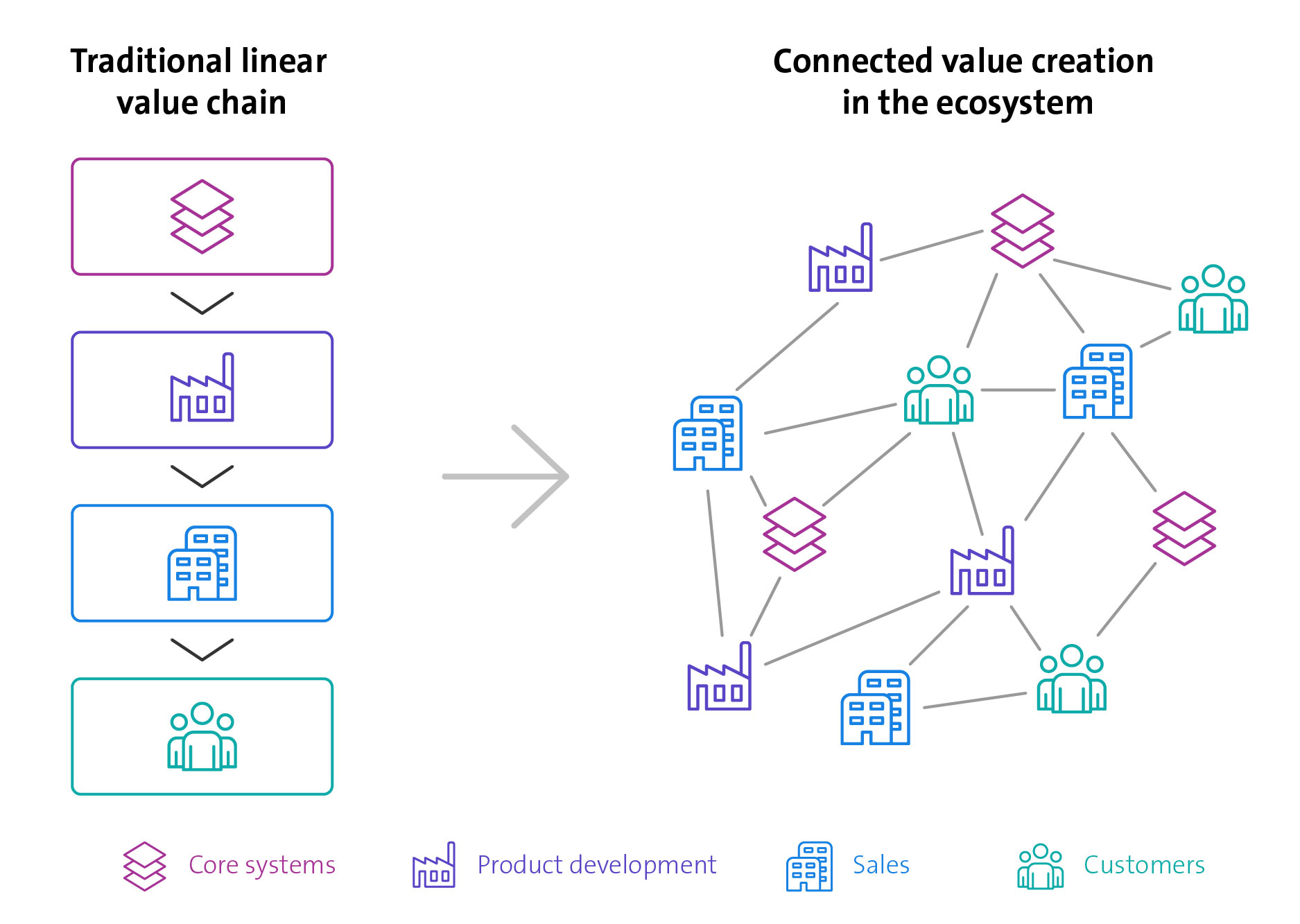

Our integration platform, your Open Finance ecosystem

The secure embedding of services within your value chain

Typical application scenarios in the Open Finance ecosystem

Customer needs are changing rapidly. In the past, customers visited banks in person; today, they do their banking using the bank’s digital and physical touchpoints – tomorrow, they will be using a single, provider-independent environment that meets all their needs.

PEP check

Banks have an obligation to reliably identify politically exposed persons and observe compliance guidelines.

Swisscom’s solution

The Open Business Hub uses a Pythagoras API for automated, accurate PEP detection and compliance verification, reducing manual effort and regulatory risk without requiring the customer to build the necessary expertise itself.

Multibanking for Individuals (retail)

Challenge: retail customers want a holistic view of their financial situation and the ability to plan and optimise all aspects of personal finance over the long term.

Swisscom’s solution:

Swisscom has joined forces with 23 banks and SIX (under a Memorandum of Understanding) to actively drive forward this initiative with the Account Information Service API via SIX bLink. It is therefore helping banks to strengthen end customer satisfaction and loyalty.

Connection to accounting software

Challenge: business customers need their banking transactions to be perfectly synchronised with their accounting software.

Swisscom’s solution:

The Open Business Hub establishes a direct connection between bank accounts and accounting software such as Klarna and bexio (via AIS/PSS API via SIX bLink), automates data exchange and thus increases efficiency. This allows banks to increase SME customer loyalty while also taking advantage of upselling and cross-selling opportunities.

Connection to external asset managers

Challenge: integrating external asset managers into existing banking systems is often a complex and time-consuming process.

Swisscom’s solution

The Open Business Hub facilitates the fast and secure connection of external asset managers, optimises processes and extends the service offering by connecting third parties such as Assetmax, evoq, evolut, WealthArc, etc. (via Open Wealth API and SIX bLink).

Digital appointment scheduling

Challenge: coordinating personal appointments can be a long and drawn-out task for both customers and advisors.

Swisscom’s solution

By integrating digital scheduling API ‘at point’ into a bank’s IT environment, the Open Business Hub enables efficient, flexible scheduling.