Banking as a Service (BaaS)

Core Banking Services deliver IT infrastructure for banks

With the help of Banking as a Service (BaaS), you can remain agile and use your resources to develop new and innovative products. Reduce in-house IT effort by opting for Core Banking Services and benefit from a reliable IT infrastructure, including fail-safe operation and future-oriented scalability.

When is it the right solution?

If your bank wants to experience the benefits of modern banking platforms without investing in its own human resources or in building or expanding your technology know-how. You are also looking for a reliable cost planning basis for your core banking system.

Core Banking Services – our offer

Downloads

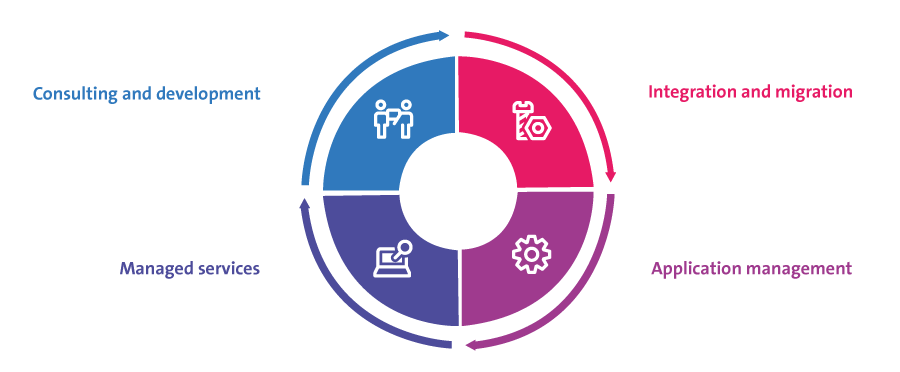

Our Core Banking Services

For 20 years, we have been offering banks comprehensive services for their core banking systems.Choose the services you need.

Possible applications

What can we do for you?

React quickly and effectively to the changing habits and needs of your customers – and anticipate market changes in good time. Our Core Banking Services will help you become more agile. Read three examples here.

Avaloq Services

Outsource further development and operation of the platform

Your requirement

You want to get the most out of your Avaloq banking system.

Integration

Moving to a new platform

Your requirement

You have taken over a bank and want to integrate its customer data into your existing core banking solution.

End- of- Life

Setting up a new platform

Your requirement

Your core banking system will soon reach the end of its life cycle. You need a replacement.