“Swisscom is reporting stable operating income and a good market performance – despite many imponderables due to COVID-19, saturation in the Swiss market and tough competition,” said CEO Urs Schaeppi. “Thanks to well-developed networks, attractive offers and good customer service, we continue to have a high level of customer satisfaction. High price pressure and the effects of COVID-19 depressed revenue in the Swiss core business. However, thanks to improved efficiency, we were able to offset most of this decline. In September, we received positive feedback from customers and the public with our new, comprehensive entertainment experience: Swisscom TV became blue TV, Teleclub hit the ground running as blue+ and Kitag cinemas are now called blue Cinema. Our Italian subsidiary Fastweb also performed well again, seeing growth in revenue, operating income and customer base. All in all, this means that we are on course at Swisscom and can confirm the financial outlook for 2020 as a whole.”

Price war in Swiss core business, growth at Fastweb

Group revenue of CHF 8,201 million is CHF 176 million (-2.1%) lower than the previous year after currency adjustments. In its saturated Swiss core business, Swisscom generated revenue of CHF 6,148 million (-3.5%). The CHF 226 million decline in revenue is mainly driven by ongoing price pressure and the impact of COVID-19; roaming accounts for around a third of this (CHF 73 million). Business in Italy performed positively: Fastweb reported year-on-year revenue growth of EUR 90 million (+5.7%).

The decline in the Swiss core business was largely offset by improved efficiency. Consolidated operating income before depreciation and amortisation (EBITDA) totalled CHF 3,356 million, which was CHF 4 million below the previous year. On a comparable basis with constant exchange rates, the EBITDA rose by CHF 7 million (+0.2%). EBITDA in the core Swiss market was practically stable (-0.5%), while that of Fastweb increased by 4.6% (in EUR). The bottom line is a solid net income of CHF 1,166 million, CHF 15 million or 1.3% below the previous year, mainly as a result of a higher income tax expense.

Ongoing high capital expenditure in network infrastructure

Swisscom continuously invests in the quality, coverage and performance of its network infrastructure, reinforcing its position at the cutting edge of technology. At CHF 1,632 million (-11.0%), Group-wide capital expenditure remained high by the end of September and comparatively stable.

Broadband expansion in the fixed network on course

As at the end of September 2020, Swisscom in Switzerland had connected around 4.3 million or 80% of homes and businesses to its ultra-fast broadband service (speeds in excess of 80 Mbps). Meanwhile, 3.0 million or 56% of homes and offices enjoy connections with speeds of more than 200 Mbps. Swisscom will make ultra-fast broadband available in every municipality by the end of 2021, even in remote locations.

Swisscom has set itself ambitious expansion targets up to 2025, with the claim of offering all customers the best network in Switzerland everywhere and at all times. By the end of 2025, FTTH coverage is set to double compared with 2019, reaching up to 60%.

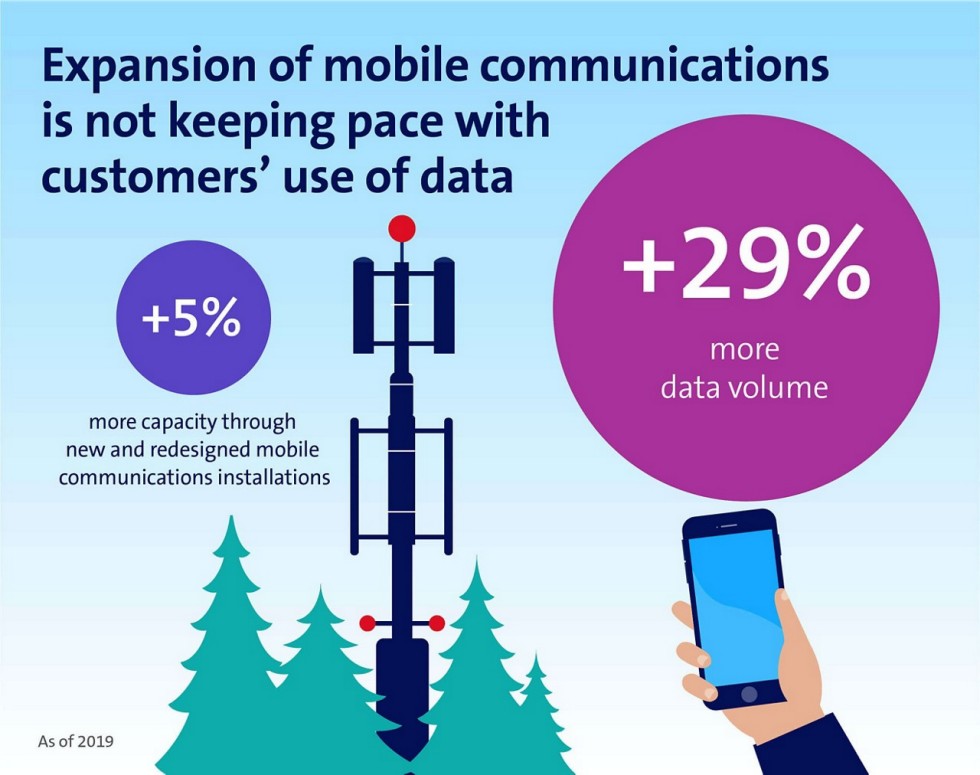

Expansion of mobile network faltering, demand growing

As at the end of September 2020, the nationwide population coverage of Swisscom’s 4G/LTE network was 99%. Since the end of 2019, Swisscom has supplied 90% of the Swiss population with 5G coverage with speeds of up to 1 Gbps. In order to exploit the potential of 5G and transmit data faster and more efficiently, it is essential to renew existing antennas and build new ones supporting 4G as well as 5G.

Due to the increased demand, data volumes are growing at a much faster rate than the expansion of network capacity for 4G and 5G. As a result, data volumes on the mobile network increased by 29% in 2019 in comparison with the previous year. However, due to restrictions such as moratoria in some cantons, the implemented measures, such as additional antennas, frequency management and software upgrades, only increased the capacity of the mobile network by 5%. The expansion of the mobile network and capacities is more important than ever in order to prevent data bottlenecks on the network and drive forward the digitisation of the economy and our society.

Trend towards bundled offerings: inOne continues to grow

The number of TV and broadband connections remains high, and demand for bundled offerings is intact. Residential customers in particular appreciate the modular, flexible inOne subscription.

inOne as a key driver of convergence

At the end of September 2020, Swisscom had 2.42 million inOne customers in the residential customer segment. inOne accounts for 68% of all mobile subscriptions and 74% of broadband connections in this segment, while 46% of customers use a combined offer.

Strong price momentum on fixed and mobile networks

The markets for broadband and TV are saturated and driven strongly by promotional offerings. The number of fixed-line broadband connections declined slightly compared to the previous year. The number of TV access lines increased slightly compared with the previous year but remained stable in the third quarter. The downward trend in traditional fixed-line telephony is slowing due to the migration to IP, which is now complete: At the end of September 2020, Swisscom had 1.55 million fixed-line phone connections, equivalent to a decrease of 48,000 connections in the first nine months of 2020.

The number of postpaid lines in mobile communications rose by 68,000 compared with the end of September 2019, and by 50,000 in the first nine months of the year, while the number of prepaid lines fell by 130,000 in the first nine months. Swisscom had a total of 6.25 million mobile access lines as at the end of September 2020.

Switzerland sees blue: one name for TV, streaming, cinema and gaming

In September, Swisscom launched a comprehensive entertainment experience under the name blue, with new offers and content and the freedom to access it anywhere. It is also available to customers of competitors. Since 20 October, Swisscom customers have once again been able to tune in live to the games of the highest leagues in Swiss ice hockey and will never need to miss another match. The MySports channels can be easily subscribed to directly via the blue TV platform with just a few clicks and paid for via the Swisscom bill.

Business customers: fierce competition and increasing demand for ICT solutions

The market for business customers is still dominated by high price pressure and new technologies. Revenue from telecommunications services fell by 7.3% year on year to CHF 1,296 million. Swisscom has a strong position as a full-service provider and customer satisfaction remains high. Demand for cloud, security and unified communications & collaboration solutions (e.g. conferencing services) increased. Revenue in the solutions business was up by CHF 15 million (+1.9%) in the first nine months of 2020 to CHF 786 million.

Fastweb registers growth in customer base, revenue and operating income

Fastweb again performed healthily in the third quarter: Its fixed-line broadband business also did well. The number of broadband customers went up by 3.6% to 2.70 million within the space of a year. Its mobile communications business also grew again, up 13.6% compared to the previous year, reaching 1.89 million customers in a saturated and highly competitive market. Fastweb is placing a stronger focus on convergence: 34% of subscribers already use a bundled offering combining fixed network and mobile services.

The corporate business segment also continued to perform positively, with revenue growth of EUR 34 million (+5.4%). Fastweb increased its revenue in the first nine months to EUR 1,674 million (+5.7%). Earnings before interest, taxes, depreciation and amortisation (EBITDA) rose to EUR 568 million (+4.6%).

Michael Rechsteiner is proposed as the new Chairman of the Board of Directors

The Chairman of the Board of Directors, Hansueli Loosli (1955), will reach the maximum term of office of twelve years stipulated in the Articles of Association at the forthcoming General Meeting of 31 March 2021 and will therefore not stand for re-election. Hansueli Loosli has been Chairman of the Board of Directors since 2011 and has strongly influenced Swisscom’s strategy and orientation as a leading ICT company in Switzerland. He will in future concentrate on mandates in the business world. The Board of Directors proposes Michael Rechsteiner (1963), who has been a member of the Board since 2019, for election as Chairman. Michael Rechsteiner is currently the European head of Power Services and Gas Power at General Electric. He graduated with a Master of Mechanical Engineering from the Swiss Federal Institute of Technology Zurich (ETH Zurich) and a Master of Business Administration from the University of St. Gallen, and has many years of management experience in international corporations.

Eugen Stermetz will be the new Chief Financial Officer of Swisscom from 1 March 2021

The Board of Directors of Swisscom has appointed Eugen Stermetz (1972) as the new Chief Financial Officer (CFO) and a member of the Group Executive Board. Eugen Stermetz has very broad experience in the field of finance and has been working for Swisscom in various functions since 2012, for example as CFO of the participations and Head of Mergers & Acquisitions and Treasury. He started his career in management consulting and subsequently held various CFO positions in the IT and pharmaceutical industries. As citizen of Austria, Eugen Stermetz studied business administration at the University of St. Gallen (HSG) and completed his studies with a doctorate at the Vienna University of Economics and Business.

Eugen Stermetz will be taking over from Mario Rossi (1960), who has held a variety of positions at Swisscom since 1998 and has been CFO of Swisscom and a member of the Executive Board since 2013. Mario Rossi will in future concentrate on mandates in the business world. Over many years, he has had a strong influence on Swisscom’s successful positioning in the financial community. The Swisscom Board of Directors and Group Executive Board are sorry to see him go. They would like to thank him for his outstanding commitment to the company and to wish him all the best for the future both professionally and personally.

Financial outlook remains unchanged

For the 2020 financial year, Swisscom still expects net revenue of around CHF 11.0 billion, EBITDA of around CHF 4.3 billion and capital expenditure of around CHF 2.3 billion. Subject to achieving its targets, Swisscom will propose payment of an unchanged, attractive dividend of CHF 22 per share for the 2020 financial year at the 2021 Annual General Meeting. Due to COVID-19 and the ordinance on combating the pandemic, the Board of Directors has decided to host the 2021 Annual General Meeting virtually as in 2020. Shareholders will be informed in due course.

| 1.1.-30.09.2019 | 1.1.-30.09.2020 | Change (adjusted*) |

|

|---|---|---|---|

| Net revenue (in CHF million) | 8,456 | 8,201 | -3,0% (-2,1%) |

| Operating income before depreciation and amortisation, EBITDA (in CHF million) | 3,360 | 3,356 | -0,1% (0,2%) |

| Operating income, EBIT (in CHF million) |

1,529 | 1,523 | -0,4% |

| Net income (in CHF million) | 1,181 | 1,166 | -1,3% |

| Swisscom TV access lines in Switzerland (on 30.9. in thousands) | 1,540 | 1,551 | 0,7% |

| Retail broadband access lines in Switzerland (on 30.9. in thousands) | 2,054 | 2,045 | -0,4% |

| Mobile access lines in Switzerland (on 30.9. in thousands) |

6,358 | 6,253 | -1,7% |

| Fastweb broadband access lines (on 30.9. in thousands) |

2,610 | 2,704 | 3,6% |

| Fastweb mobile access lines (on 30.9. in thousands) |

1,663 | 1,889 | 13,6% |

| Capital expenditure (in CHF million) | 1,833 | 1,632 | -11,0% |

| Of which capital expenditure in Switzerland (in CHF million) | 1,338 | 1,191 | -11,0% |

| Group employees (FTEs on 30.9.) | 19,500 | 19,026 | -2,4% |

| Of whom employees in Switzerland (FTEs on 30.9.) | 16,788 | 16,119 | -4,0% |

* On a like-for-like basis and at constant exchange rates

Downloads

-

Press Release

(PDF file, 194 KB)

-

Picture Urs Schaeppi

(JPG file, 786 KB)

-

Picture Michael Rechsteiner

(JPG file, 160 KB)

-

Picture Eugen Stermetz

(JPG file, 741 KB)

-

Graphic 1

(JPG file, 188 KB)

Disclaimer

This press release contains forward-looking statements. In this press release, such forward-looking statements may include, but are not limited to, statements relating to our financial position, operating results and certain strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behaviour of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s and Fastweb’s past and future filings and reports, including those filed with the U.S. Securities and Exchange Commission and in past and future filings, press releases, reports and other information posted on Swisscom Group Companies’ websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication.

Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Subscribe to news

Subscribe to our news by e-mail

Contact us

Address

Swisscom

Media Relations

Alte Tiefenaustrasse 6

3048 Worblaufen

Postal address:

Postfach, CH-3050 Bern

Switzerland

Contact

Tel. +41 58 221 98 04

media@swisscom.com