CEO Urs Schaeppi comments on the third quarter results for 2016 as follows: “We have again achieved solid results in the third quarter despite fierce competition. Strong pressure on pricing and decreasing roaming prices are good news for our customers but more challenging for our revenue and profitability. On a more positive note, there is increased growth in bundled products and TV access lines, our solutions business for corporate customers and Fastweb. Thanks to strong market performance and active cost management we are on target.”

Summer holidays influence high demand for inclusive roaming

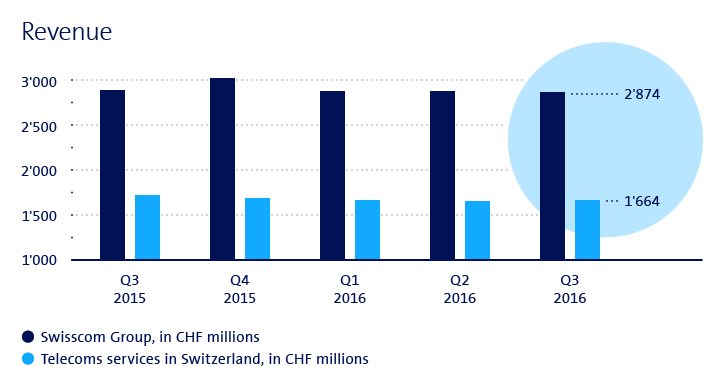

Swisscom’s net revenue for the third quarter 2016 remained effectively at the same level as the previous year. Whilst in Switzerland revenue from telecommunications services declined by 1.9% overall in the first three quarters as a result of strong pressure on prices and increasing market saturation, this development strengthened in the third quarter. Revenue from Swisscom’s telecommunications services was down 3.1%, representing CHF 53 million in the third quarter due primarily to increased inclusive holiday roaming services. This loss could not be completely offset by active cost management or through new services and customer growth.

EBITDA rose however by 6.7% to CHF 3,307 million. Adjusted for non-recurring items (in particular compensation from a legal dispute with Fastweb and in prior year, recognition of a provision for Competitive Commission fines for broadband services) it fell by 1.7%. In the first three quarters EBITDA fell in the Swiss core business by CHF 102 million or 3.5%, due to pressure on pricing, the cost for roaming and subscriber acquisition as well as low subscription growth. Fastweb’s EBITDA grew during the same period by EUR 30 million or 7.4%. Swisscom's net income rose by 13.1% to CHF 1,197 million.

Swisscom's headcount fell by 311 FTEs to 21,292, a decrease of 1.4%. Excluding company disposals and due to efficiency measures, the number of staff fell by 350 FTEs, a decrease of 1.6%.

The outlook for 2016 remains unchanged. Swisscom expects a net revenue in excess of CHF 11.6 billion, an EBITDA of approximately CHF 4.25 billion and capital expenditure of approximately CHF 2.4 billion. If targets are met, Swisscom will propose to the 2017 Annual General Meeting of Shareholders a payment of CHF 22 per share for the 2016 financial year.

Sustained high level of capital expenditure, network for the Internet of Things established

Group-wide capital expenditure increased by 1.8% to CHF 1,768 million, in Switzerland it fell slightly by 0.8% to CHF 1,292 million. Swisscom provides a substantial contribution to Switzerland’s leading position in capital expenditure in the telecommunications market per citizen. Switzerland has maintained this OECD statistic of being the global leader since 2010 and has continued the lead steadily since.

Progress continues to be made on expanding the broadband network: As at the end of September Swisscom has provided around 2.4 million lines with the latest technology. In total Swisscom has connected around 3.4 million homes and businesses to its ultra-fast broadband service (speeds in excess of 50 Mbps). In September Swisscom was the first European telecommunications provider to put the latest G.fast transmission standards into operation. In October Swisscom put a complete Low Power Network (LPN) into operation for the Internet of Things. This allows high coverage and energy efficient transmission at low cost. The LPN network already covers just over 75% of the Swiss population.

Bundled offers and demand for inclusive roaming continue to grow

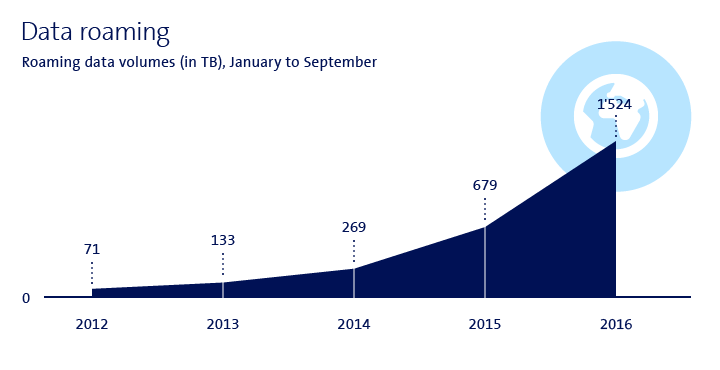

Swisscom is holding its ground with stable market shares in the saturated Swiss mobile communications market . Whilst in the first three quarters of the year 27,000 new postpaid subscribers were gained, the number of prepaid customers saw a small decline. The number of broadband connections rose by 0.1%, whereas the number of fixed-line connections fell by 6.5% to 2.46 million. Bundled packages remain popular. At the end of September 2016, 1.59 million customers were using a bundled package which represents an increase by 17.1% year on year. Correspondingly, revenue from bundled contracts rose by 12.2% to CHF 1,846 million. The demand for roaming abroad continues to expand. Boosted by price reductions and inclusive services for Natel infinity, year-on-year data traffic rose by a factor of 2.2 and voice traffic by 12%. This clearly demonstrates the effect of constant price reductions and inclusive services with Natel infinity subscriptions. Three quarters of global data volume was no longer billed to residential customers in the third quarter 2016. Of this number, many customers benefited from holiday-related price reductions in the third quarter. These price reductions over the year had a negative impact on Swisscom revenue to the tune of CHF 100 million.

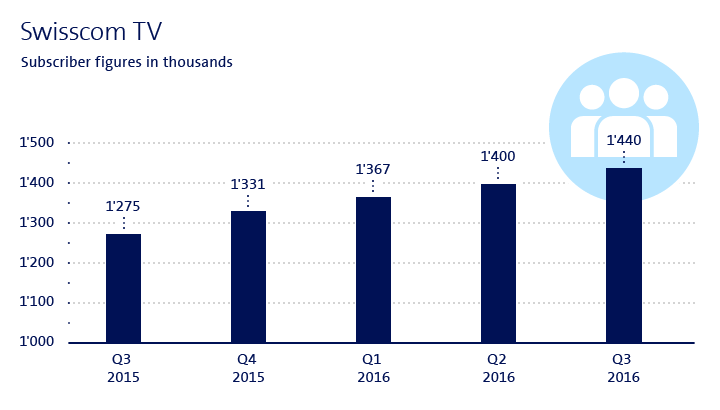

Swisscom TV is popular and in demand. The number of Swisscom TV access lines rose by 12.9% to 1.44 million (+40,000 in the third quarter) despite fierce competition from other providers. The announcement in October of our Football and Ice Hockey Sports offer made Swisscom TV even more attractive to customers.

Price pressure on corporate business

Revenue from external customers in the Enterprise Customers division fell by 1.3% to CHF 1,776 million as a result of pricing pressure on telecommunications services. The price-related decline in revenue in the mobile phone market was offset by higher revenue in the solutions business. Swisscom gained a number of well-known corporate customers and is implementing cloud, digitisation and outsourcing strategies for these.

Growth in Fastweb

Fastweb performed very well in a difficult market environment. The revenue reported by Fastweb in Italy rose by 2.5% to EUR 1,318 million due to customer growth. The customer base in the broadband business grew by 5.7% to 2.3 million (+94,000 in the first three quarters). Revenue from residential customers rose year on year by 3.4% to EUR 675 million. Revenue from corporate business remained stable at EUR 517 million (+0.2%). Capital expenditure rose by 6.7% to EUR 430 million mainly as a result of growth in the high-speed broadband network. Overall, Fastweb recorded a segment result before depreciation and amortisation (EBITDA) of EUR 490 million. This figure includes the payment of EUR 55 million from a telecommunications provider resulting from an out-of-court settlement. Adjusted for this non-recurring income, the segment result increased by EUR 30 million or 7.4%. The adjusted profit margin rose from 31.5% to 33%.

The expansion of Italy's broadband network continues at full speed: Fastweb and Telecom Italia intend to cooperate on the rollout of Fibre to the Home (FTTH). The aim is for 13 million homes and businesses in Italy to be connected to the broadband network by 2020. Fastweb also plans to grow further in the mobile telephony sector: New offers as the result of an agreement with Telecom Italia will follow in 2017. From the sale of network operator Metroweb, Swisscom expects to book a gain of around CHF 40 million in the fourth quarter 2016.

Interim report third quarter figures at a glance

|

1.1.-30.9.2015 |

1.1.-30.9.2016 |

Change |

Net Revenue (in CHF million) |

8,651 |

8,643 |

-0.1% |

Operating income before depreciation and amortisation, EBITDA (in CHF million) |

3,099 |

3,307 |

6.7% |

Operating income EBIT (in CHF million) |

1,554 |

1,691 |

8.8% |

Net income (in CHF million) |

1,058 |

1,197 |

13.1% |

Swisscom TV access lines in Switzerland (as at 30 September in thousands) |

1,275 |

1,440 |

12.9% |

Mobile access lines in Switzerland (as at 30 September in thousands) |

6,618 |

6,613 |

-0.1% |

Revenue from bundled contracts (in CHF million) |

1,646 |

1,846 |

12.2% |

Broadband access lines Fastweb (as at 30 September in thousands) |

2,172 |

2,295 |

5.7% |

Capital expenditure (in CHF million) |

1,737 |

1,768 |

1.8% |

Of which capital expenditure Switzerland (in CHF million) |

1,302 |

1,292 |

-0.8% |

Group employees (FTEs as at 30 September) |

21,603 |

21,292 |

-1.4% |

Of which employees in Switzerland (FTEs as at 30 September) |

18,936 |

18,551 |

-2.0% |

Detailed interim report:

Related documents:

Disclaimer

This communication contains statements that constitute "forward-looking statements". In this communication, such forward-looking statements include, without limitation, statements relating to our financial condition, results of operations and business and certain of our strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behaviour of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s and Fastweb’s past and future filings and reports, including those filed with the U.S. Securities and Exchange Commission and in past and future filings, press releases, reports and other information posted on Swisscom Group Companies’ websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication.

Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Downloads

Contact us

Address

Swisscom

Media Relations

Alte Tiefenaustrasse 6

3048 Worblaufen

Postal address:

Postfach, CH-3050 Bern

Switzerland

Contact

Tel. +41 58 221 98 04

media@swisscom.com