Hybrid cloud services, solutions and consulting

Hybrid cloud solutions are the key to digitalisation

Managing the multi-cloud: We will show you the most important aspects that need to be considered when introducing and operating multi cloud architectures.

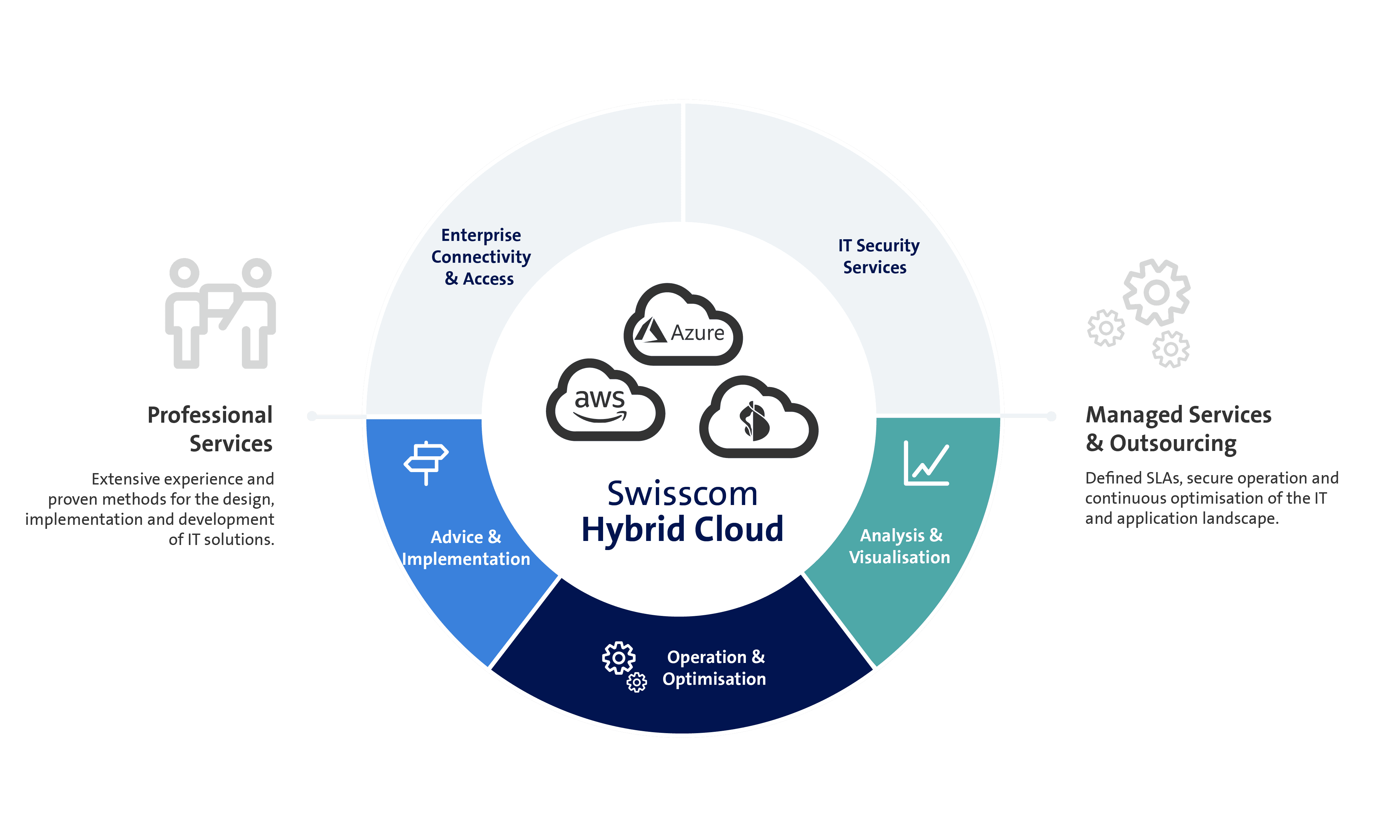

Make full use of the benefits of private and public clouds. We support you with hybrid cloud services, solutions and consulting.

Together, we can develop powerful hybrid cloud solutions that take your company to the next level in agility, cost, scalability and competitiveness.

Swisscom Cloud expertise

Your hybrid cloud solution, tailored to your business needs

Whether you are interested in a hybrid solution that includes specially developed and Public Cloud solutions or an end-to-end Managed Services solution: we’re there for you and your customers.

Five scenarios for a secure, hybrid cloud environment

Cloud Foundation

Choose the right strategy

Customer requirements

Choosing the right IT strategy is crucial for the success of a company. But new technologies and services are appearing all the time and your in-house IT landscape can soon become outdated. Finding the right approaches in this dynamic environment is challenging. As is making the right decisions about governance, security, and models for target operating, sourcing and cost.

How Swisscom supports you

Drawing on proven methodologies, our specialists are here to give you the expert support you require, helping you implement your plans step by step and achieve your goals right from the start.

Modernisation

Modernise your infrastructure & applications

Customer requirements

IT departments struggle to cope with ever-rising business demands and the costs of maintenance are high. Modifications take considerable effort and involve long implementation times.

How Swisscom supports you

How Swisscom supports youOur experienced engineers support you in the operation and maintenance of your IT infrastructure, freeing up your capacities and allowing you to focus on your core business. With Container Services, we also help build a bridge to a future-oriented IT infrastructure.

Innovation & transformation

Embrace new business models

Customer requirements

Disruptive technologies are opening up entirely new business areas and models for companies. However, companies often lack the requisite knowledge internally and struggle to find it on the labour market.

How Swisscom supports you

With our extensive cloud expertise and strategic partnerships with global Public Cloud providers, you can access modern cloud technologies quickly and easily, and swiftly take advantage of these without any big initial investments in hardware or software.

Operation & Optimisation

Reduce complexity & cost

Customer requirements

The efficient operation of a heterogeneous IT environment is complex and costly, and this complexity is only increasing as cloud services and other technologies continue to evolve. Without the necessary expertise, companies quickly lose sight of the big picture and lose touch with what they are trying to achieve, resulting in a suboptimal solution design.

How Swisscom supports you

Together, we define which operational tasks we can effectively take off your hands and you can then rely on us to take care of these for you. We also support you in the ongoing optimisation of the IT landscape, taking into account costs, performance, security, compliance and all other aspects that are important to you.

Data Value

Use data intelligently

Customer requirements

Generating added value from data for the development of your business is a challenge, but it is essential for your continued existence on the market. Intelligent systems, resources and expertise alone are not enough: they need to interact as perfectly as possible.

How Swisscom supports you

Our experts show you how to use your data intelligently and effectively to achieve your growth targets and introduce new business processes. Thanks to our comprehensive cloud services, you can do this gradually and without high upfront investments.

That’s why Swisscom is the right choice for your cloud projects

Whatever the operating model (on-premises, Private, Public Cloud or hybrid), our more than 400 specialised cloud experts, with their many years of experience, are here to support you.

We tailor cloud solutions to your needs, relying on our know-how and numerous (Public) Cloud certifications.

More and more B2B customers in Switzerland have benefited from our ICT, cloud and managed services expertise.

From our networks to our data centres, we consistently ensure the highest security standards that meet your compliance requirements.

Strategic partnerships with leading international cloud providers such as Microsoft and AWS permit comprehensive, industry-specific, end-to-end support.