The Swisscom share

Swisscom shares are publicly traded on the SIX Swiss Exchange and are listed in the Swiss Market Index, comprising the largest and most liquid stocks traded on the Swiss stock exchange. Swisscom shares are also traded on the US over-the-counter market in the form of American Depositary Receipts (ADRs) under the ticker SCMWY. The Swisscom share enjoys a sound reputation on the capital market with attractive dividends.

| ISIN | CH0008742519(opens in new tab) |

| Issued shares | {shares} |

| Market capitalisation (CHF billion) | {cap} |

| Symbol | SCMN |

| ISIN | US8710131082(opens in new tab) |

| Issued shares | {shares} |

| Market capitalisation (USD billion) | {cap} |

| Symbol | SCMWY |

Return

Total shareholder return is calculated from the share price development and the dividend. Total return shows the share price development including reinvested dividend for the given period.

Dividend

Swisscom pursues a dividend policy with high, sustainable and rising dividends in line with the development of the free cash flow. Since 2011, Swisscom has paid an annual dividend of CHF 22 per share. Swisscom will propose a dividend of CHF 26 per share for the 2025 financial year at the Annual General Meeting on 25 March 2026. For the 2026 financial year, Swisscom plans to propose a dividend of CHF 27 per share to the Annual General Meeting 2027 if the financial targets are met.

Return calculator

You can use the return calculator to calculate the current value and income from your investments in Swisscom shares. You can calculate performance on the basis of number of shares purchased or invested amount.

Analysts

Swisscom's strategy, business performance and market situation are subject to continual assessment by analysts from the leading financial institutions. Their recommendations can be summarised as follows:

Buy

14%

Hold

45%

Sell

41%

(Source: Bloomberg, 12.01.2026)

Current analyst recommendations in detail

The recommendations listed below are updated on an ongoing basis. This list is not definitive. The analysts' opinions are based on their estimates and assumptions and are not necessarily shared by Swisscom.

| Update | 12.01.26 |

|---|---|

| Bank | BNP Paribas Exane |

| Analyst | Joshua Mills |

| Telephone | +44 203 430 8670 |

| Recommendation | Outperform |

| Update | 08.01.26 |

|---|---|

| Bank | LBBW |

| Analyst | Bettina Deuscher |

| Telephone | +49 711 127 76791 |

| Recommendation | Hold |

| Update | 07.01.26 |

|---|---|

| Bank | UBS |

| Analyst | Polo Tang |

| Telephone | +44 20 7568 1286 |

| Recommendation | Buy |

| Update | 07.01.26 |

|---|---|

| Bank | JP Morgan |

| Analyst | Ajay Soni |

| Telephone | +44 20 3493 8462 |

| Recommendation | Underweight |

| Update | 22.12.25 |

|---|---|

| Bank | Intesa Sanpaolo |

| Analyst | Andrea Devita |

| Telephone | +39 02 4127 9016 |

| Recommendation | Neutral |

| Update | 19.12.25 |

|---|---|

| Bank | Morningstar |

| Analyst | Javier Correonero |

| Telephone | +1 877 626 3227 |

| Recommendation | Sell |

| Update | 17.12.25 |

|---|---|

| Bank | Berenberg |

| Analyst | Paul Sidney |

| Telephone | +44 20 3207 7842 |

| Recommendation | Hold |

| Update | 16.12.25 |

|---|---|

| Bank | New Street Research |

| Analyst | Russell Waller |

| Telephone | +44 207 375 9125 |

| Recommendation | Neutral |

| Update | 15.12.25 |

|---|---|

| Bank | Kepler Cheuvreux |

| Analyst | Javier Borrachero |

| Telephone | +34 91 436 5161 |

| Recommendation | Reduce |

| Update | 08.12.25 |

|---|---|

| Bank | Barclays |

| Analyst | Maurice Patrick |

| Telephone | +44 203 134 3622 |

| Recommendation | Underweight |

| Update | 04.12.25 |

|---|---|

| Bank | AlphaValue/Baader |

| Analyst | Jean-Michel Salvador |

| Telephone | +49 619 6761 3218 |

| Recommendation | Reduce |

| Update | 13.11.25 |

|---|---|

| Bank | Morgan Stanley |

| Analyst | Emmet Kelly |

| Telephone | +44 20 7425 6830 |

| Recommendation | Overweight |

| Update | 10.11.25 |

|---|---|

| Bank | Bank Vontobel |

| Analyst | Mark Diethelm |

| Telephone | +41 44 283 7182 |

| Recommendation | Hold |

| Update | 06.11.25 |

|---|---|

| Bank | Citi |

| Analyst | Siyi He |

| Telephone | +44 207 986 9876 |

| Recommendation | Neutral |

| Update | 06.11.25 |

|---|---|

| Bank | Oddo |

| Analyst | Stephane Beyazian |

| Telephone | +33 625 80 17 56 |

| Recommendation | Underperform |

| Update | 30.10.25 |

|---|---|

| Bank | Research Partners |

| Analyst | Reto Huber |

| Telephone | +41 44 533 40 30 |

| Recommendation | Hold |

| Update | 22.10.25 |

|---|---|

| Bank | Deutsche Bank |

| Analyst | Robert Grindle |

| Telephone | +44 20 7545 8490 |

| Recommendation | Hold |

| Update | 21.10.25 |

|---|---|

| Bank | Redburn |

| Analyst | Max Findlay |

| Telephone | +44 207 000 2195 |

| Recommendation | Sell |

| Update | 07.09.25 |

|---|---|

| Bank | Nextgen Research |

| Analyst | Justin Funnell |

| Telephone | +44 7399 520 675 |

| Recommendation | Neutral |

Analyst consensus Q4 2025

The analyst consensus (publication date 13 January 2026) presents the average expected value of key performance indicators based on analyst estimates between December 5 and 23, 2025.

Ownership structure

After completion of the final share buyback in 2006 and the implemented capital reduction (by 4.9 million shares), Swisscom has had a static 51.8 million shares since 2009. The Swiss Confederation significantly reduced its holding in 2013 (by 5.6%). Today, Swisscom's majority shareholder holds 51% of the shares.

Buybacks

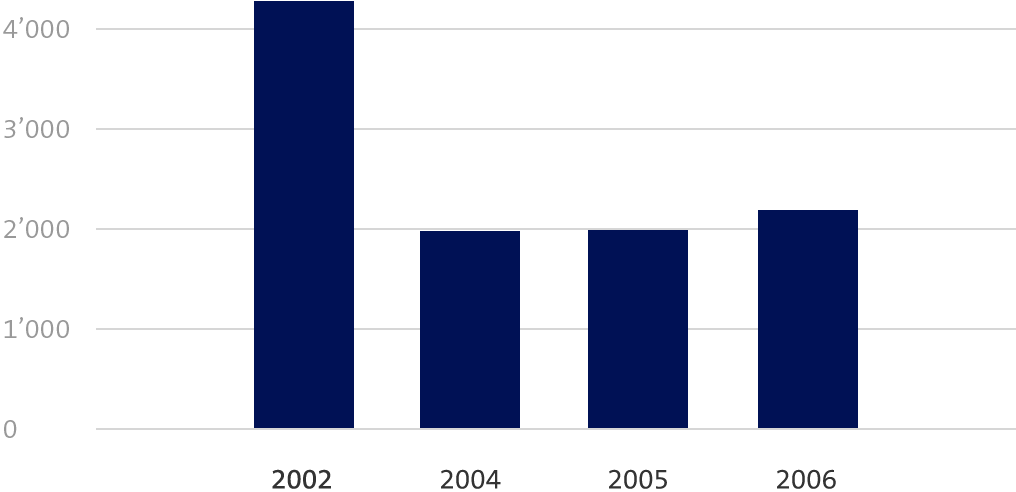

Through its four buyback programmes in 2002, 2004, 2005 and 2006, Swisscom reimbursed a total of CHF 10.4 billion to shareholders. In addition to the dividends in the 2000, 2001 and 2002 fiscal years CHF 8 per share or CHF 1.6 billion was paid out in the form of tax-free capital reductions.

Ratings

Independent ratings assess Swisscom’s corporate responsibility, standardised according to ESG criteria, and ensure that the environmental impact, social aspects and governance of our activity are transparent and comparable.

The opinions, estimates and forecasts of analysts, and the consensus information presented derived from it, regarding Swisscom’s performance are the analysts’ alone and do not represent opinions, estimates or forecasts of Swisscom or its management. Swisscom has not verified any of the information it has received and makes no representation as to the accuracy or completeness of the consensus information. Nor does Swisscom endorse or concur with, or assume responsibility for, such analyst information or recommendations or assume any responsibility to update or supplement such information. This material is being provided for information purposes only and is not intended to, nor does it, constitute investment advice or any solicitation to buy, hold or sell securities or other financial instruments.

Consensus on Swisscom’s financial results also available from other sources and they could differ from what is reported above due to the different analysts involved, timing at which the data is collected and/or other reasons. Swisscom does not assume any liability for any potential discrepancy.

Disclosure of holdings:

Any shareholder that reaches, falls below or exceeds a threshold of 3, 5, 10, 15, 20, 25, 33⅓, 50 or 66⅔ percent of the voting rights, has a duty of disclosure towards Swisscom and the SIX Swiss Exchange.