CEO Urs Schaeppi comments on the first three months of 2017 as follows: “We earned a solid result in the first quarter, and we did this under continuing heavy pressure and in a difficult environment. The trends in 2016 are continuing in the first quarter of 2017, as expected. Core business, especially fixed-line telephony, fell significantly. The intensive competition, strongly driven by promotions, and high level of market saturation are challenging our revenue and profitability. Welcome factors are the continuing growth in TV and bundled products and the major advances in expanding our ultra-fast broadband network. I am also pleased by the market success of Fastweb in mobile telephony and the broadband area. For the rest of the year I am expecting continuing heavy pressure on prices. However, I am also expecting a boost in sales, thanks to inOne, our new bundled product range. Our financial forecast for 2017 is unchanged – we are on track.”

Decline in core business in line with expectations

Net revenue at Swisscom is down slightly. Switzerland saw revenue from telecommunications services fall by 1.8% overall in the past year as a result of strong pressure on prices and increasing market saturation, and this development strengthened in the first quarter. In the first three months Swisscom revenue from telecommunications services fell by CHF 37 million (-2.2%). Around 50% of this decrease in revenue was the result of a decline in subscribers in fixed-line telephony, while the other 50% was due to price reductions, including roaming, and a decline in corporate business.

Thanks to prudent planning and active cost management, Swisscom succeeded in compensating for around half the decline in revenue in Swiss core business. As announced, Swisscom will reduce its cost base by over CHF 300 million from 2015-2020. In the first three months, EBITDA fell CHF 26 million (-2.7%) in Swiss core business. During the same period, EBITDA at Fastweb grew EUR 14 million, or 10.7%. Swisscom's net profit rose by 2.5% to CHF 373 million.

Compared to the previous year, Swisscom headcount in Switzerland decreased by 680 FTEs to 18,280 at end-March 2017 as a result of the decline in core business. Around half of the reduction was offset by natural fluctuation and vacancy management. In the first quarter of 2017, the decrease was 92 FTEs.

Popular bundled products – another chapter in the success story

The bundled products, combining fixed-line, broadband and TV, have maintained their popularity. At the end of March 2017, over 1.7 million customers were using a bundled package, which represents an increase of 18.6% year on year. Revenue from bundled contracts increased by 12.1% to CHF 676 million. inOne is a new and innovative Swisscom service which combines broadband, Swisscom TV, fixed-line and mobile flat rates for up to five people, but also has the option to modify or entirely remove each element to suit personal needs. inOne will counter the decline in subscriber growth.

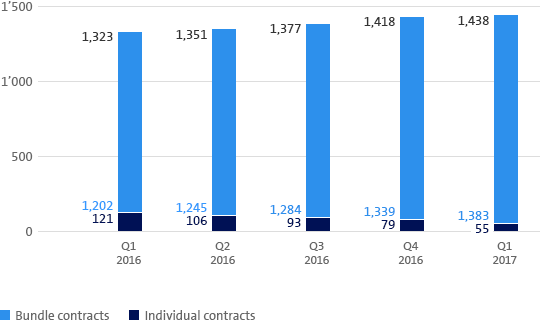

Swisscom TV also continues to enjoy great popularity and demand. The number of Swisscom TV access lines rose by 8.7% year on year to 1.44 million (+20,000 in the first quarter) despite fierce competition from other providers.

Swisscom TV subscribers in thousands

Saturated mobile market – best in class for roaming prices

In the saturated Swiss mobile market, which is generally declining, growth in subscriptions remains flat at Swisscom. In the first three months of the year, there was slight growth in mobile postpaid offers (0.2%), but a decrease in the number of prepaid customers (-1.0%).

Year on year, data traffic generated abroad grew 86%, while voice traffic grew 7%. This clearly demonstrates the effect of continuing price reductions and inclusive services with Natel infinity subscriptions. Three quarters of global data volume was no longer billed to retail customers in the first quarter of 2017. Swisscom continues to offer the lowest rates for roaming. At end-March Swisscom actually reduced roaming rates further. The prices for data packets were cut by up to 60%, in some cases undercutting the prices of providers from the EU. In addition, 26 countries were moved to a cheaper tariff zone, which corresponds to a price reduction of up to 80% for individual destinations. Swisscom continues to expect that price reductions and inclusive services will reduce 2017 results by some CHF 70 million.

The number of broadband connections also fell in the first quarter (-0.2%), and the number of fixed-line telephony connections decreased by 3.0% to 2.3 million.

Demanding corporate business – even more drive for the Internet of Things

Revenue with external customers in the Enterprise Customers division fell by 3.8% to CHF 586 million, primarily due to continuing heavy price pressure on telecommunications services. There was also a decrease in revenue of CHF 7 million (-2.6%) in the solutions business, due primarily to project and customer specific reasons. However, Swisscom gained a number of prominent corporate customers in the first quarter, and is implementing cloud, digitisation and outsourcing strategies for these. Swisscom is well positioned in the convergent B2B ICT market.

For the Internet of Things, Swisscom is one of the first providers worldwide to achieve national coverage. The Swiss Low Power Network (LPN) has been operating since autumn 2016. Swisscom has been working with Swiss Post on the Internet of Things since March 2017, and is able to quickly increase network density thanks to the additional Post locations. By end-2017 90% of the Swiss population will be covered by LPN.

Investment in the future – accelerated expansion of the ultra-fast broadband network

Group-wide capital expenditure fell 11.2% to CHF 529 million, dropping 14.8% to CHR 362 million in Switzerland as seasonal effects led to a lower level of capital expenditure. Despite ongoing heavy price pressure, Swisscom is maintaining its policy of high investment in its infrastructure. In Switzerland Swisscom will invest around CHF 1.75 billion in 2017. “Swisscom is investing more than twice as much in the networks as all other Swiss telecommunications providers together. The investment will pay off if we maintain our leadership in technology,” Urs Schaeppi says. “We are proud of our new network for the Internet of Things, and of our ultramodern mobile coverage. We cover over 99% of the population with 4G and over 40% with 4G+.”

Expansion of the broadband network continues. At the end of March, more than 2.6 million high-speed lines were equipped with the latest fibre-optic technology. Overall, Swisscom has connected more than 3.6 million homes and businesses to its ultra-fast broadband service (speeds in excess of 50 Mbps). Thanks to the expansion of fibre optic technology to just a few metres from the home (fibre to the street, FTTS) and the use of transmission technologies in copper cable lines to the last few metres, Swisscom is able to accelerate expansion of its broadband network significantly. By end-2021 Swisscom will have connected all municipalities and over 90% of Swiss homes and businesses with the latest optical fibre technologies. Every effort was also made in the first quarter of 2017 to push ahead with expanding the capacity of the mobile communications network. A test by the German magazine “Chip” again confirmed that Swisscom operates the best mobile network in Switzerland.

The regulatory environment will continue to be a challenge in 2017. Entrepreneurial freedom, innovations and a high level of investment continue to be of central importance for Swisscom in an increasingly globalised environment. This is also true with regard to a potential revision of the Federal Telecommunications Act and various other upcoming antitrust and legislative proceedings.

Growth by Fastweb – successful broadband business

Fastweb performed very well in a difficult market environment. The revenue reported by Fastweb in Italy rose by 3.0% to EUR 453 million due to customer growth. The customer base in the broadband business grew by 7.1% to 2.4 million within a year (+45,000 in the first three months) – particularly in optical fibre areas. Revenue from residential customers rose year on year by 4.0% to EUR 232 million. Expansion of Italy's broadband network continues at full speed: The aim is for 13 million homes and businesses in Italy to be connected to the ultra-fast broadband network by 2020.

Fastweb is also growing in mobile telephony. The number of mobile customers rose by 87,000 in the first quarter, almost three times as many new customers as in the previous year’s period.

In the first three months, Fastweb reported a segment result before depreciation and amortisation (EBITDA) of EUR 145 million (+10.7%). Capital expenditure was virtually unchanged at EUR 155 million (+0.6%), a high level driven by the expansion of the ultra-fast broadband network.

Financial outlook remains unchanged

“Our environment will continue to be challenging for the rest of the year,” confirms CEO Urs Schaeppi. “However, we’re on track, and well placed for future developments.” For 2017, Swisscom expects a net revenue of around CHF 11.6 billion, EBITDA of around CHF 4.2 billion and capital expenditure of around CHF 2.4 billion. If the targets are met, Swisscom will propose to the 2018 Annual General Meeting payment of an unchanged dividend of CHF 22 per share for the 2017 financial year.

Interim report first quarter figures at a glance

|

|

1.1.-31.3.2016 |

1.1.-31.3.2017 |

Change |

Net revenue (in CHF million) |

2,885 |

2,831 |

-1.9% |

Operating income before depreciation and amortisation, EBITDA (in CHF million) |

1,081 |

1,073 |

-0.7% |

Operating income EBIT (in CHF million) |

535 |

550 |

2.8% |

Net income (in CHF million) |

364 |

373 |

2.5% |

Swisscom TV access lines in Switzerland (in thousands as at 31 March) |

1,323 |

1,438 |

8.7% |

Mobile access lines in Switzerland (in thousands as at 31 March) |

6,615 |

6,601 |

-0.2% |

Revenue from bundled contracts (in CHF million) |

603 |

676 |

12.1% |

Fastweb broadband access lines (in thousands as at 31 March) |

2,241 |

2,400 |

7.1% |

Capital expenditure (in CHF million) |

596 |

529 |

-11.2% |

Of which capital expenditure Switzerland (in CHF million) |

425 |

362 |

-14.8% |

Group headcount (FTEs as at 31 March) |

21,645 |

21,079 |

-2.6% |

Of which in Switzerland (FTEs as at 31 March) |

18,960 |

18,280 |

-3.6% |

Detailed interim report:

Related documents:

Disclaimer

This communication contains statements that constitute "forward-looking statements". In this communication, such forward-looking statements include, without limitation, statements relating to our financial condition, results of operations and business and certain of our strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behaviour of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s and Fastweb’s past and future filings and reports, including those filed with the U.S. Securities and Exchange Commission and in past and future filings, press releases, reports and other information posted on Swisscom Group Companies’ websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication.

Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact us

Address

Swisscom

Media Relations

Alte Tiefenaustrasse 6

3048 Worblaufen

Postal address:

Postfach, CH-3050 Bern

Switzerland

Contact

Tel. +41 58 221 98 04

media@swisscom.com